RBI issues the Sovereign Gold Bonds Upcoming Issues dates online. Every year, RBI releases Sovereign Gold Bonds. For 2024, the upcoming SGB dates is yet awaited. The next SGB issue date is expected to be released soon by RBI. If you are interested in gold investment with Sovereign Gold Bonds, stay tuned for the latest SGB dates.

Sovereign Gold Bonds (SGBs) are considered safe government securities with their value denominated in multiples of grams of gold. There has been a notable increase in investors opting for SGBs as a substitute for physical gold. To purchase an SGB, simply approach a SEBI-authorized agent or broker. Upon redemption of the bond, the corpus will be deposited into your registered bank account based on the current market value.

Investors have the option to apply for SGBs online using the websites of participating commercial banks, brokers, or Stock Holding Corporation of India (SHCIL). When applying online and making digital payments, investors can receive a slight discount on the issue price, with the price being Rs.50 per gram less than the nominal value.

Table of Contents:

- ⇾ Features of Sovereign Gold Bond

- ⇾ Upcoming Issues of Sovereign Gold Bonds

- ⇾ Sovereign Gold Bond (SGB) Scheme issuance from October 2023 to March 2024

- ⇾ Reasons to Consider Investing in Sovereign Gold Bonds

- ⇾ Eligibility Criteria for Sovereign Gold Bonds (SGB)

- ⇾ Documents Required For Sovereign Gold Bonds (SGB)

- ⇾ Tax Implications on SGB

- ⇾ FAQs

Features of Sovereign Gold Bond

The table below gives an overview of the Sovereign Gold Bond investments.

| Feature | Description |

|---|---|

| Investment Type | Gold-backed Bond |

| Issuer | Government of India |

| Minimum Investment | 1 gram of gold |

| Maximum | 4kg (20kg for trust) |

| Maturity Period | 8 years |

| Early Redemption | After 5 years |

| Interest Rate Earned | 2.5% per annum (paid semi-annually) |

| Taxation on Capital Gains | 20% with indexation |

Read More

Read Less

Are you looking for a gold Loan?

Upcoming Issues of Sovereign Gold Bonds

The Sovereign Gold Bond issue dates for 2024, is awaited and can be released soon.

You can check the latest updates here and also on the official website of RBI regarding the next SGB issue date.

RBI Issues Notifications for New SGB Issues, for premature redemptions of SGBs and also for final redemption of SGBs.

| Year | Date of Subscription | Date of issuance |

|---|---|---|

| 2024-25 | To be released soon | To be released soon |

Besides, you can check other updates from RBI on SGBs. Check Latest RBI notification on upcoming SGBs from the linked page.

Sovereign Gold Bond (SGB) 2023-24

Check the SGB issuance from October 2023 to March 2024 from the table below:

| Tranche | Date of Subscription | Date of issuance |

|---|---|---|

| 2023-24 Series III | December 18 – December 22, 2023 | December 28, 2023 |

| 2023-24 Series IV | February 12 – February 16, 2024 | February 21, 2024 |

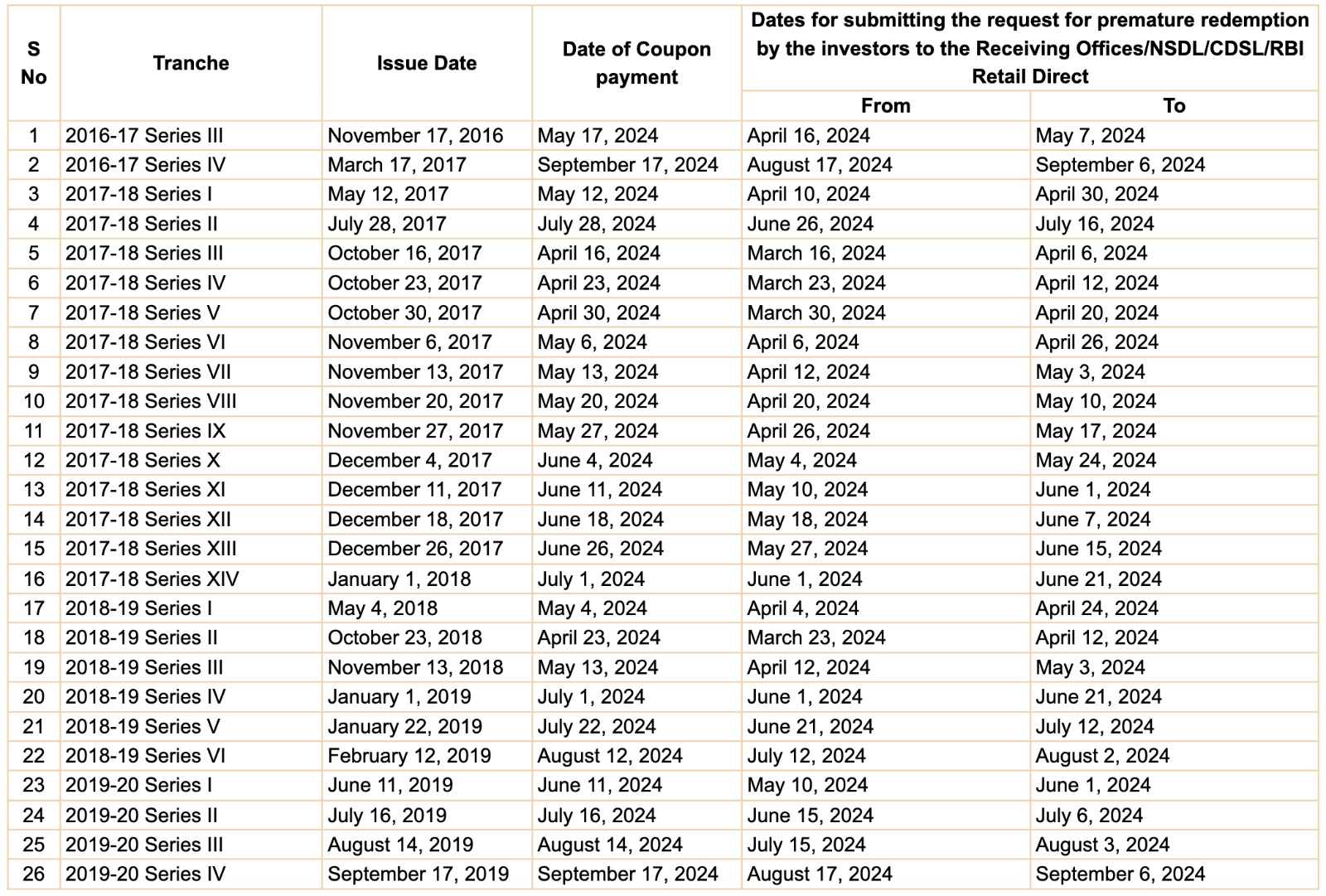

SGB Scheme Calendar for Premature Redemption from Apr to Dec 2024

Check the Sovereign Gold Bond (SGB) Scheme Calendar notification by RBI for premature redemption from April 20204 to December 2024.

Note that the dates and schedule can change, and it is advised to be upto date with the official RBI website.

Reasons to Consider Investing in Sovereign Gold Bonds

Sovereign Gold Bonds (SGBs) offer a convenient and cost-effective alternative to investing in physical gold. Here are the key reasons why investors should consider adding SGBs to their portfolio:

- Investors looking to diversify their portfolio may consider allocating 5%-10% to Sovereign Gold Bonds (SGBs) which are a low-risk investment, suitable for investors with a low-risk appetite.

- The cost of buying or selling SGBs is quite low compared to physical gold.

- The expenses associated with SGBs are nominal compared to physical gold.

- SGBs can be easily stored in Demat form, eliminating the hassle of storing physical gold.

- Holding SGBs eliminates the risk of theft, as they are in electronic form.

Did you know! In case of an emergency cash requirement, you can get a loan on SGB instead of a premature withdrawal of SGB.

Are you looking for a personal loan?

Eligibility Criteria for Sovereign Gold Bonds (SGB)

The Sovereign Gold Bond scheme offered by the Reserve Bank of India (RBI) has specific eligibility criteria that individuals must meet. These include:

- Open to any Indian resident

- Eligible investors include:

- Individuals

- Trusts

- Hindu Undivided Families (HUFs)

- Charitable institutions

- Universities

- You can also invest on behalf of a minor

Don't know your credit score? You can find out for free!

Documents Required For Sovereign Gold Bonds (SGB)

For applying for Sovereign Gold Bonds (SGB), you'll need to provide Know Your Customer (KYC) documents:

- PAN Card: Mandatory for all applicants.

- Identity Proof: One of these - Voter ID, Aadhaar Card, Passport.

- Bank account details for receiving payment.

Tax Implications on SGB

The interest earned on SGBs is not subject to TDS (tax deducted at source). Instead, it is added to the investor's annual income and taxed according to their applicable tax slab.

Regarding the Capital Gains from SGBs, if the investor holds the bond until maturity, the maturity amount received is tax-exempt. However, if the investor chooses to redeem the bond prematurely or sell it on the secondary market, the following tax implications apply:

- If the bond is held for less than three years before being sold, the capital gains are considered short-term and taxed according to the investor's applicable tax slab.

- If the bond is redeemed or sold after three years from the purchase date, the capital gains are considered long-term and taxed at 20% with indexation benefits.

Do you need an Emergency loan?

- Gold Loan

- SBI Gold Loan

- HDFC Gold Loan

- ICICI Gold Loan

- IDFC Gold Loan

- Axis Bank Gold Loan

- Canara Bank Gold Loan

- Bank of Baroda Gold Loan

- PNB Gold Loan

- Federal Bank Gold Loan

- Indian Overseas Bank Gold Loan

- Gold Monetization Scheme

- Union Bank Gold Loan

- Indian Bank Gold Loan

- Bank of Maharashtra Gold Loan

- IIFL Gold Loan

- Manappuram Gold Loan

- Bajaj Finserv Gold Loan

- Muthoot Finance Gold Loan

- Capri Gold Loan

Frequently Asked Questions

There hasn't been an official announcement for the Sovereign Gold Bond (SGB) 2024-25 series yet. However, based on past trends, the first tranche (Series 1) issuance is expected around June 2024 (it is currently June 22nd, 2024).

You might be able to buy SGB in the next tranche, potentially around June-July 2024, depending on the RBI's announcement.

On June 14, 2024, the Reserve Bank of India released information regarding the early redemption terms for two Sovereign Gold Bonds, specifically SGB 2017-18 Series IX and SGB 2019-20 Series I. These bonds were initially issued on December 11, 2017, and June 11, 2019, respectively.

Yes, Sovereign Gold Bonds are considered a safe investment as they are backed by the Government of India and carry minimal credit risk.

Sovereign Gold Bonds are expected to remain a popular investment option as they provide an attractive alternative to physical gold with additional benefits.

It depends on your goals. SGBs offer capital appreciation based on gold prices, while FDs offer fixed interest rates.

No, Sovereign Gold Bonds are issued by the RBI in tranches at regular intervals, and investors can only subscribe during the specified subscription windows.

The decision to invest in Sovereign Gold Bonds depends on your investment goals, risk appetite, and the current market conditions.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users