A TMB Recurring Deposit (RD) account is a savings option offered by Tamilnad Mercantile Bank with a predetermined interest rate/ dynamic. It encourages regular saving by letting you deposit a fixed amount every month for a chosen period (between 1 and 10 years). TMB offers competitive interest rates on the total amount saved, with rates increasing for senior citizens as beneficiaries. It's a good way to build a lump sum over time with guaranteed returns.

The highest interest rate offered to senior citizens in the Tamilnad Mercantile Bank recurring deposit scheme is 8% p.a.

TMB RD Interest Rates 2024

TMB offers Recurring Deposit (RD) with competitive interest rates for the year 2024. Here is a table showing the interest rates for domestic term deposits and NRO deposits of below ₹2 crore:

| Deposit Tenure | Interest Rate (% p.a.) for General Public | Interest Rate (% p.a.) for Senior Citizens |

|---|---|---|

| 7-14 days | 5.25 | 5.25 |

| 15-29 days | 5.25 | 5.25 |

| 30-45 days | 5.25 | 5.25 |

| 46-60 days | 5.25 | 5.25 |

| 61-90 days | 5.25 | 5.25 |

| 91-120 days | 5.75 | 5.75 |

| 121-179 days | 6.00 | 6.00 |

| 180-270 days | 6.00 | 6.00 |

| 271 days - less than 1 yr | 6.00 | 6.00 |

| 1 yr to less than 400 days | 7.00 | 7.50 |

| 400 days | 7.50 | 8.00 |

| Above 400 days to less than 20 months & 20 days | 7.00 | 7.50 |

| 20 months & 20 days | 7.00 | 7.50 |

| Above 20 months 20 days to less than 2 years | 7.00 | 7.50 |

| 2 years to less than 3 years | 6.75 | 7.25 |

| 3 years to 10 years | 6.50 | 7.00 |

Read More

Read Less

- Additional rate of interest payable on term deposits to Senior Citizens shall not apply to NRO (Non-Resident Ordinary) Term Deposits.

- The additional rate of interest payable on term deposits to Senior Citizens shall not apply for less than one year.

Don't know your credit score? You can find out for free!

Features of TMB RD Interest Rate

Here's a breakdown of the key features of the TMB Recurring Deposit (RD) account:

| Feature | Description |

|---|---|

| Period of Deposit | 1 year to 10 years |

| Minimum Deposit | Rs. 10 (and multiples thereof) |

| Interest | Simple interest based on deposit period |

| Nomination | Available |

| Premature Closure | Allowed with penalty |

| Loan Against Deposit | Yes |

TMB Online RD Interest Rate Calculator

TMB RD interest rate calculator helps you estimate the maturity amount of your Recurring Deposit (RD) account. You have to input factors like your monthly deposit amount, desired tenure (deposit period), and the applicable interest rate. The calculator will estimate the total amount you'll receive at the end of your RD term. This helps you plan your savings goals and understand the potential returns on your RD investment.

| Invested Amount | : ₹1,000 |

| Total Interest | : ₹532 |

| Maturity Amount | : ₹12,532 |

Here's how you can use the RD Interest Rate Calculator:

Step 1: Select the tenure of your Recurring Deposit (RD) account, ranging from 6 months to 10 years. You can also switch to a quarterly investment option.

Step 2: Enter the monthly deposit amount, which can be as low as ₹500.

Step 3: The calculator will automatically compute the total interest earned and the final maturity amount at the end of the RD term.

Step 4: Adjust the tenure and monthly deposit to find the best RD plan that aligns with your investment goals and savings capacity.

Are you looking for a personal loan?

RD Calculation

The formula to calculate the maturity amount manually without using an online RD calculator is:

A = P { (1 + r/n)^(nt) }

Where,

A = maturity amount,

P = installment amount,

r = RD interest rate,

n = number of times the interest rate is compounded in a year,

t = tenure in years.

Example:

For example, if you deposit ₹1,000 per month for 5 years at an annual interest rate of 6% compounded quarterly, then the maturity value would be:

A = P*(1+R/N)^(Nt)

A = 1000 * (1 + 0.06/4)^(4*5)

A = ₹70,065

Therefore, the maturity amount for an RD investment of ₹1,000 every month with a 6% annual interest rate compounded quarterly over 5 years would be approximately ₹70,065

Premature Withdrawal of TMB RD Account

Interest will not be paid if a deposit is withdrawn prematurely within 14 days of the deposit or renewal date. If the depositor chooses to withdraw early, a penal interest of 1% will be charged based on the applicable rate for the period the deposit was held with the bank or the contract rate, whichever is lower.

RD Interest Rates of Top Banks

Here is a comprehensive list of RD interest rates from top banks:

| Bank Recurring Deposit | RD Interest Rates (p.a) General Public |

RD Interest Rates (p.a) Senior Citizens |

|---|---|---|

| TMB RD Interest Rates | 6.75% to 7.75% | 7.00% to 8.25% |

| SBI RD Interest Rates | 6.50% to 7.00% | 7.25% to 7.50% |

| ICICI Bank RD Interest Rates | 4.75% to 7.20% | 5.25% to 7.75% |

| HDFC Bank RD Interest Rates | 4.50% to 7.25% | 5.00% to 7.75% |

| Axis Bank RD Interest Rates | 5.75% to 7.20% | 6.25% to 7.85% |

| Bank of Baroda RD Interest Rates | 5.75% to 7.25% | 6.25% to 7.75% |

| Punjab National Bank RD Interest Rates | 6.00% to 7.25% | 6.50% to 7.75% |

| IDBI Bank RD Interest Rates | 6.25% to 7.00% | 6.75% to 7.50% |

| Canara Bank RD Interest Rates | 6.15% to 7.25% | 6.65% to 7.75% |

| Indian Bank RD Interest Rates | 4.50% to 7.25% | 5.00% to 7.75% |

| Union Bank of India RD Interest Rates | 5.75% to 6.50% | 6.25% to 7.00% |

| Yes Bank RD Interest Rates | 6.10% to 7.75% | 6.60% to 8.25% |

| Bandhan Bank RD Interest Rates | 4.50% to 7.85% | 5.25% to 8.35% |

| Bank of India RD Interest Rates | 4.50% to 6.00% | 5.00% to 6.50% |

| Bank of Maharashtra RD Interest Rates | 5.50% to 6.25% | 6.00% to 6.75% |

| City Union Bank RD Interest Rates | 6.25% to 7.00% | 6.50% to 7.50% |

| DBS Bank RD Interest Rates | 6.00% to 7.50% | 6.50% to 8.00% |

| Dhanalakshmi Bank RD Interest Rates | 6.50% to 7.25% | 6.50% to 7.75% |

| Federal Bank RD Interest Rates | 5.75% to 7.50% | 6.25% to 8.00% |

| IndusInd Bank RD Interest Rates | 7.00% to 7.75% | 7.50% to 8.25% |

| Jammu and Kashmir Bank RD Interest Rates | 5.75% to 7.10% | 6.25% to 7.60% |

| Karnataka Bank RD Interest Rates | 5.80% to 7.40% | 6.20% to 7.90% |

| Karur Vysya Bank RD Interest Rates | 6.25% to 7.50% | 6.25% to 8.00% |

| Post Office RD Rate | 6.50% | 6.50% |

| Saraswat Bank RD Interest Rates | 7.00% to 7.50% | 7.50% to 8.00% |

| South Indian Bank RD Interest Rates | 5.00% to 7.40% | 5.50% to 7.90% |

Read More

Read Less

Note: The interest rates are subject to change. Do visit the official website for updated rates.Do you need an Emergency loan?

Steps to Open TMB RD Account Online

Here are the steps to open a Recurring Deposit (RD) account with Tamilnad Mercantile Bank (TMB) online:

Step 1: Visit the official TMB website and click on ‘Apply Online’.

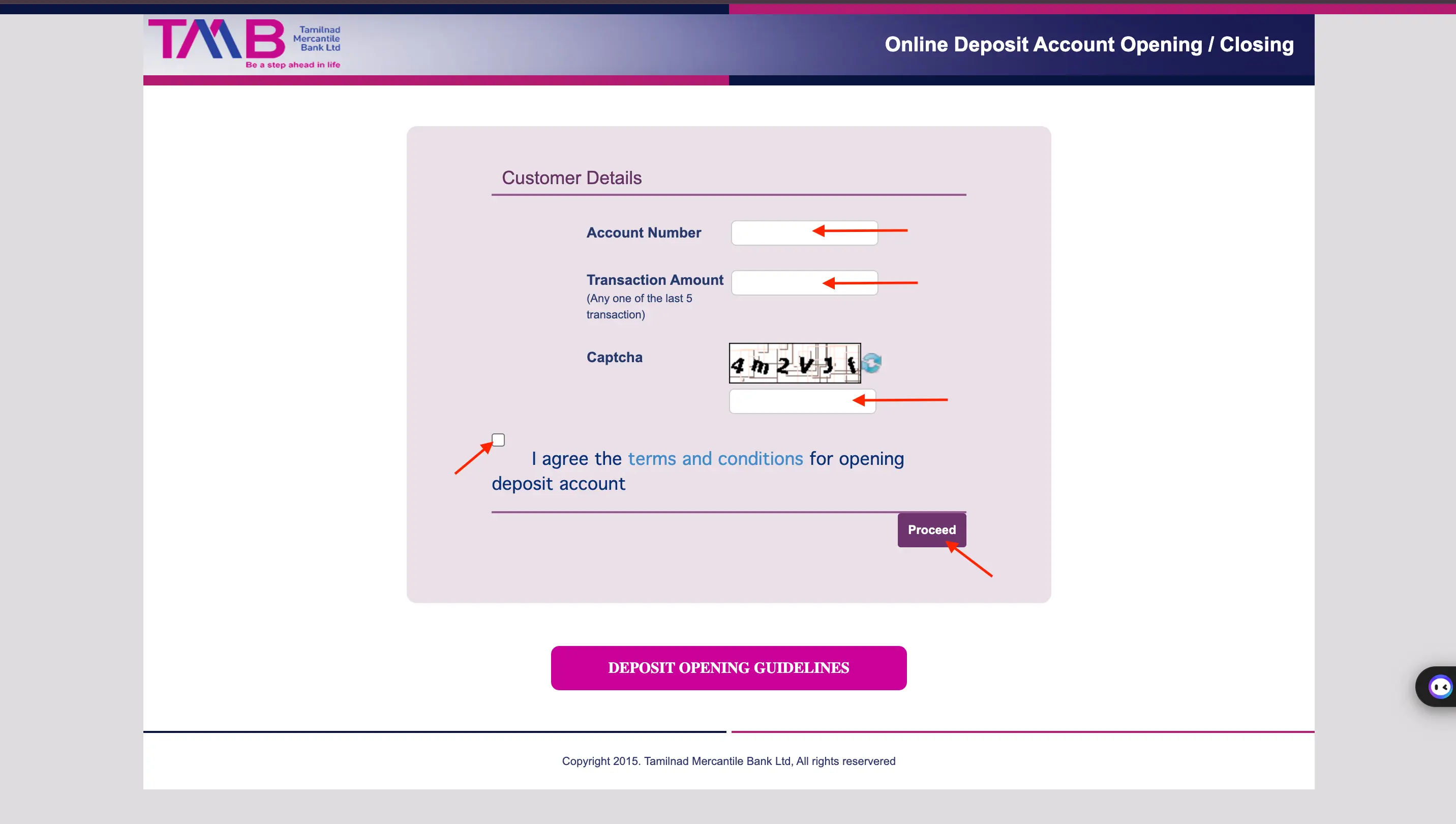

Step 2: Fill in the Customer details such as the Account Number, Transaction Amount, and Captcha. Then Agree to the Terms and Conditions and Click on ‘Proceed’.

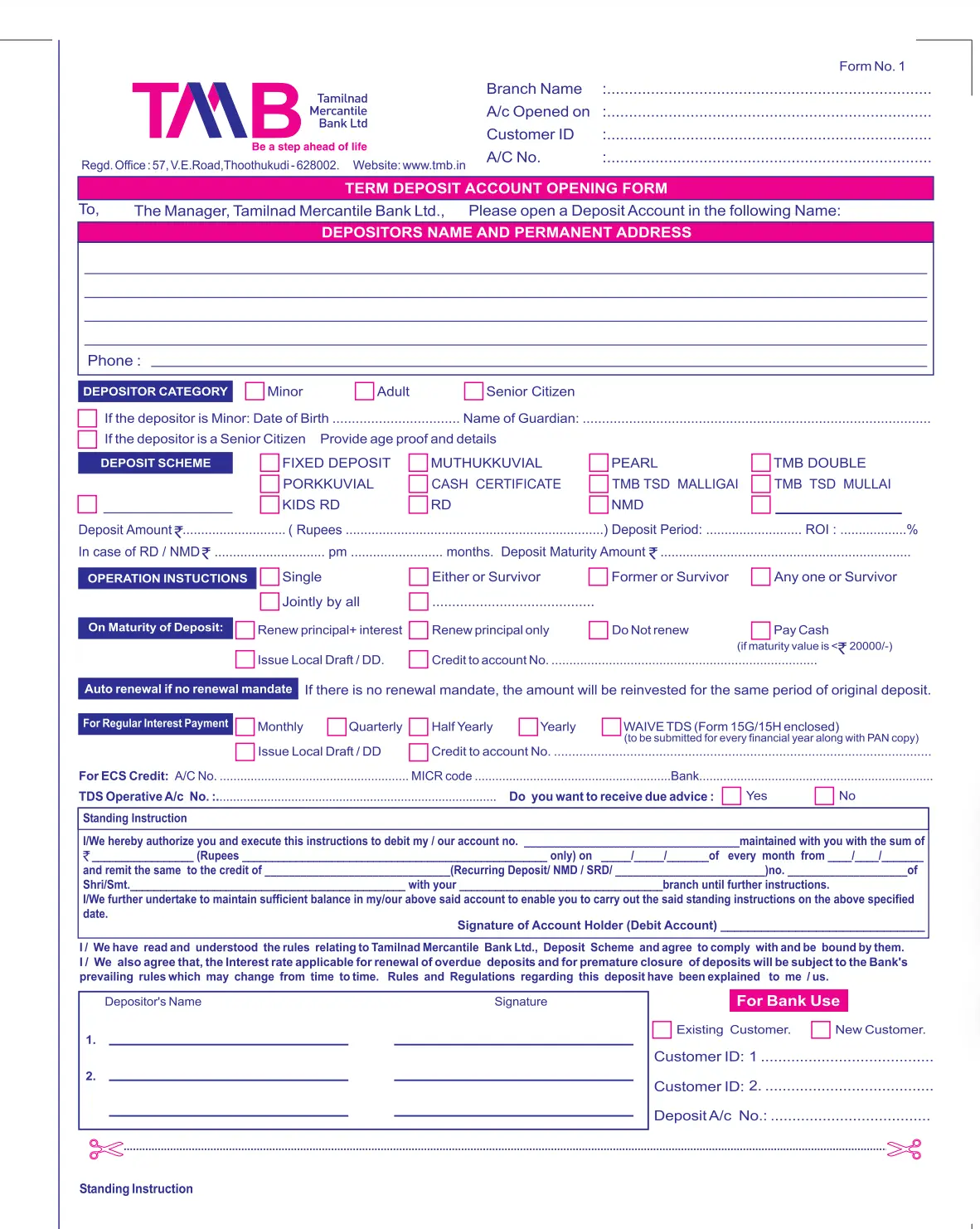

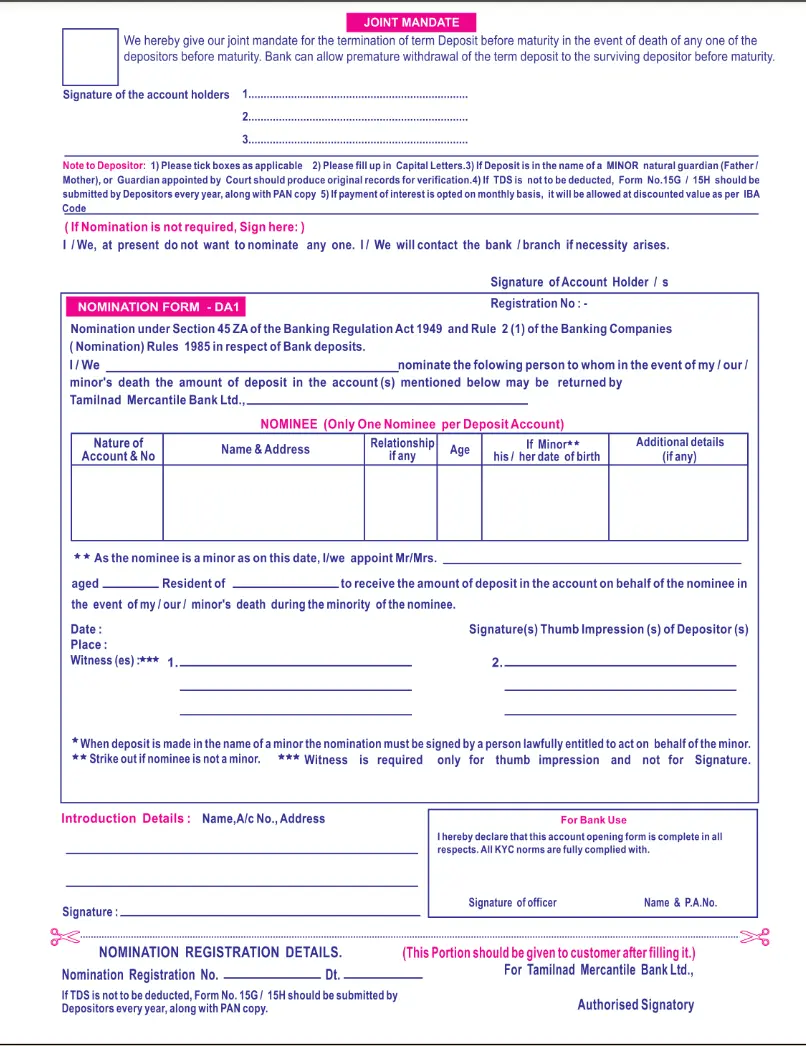

Step 3: Fill in the online RD account opening form and upload the required KYC documents as per the instructions.

Step 4: Review and confirm the details entered in the form.

Step 5: Make the initial RD deposit through net banking, UPI, or any other available digital payment method.

Steps to Open TMB RD Account Offline

Here are the steps to open a Recurring Deposit (RD) account with TMB (Tamilnad Mercantile Bank):

Step 1. Visit the Official website of TMB and download the RD Account Opening Application Form.

Step 2: Fill in the RD account opening form.

Step 3: Once you fill out the form, take a printout and visit the nearest TMB branch.

Step 4: Submit the application form along with the necessary documents.

Step 5: Pay the initial deposit to open the RD account.

Eligibility Criteria to Open TMB RD Account

The following individuals and entities are eligible to open a recurring deposit account with Tamilnad Mercantile Bank:

- All Indian residents

- Members of Hindu Undivided Families (HUF)

- Private and public limited companies

- Trusts and Societies

Documents Required to Open TMB RD Account

Here are the key documents required to open a Recurring Deposit (RD) account with Tamilnad Mercantile Bank (TMB):

- Identity Proof: PAN card, Aadhaar card, or Voter ID

- Address Proof: Aadhaar card, Voter ID, or utility bill

- Photographs: Passport-size photographs

- Bank Account Details: Cancelled cheque or bank statement

- Additional documents may be required for NRIs, PIOs, and minors.

Types of TMB RD Account

TMB offers various types of RD schemes. They include:

| RD Scheme | Description |

|---|---|

| General RD |

|

| Kid's RD |

|

| ERD RD |

|

| Navarathnamala RD |

|

Apply For a Personal Loan with the Best Interest Rates

Frequently Asked Questions

The minimum tenure for a TMB Recurring Deposit is 1 year.

To apply for a TMB Recurring Deposit account, you can visit the nearest TMB branch, fill out the account opening form, submit the required documents, and make the initial deposit.

Yes, a Recurring Deposit typically has a lock-in period, which means you cannot withdraw the funds before the maturity date without incurring a penalty.

To open a regular recurring deposit with Tamilnad Mercantile Bank, a minimum initial balance of Rs. 1000 is required.

Currently, there is no overdraft facility for recurring deposits. However, under specific conditions, you may request a loan against the deposit.

The highest interest rate offered to senior citizens in the Tamilnad Mercantile Bank recurring deposit scheme is 8% p.a.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users