The Permanent Account Number (PAN) Card is an important identifier issued by the Income Tax Department under the guidance of the Central Board of Direct Taxes (CBDT). It consists of a unique ten digit alphanumeric code that is used to collect financial information of individuals, businesses or other entities.

The card has a unique identification key to help tax returns and authentication and serves as a proof of identification as it includes your PAN, name and date of birth and other personal information.

If you have more than one PAN card, you will be charged a penalty of ₹10,000. So, to avoid paying extra charges, you can cancel them through Protean (Formerly NDSL) or UTIITSL portal.

Table of Contents:

- ⇾ PAN Card Details

- ⇾ Steps to Apply For New PAN Card Online

- ⇾ Steps to Apply For PAN Through Protean NSDL Portal

- ⇾ Steps to Apply For PAN Through UTIITSL Portal

- ⇾ Steps to Apply For New PAN Card Offline

- ⇾ PAN Card Eligibility

- ⇾ Forms Required For PAN Application

- ⇾ Documents Required to Apply For a PAN Card

- ⇾ Steps to Check Your PAN Card Status Online

- ⇾ Ways to Make Corrections in PAN Card

- ⇾ Steps to Apply For a Duplicate PAN Card

- ⇾ PAN Card Customer Care Number

- ⇾ Frequently Asked Questions

PAN Card Details

The NSDL PAN card consists of important information of the individual, HUFs or business such as identification name, PAN number and age information. Here are the details of the PAN card details:

- Details of the cardholder:

- For individuals, details like your full name, father’s name and date of birth will be displayed on the card.

- For businesses or other entities, details like the name of the business or entity, date of registration will be printed on the card.

- PAN number:

PAN number example: ADGFK3457C

The PAN number consists of a unique 10 digit alphanumeric code where each character represents the cardholder’s information. The first three letters are alphabetical in order (A-Z) categorising the type of card holder, whether they are an individual, business or belong to other entities. While the fourth letter represents the category of the taxpayer with the following specific letters signifying different entities:

- A – Association of Persons (AOP)

- B – Body of Individuals

- C – Company

- F – Firms

- G – Government

- H – Hindu Undivided Family

- L – Local Authority

- J – Artificial Judicial Person

- P – Individual

- T – Trust (Association of Persons)

The fifth character represents the initial of the individual’s surname followed by 4 numbers and the final character being an alphabetic letter.

- Verification:

- Signature: The card holder’s signature is also printed which is important in financial transactions.

- Photograph: The PAN card for individuals will also have a photograph of the card holder which will be important for visual identification. However, there are no photographs on the PAN card of businesses and other entities.

Get to know your PAN Card better from the linked page.

Are you looking for a personal loan?

Steps to Apply For New PAN Card Online

The PAN card is an important document for financial purposes for which you can easily apply online through the UTIITSL or NSDL website. Here are the steps to apply for a PAN Card:

Steps to Apply For PAN Through Protean NSDL Portal

You can easily apply for a PAN Card through Protean (Formerly NSDL) website and the UTIITSL website, here are the steps you can follow:

Step 1: Visit the NSDL website: www.protean-tinpan.com and click on ‘Apply for PAN Online’.

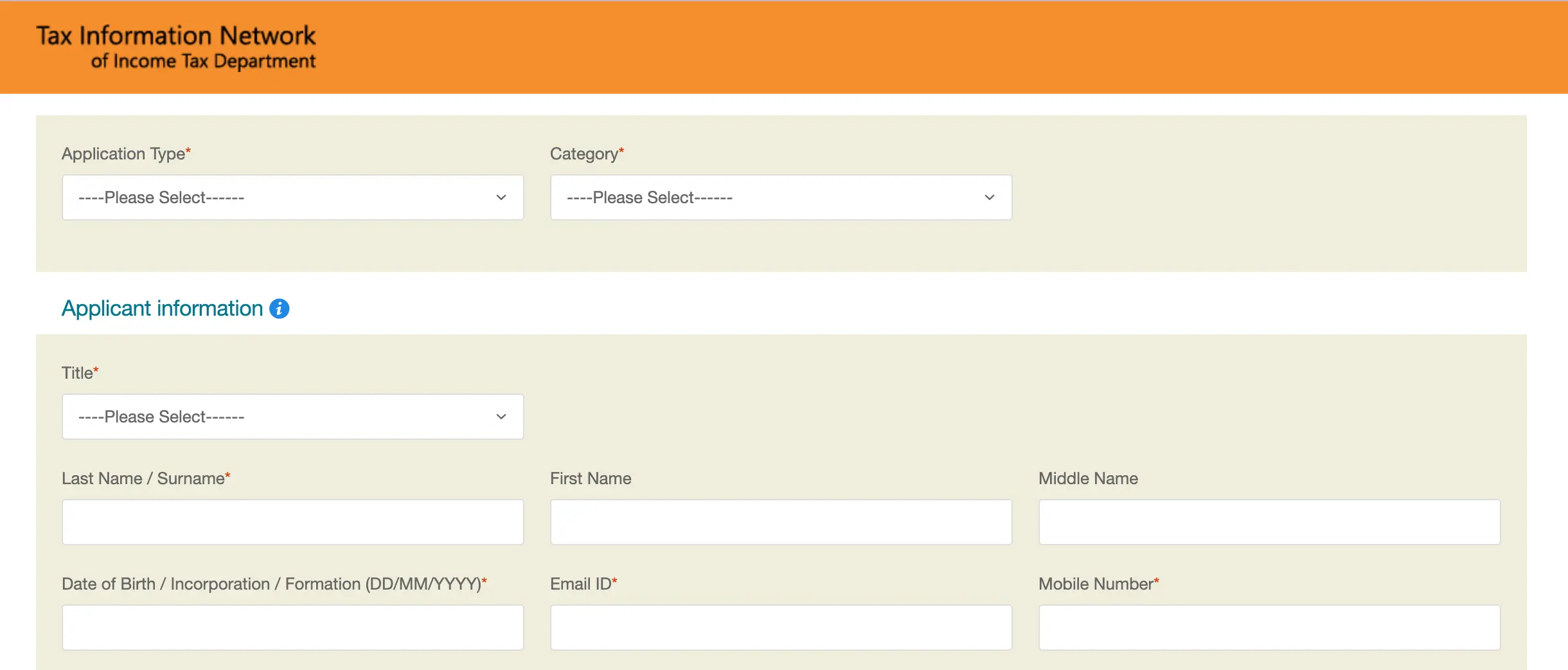

Step 2: Fill in the application form, entering all details of the application type, category, title, name, date of birth, email ID and mobile number.

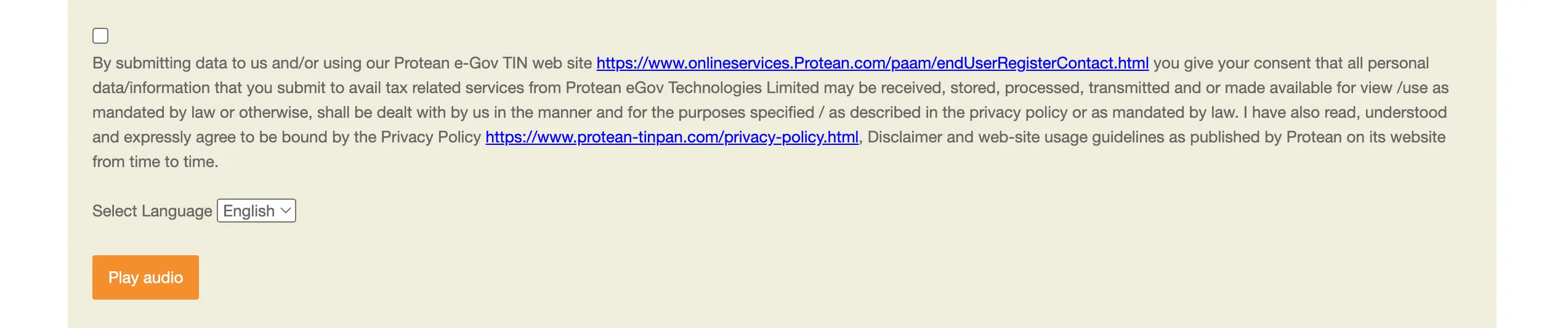

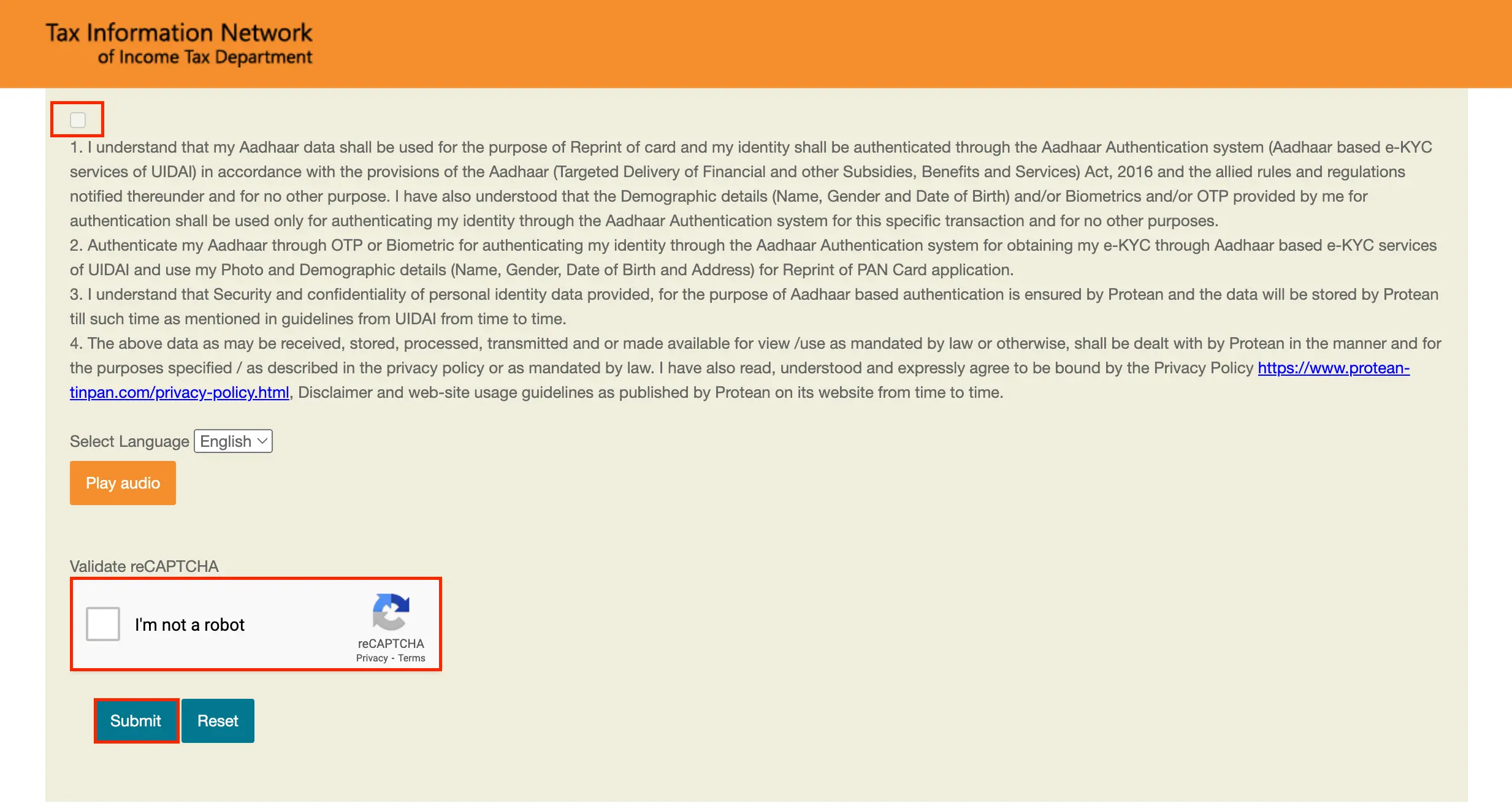

Step 3: Read the privacy policy disclaimer and tick the box given to accept it.

Step 4: Validate the Captcha tick box. Then click ‘Submit’.

Step 5: You will then get a temporary token number and will be directed to complete the application form .

Step 6: Read the guidelines and complete the application form. Provide all the necessary details.

Step 7: Submit the documents like Aadhaar Card for proof of identity, address and date of birth.

Step 8: Pay the application fee, then e-sign using an Aadhaar OTP. After which you can submit the application.

Step 9: Once verified, your PAN card will be dispatched to you.

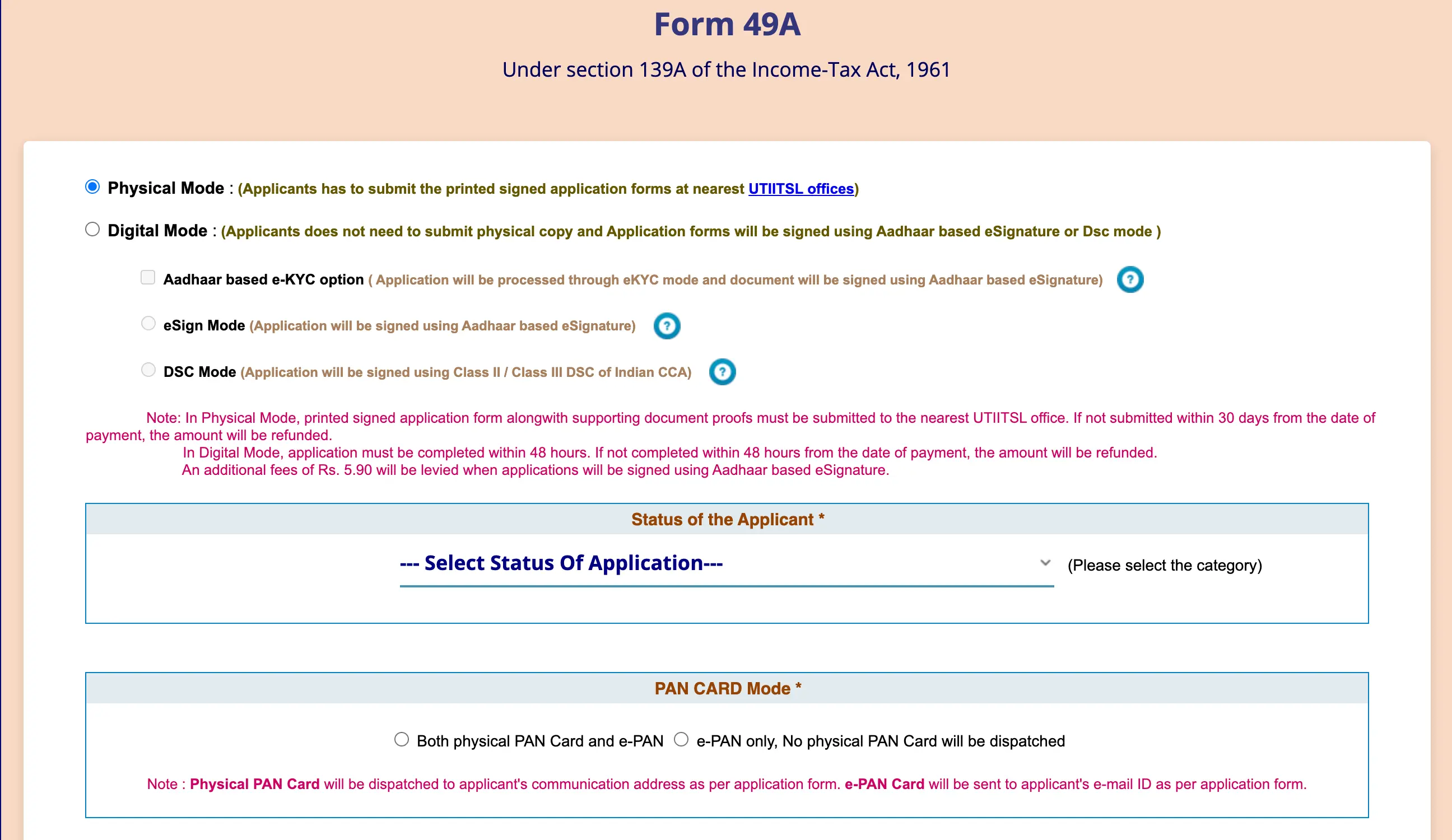

Steps to Apply For PAN Through UTIITSL Portal

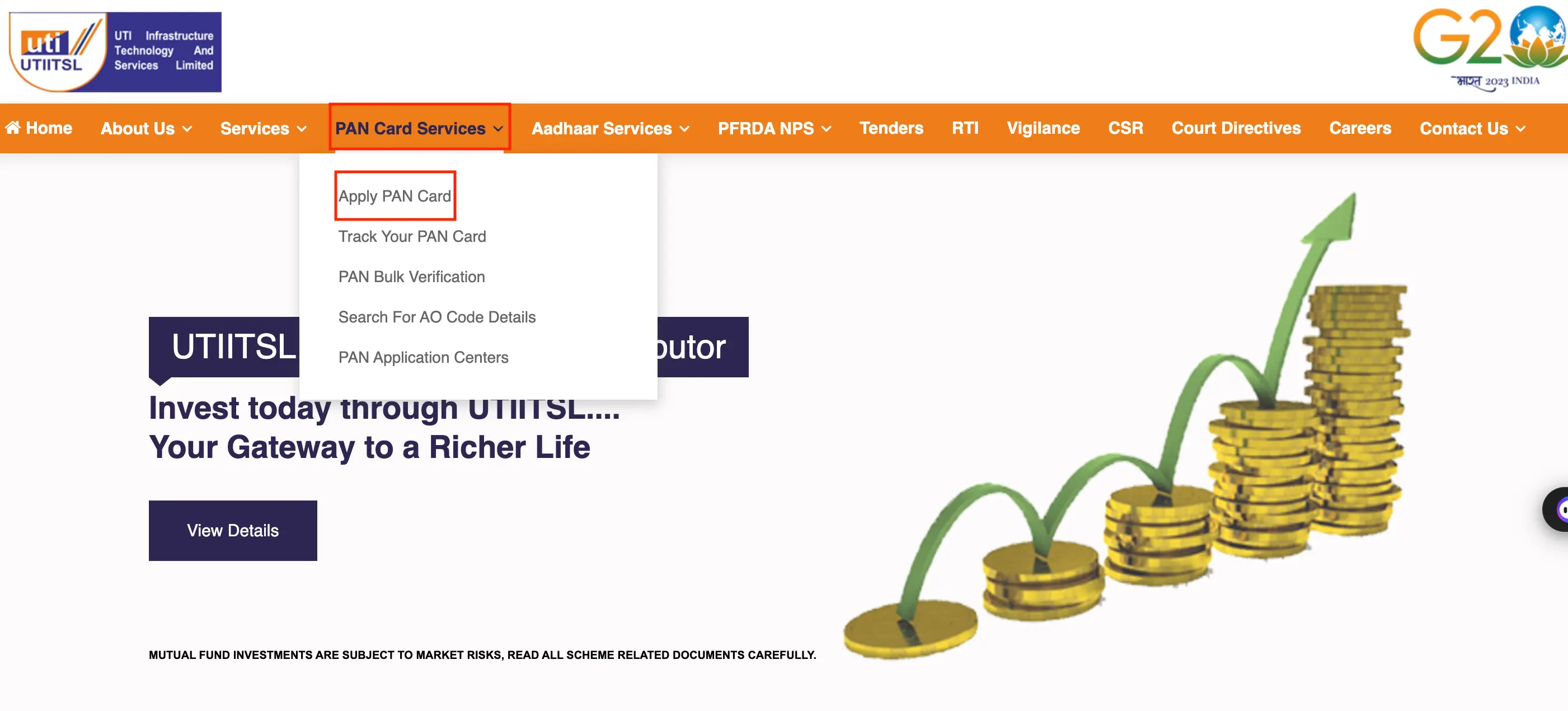

Step 1: Visit the UTIITSL website: https://www.utiitsl.com/

Step 2: Select ‘PAN services’, then ‘Apply for PAN’.

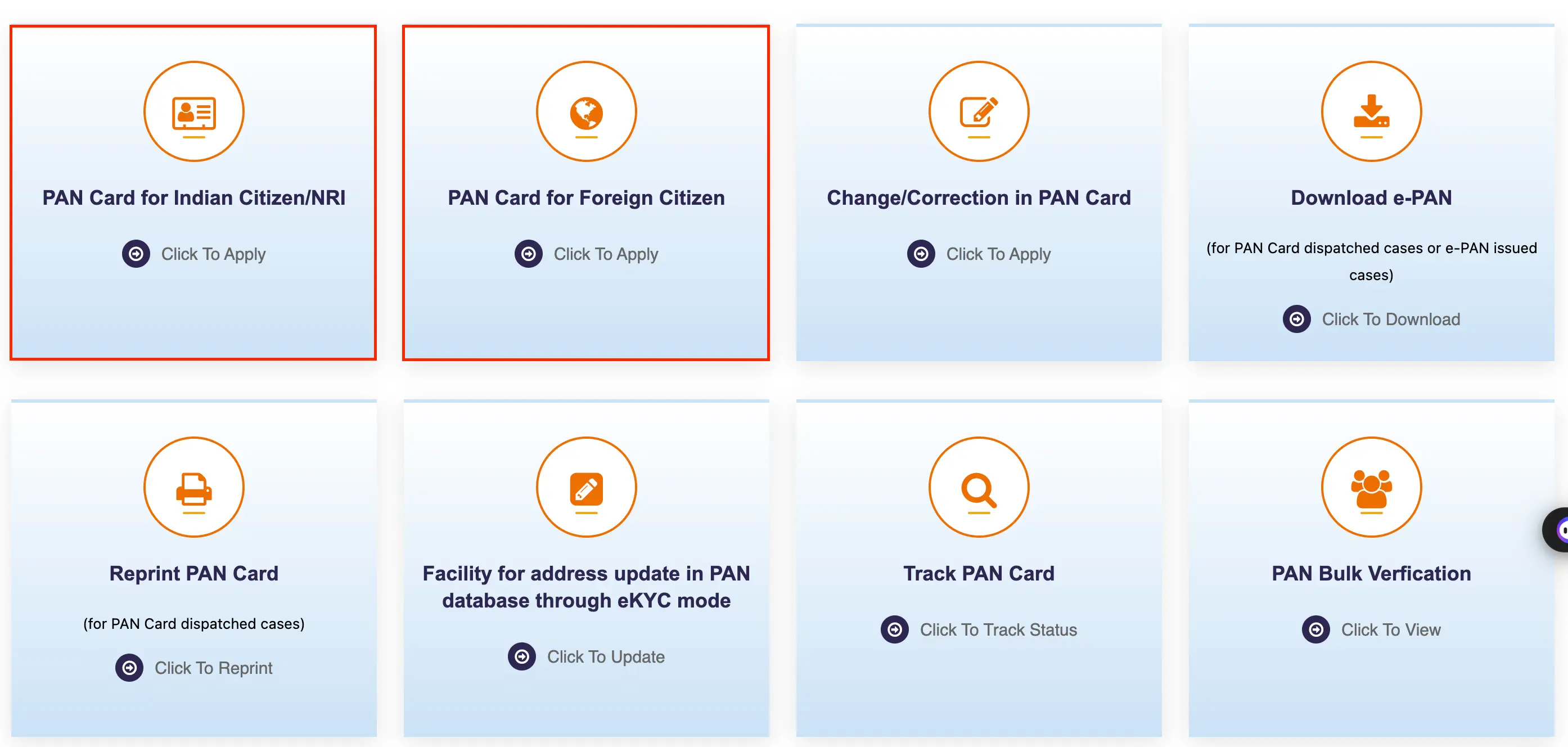

Step 3: Choose the category you would recognise yourself with, befor applying, i.e, whether you are applying as an Individual/NRI or as a Foreign Citizen.

Step 4: You can fill up Form 49A, and complete the process online or offline.

Step 5: Click the ‘Submit’ button at the bottom and you will receive a reference number. Keep the reference number safe as you will need it for future reference.

Step 6: Fill out all the important details such as your personal details then proceed to the next step.

Step 7: Submit your proof of identity, proof of address and proof of birth documents.

Step 8: Provide your parent’s contact details and personal information.

Step 9: Provide your address details and other details in the following pages.

Step 10: Submit all necessary documents.

Step 11: Pay the application fee, and submit the form. You will then have to e-sign your application via Aadhaar OTP.

Step 12: Your PAN card will be dispatched after verification.

Steps to Apply For New PAN Card Offline

NSDL and UTIITSL also offer you the option to apply for your PAN card offline. You can do so by following the steps below:

Step 1: Download the form 49A from NSDL or UTIITSL websites.

Step 2: Fill out all the required information on the form, sign the application form and attach your passport photograph.

Step 3: Submit the form along with all the required documents to a PAN issuing centre near you.

Step 4: Pay the application fee and service charges required.

Step 5: Upon submission of your application, you will get an acknowledgement number which you can use to track the application status.

Step 6: After verification, you will get your PAN card within 15 days.

Don't know your credit score? You can find out for free!

PAN Card Eligibility

Before issuing a PAN card, its database is linked to other government data portals like Aadhaar & Indian Passport. In order to prevent any future frauds, the following eligibility checks provide a secure and accurate sense of applying for a PAN Card.

- If you’re expected to file tax returns: even for specific individuals like minors, persons of unsound mind, deceased individuals or wards of court with the help of a representative assessee.

- If the transactions exceed normal limit: People involved in economic or financial activities where providing a PAN is mandatory.

Forms Required For PAN Application

The application of a PAN card depends on the category you belong to. According to that, you will have to apply for the PAN with a specific form. There are two types of forms; Form 49A and Form 49AA.

- Form 49A: This form should be used if an Indian individual, Associations of Persons, Body of Individuals, Company, Trusts, Limited Liability Partnerships or NRIs wish to apply for a new PAN Card online or offline.

- Form 49AA: This form is used by Foreign Citizen applicants to apply for an Income Tax PAN card.

Documents Required to Apply For a PAN Card

Besides filling the forms, there are necessary documents required to submit either online or offline to apply for a PAN card. Different documents are required for different categories of applicants. The documents required to apply for a PAN card are as follows:

Documents Required for Indian Citizens

Proof of Identity:

- Aadhaar Card, EPIC card, Driver’s licence, Passport, Ration Card, or

- Photo identity card issued by the Government or Public Sector Undertaking

- Pensioner card

- Central Government Health Scheme card or Ex-servicemen contributory health scheme photo card.

- Certificate of identity signed by Member of Parliament, Member of Legislative Assembly or a Gazetted Officer.

- Bank Passbook

Proof of Address:

- Aadhaar Card, EPIC card, Driver’s licence, Passport, Passport of the Spouse

- Post Office Passbook

- Latest Property Tax Assessment order

- Domicile Certificate issued by the government

- A less than three year old allotment letter of accommodation by the Government

- Property registration document

- Utility bills like electricity, water, gas bill, bank account statement, etc

- Certificate of address signed by the Member of Parliament or Member of the legislative assembly

- Employer certificate

Proof of Date of Birth:

- Aadhaar Card, EPIC card, Driver’s licence, Passport,

- Matriculation Certificate from a recognised board

- Birth Certificate issued by the municipal authority or any authorised office,

- Photo identity card issued by the government

- Domicile Certificate issued by the government

- Central Government Health Scheme card or Ex-servicemen contributory health scheme photo card.

- Pension payment order

- Marriage certificate issued by the Registrar of Marriages

- Affidavit sworn before a magistrate stating the date of birth.

For Minors:

- Proof of Identity mentioned above and Address of Parents or Guardians along with the Proof of Address.

For Hindu Undivided Family (HUF):

- An Affidavit by the Karta of HIndu Undivided Family that consists of the applicant’s name, father’s name, as well as the addresses of all the coparceners along with the above mentioned documents for identity, address and date of birth proof.

PAN Documents Required for Companies & Firms

The documents required for firms ( BOI, AOP, AOP (Trusts), Company, Limited Liability Partnership, Artificial Juridical Persons.) are provided here: For those having an office of their own in India, the following documents can be submitted:

- Companies: Certificate of Registration issued by the Registrar of Companies.

- Partnership Firms: Registration Certificate issued by the Registrar of Firms or Copy of Partnership Deed.

- Limited Liability Partnership: Registration Certificate issued by the Registrar of LLPs.

- Association of Persons (Trust): Trust Deed or Registration Number Certificate issued by the Charity Commissioner

- Association of Persons, Body of Individuals, Artificial Juridical Persons or Local Authorities: Registration Number Certificate or the Agreement Copy, given by the charity commissioner or registrar of cooperative society or any other competent authority.

For entrepreneurs and business units that are in need of extra funds and who have no static or stable office of their own, here are few documents to apply for a PAN card:

- Registration Certificate issued in the country of the applicant’s location which is attested by the ‘Apostille’ or by the Indian Embassy or HIgh Commission or Consulate of that country.

- Registration Certificate issued in India, or approval given to set up an Office in India by Indian Authorities.

Documents Required for Foreign Citizens

Proof of Identity:

- Passport, Person of Indian Origin (PIO) card issued by the Government of India,

- Overseas Citizen of India (OCI) card issued by the Government of India,

- Other Nationality or Citizenship Identification number,

- Taxpayer Identification Number attested by Apostille or by the Indian Embassy or by the High Commission or by the Consulate in the country where the applicant is located.

Proof of Address:

- Passport, Person of Indian Origin (PIO) card issued by the Government of India,

- Overseas Citizen of India (OCI) card issued by the Government of India,

- Bank Account Statement in the country of residence

- Non-resident External bank account statement in India

- Certificate of Residence in India or residential permit issued by the State Police Authorities

- Registration certificate issued by Foreigner’s registration office of Indian address

- Copy of Visa and copy of appointment letter or contract from Indian company, and certificate of Indian address issued by the employer

- Other Nationality or Citizenship Identification number

- Taxpayer Identification Number attested by Apostille or by the Indian Embassy or by the High Commission or by the Consulate in the country where the applicant is located.

Furthermore, additional documents required for foreign citizens with office address in India are:

- Proof of Employment in India: A copy of your appointment letter or contract from your Indian employer.

- Employer-Issued Address Certificate (Original):

- This certificate must be issued by an authorized signatory of your employer.

- It must be on the employer's letterhead.

- It should mention the applicant's (your) address in India.

- It must include the employer's PAN number.

- Employer's PAN Card Copy:

- Provide a copy of the PAN card for the PAN number mentioned in the employer's certificate.

Documents Required for Foreign Firms

Check out the list of documents needed for Foreign Firms BOI, AOP, AOP (Trusts), Company, Limited Liability Partnership, and Artificial Juridical Persons.

- Proof of Identity:

- Copy of Registration Certificate (Foreign): Must be issued in the applicant's country of location. Which is duly attested by an Apostille (for Hague Convention of 1961 signatory countries), The Indian Embassy/High Commission/Consulate in the applicant's country. Or authorised officials of overseas branches of Scheduled Banks registered in India.

- Proof of Address:

- Copy of Registration Certificate (Foreign): (Same requirements as Proof of Identity)

- Copy of Registration Certificate (India) that is Issued in India or a document granting approval to set up an office in India by Indian authorities.

Do you need an Emergency loan?

Steps to Check Your PAN Card Status Online

To know the status of your PAN card application, the NSDL and UTIITSL offers you the opportunity to check online using the temporary token number or the acknowledgement number. Here are the steps that you can follow:

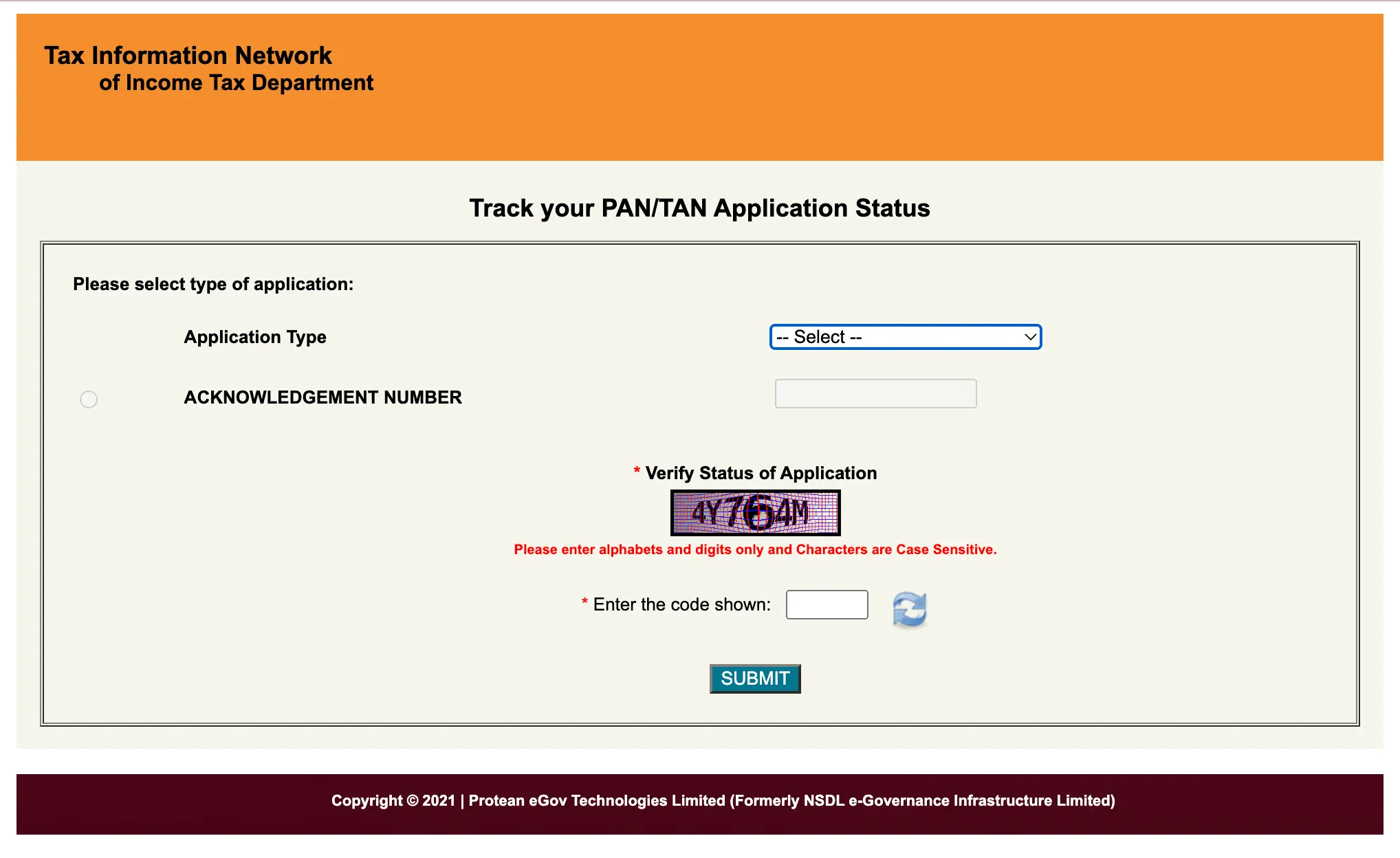

Steps to Check PAN Status Through NSDL Website

Step 1: Visit the NSDL website: https://tin.tin.nsdl.com/pantan/StatusTrack.html

Step 2: Enter the Application type, acknowledgement number, Captcha Code and click ‘Submit’.

Step 3: You will be able to see the status of your application

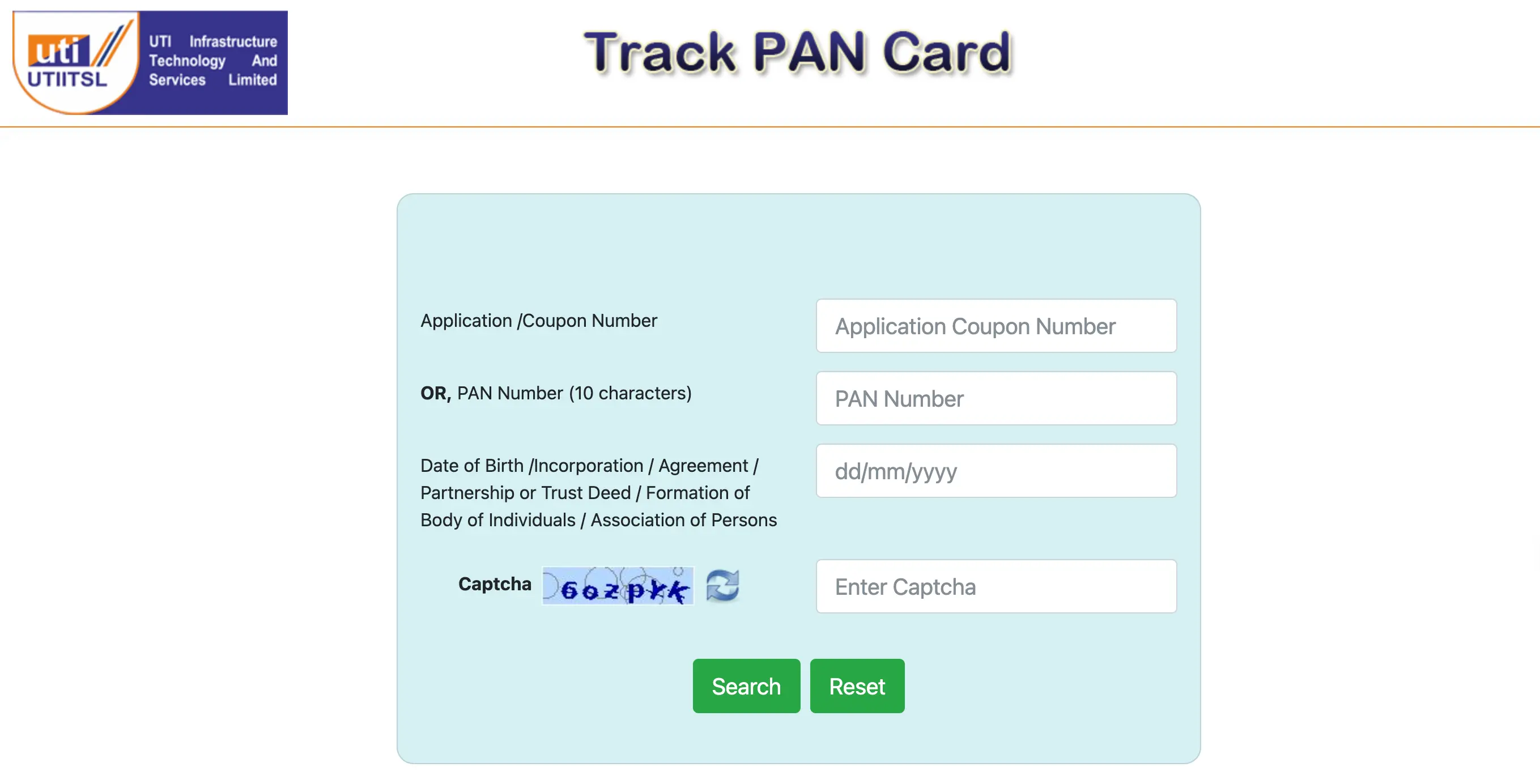

Steps to Check PAN Status Through UTIITSL Website

Step 1: Visit the or UTIITSL website:

Step 2: Enter the Application number or PAN number, Date of Birth or incorporation/ Agreement/ Partnership/ Trust Deed/ Formation of Body of Individuals/ Association of Persons date and enter the Captcha Code.

Step 3: Enter the Captcha code and then click ‘Search’

Step 4: You will then be able to see the status of your PAN card.

Ways to Make Corrections in PAN Card

If there are any mistakes regarding your personal details in the PAN card, you can change it using the form for change or correction of data in the PAN card. The NSDL offers you a way to rectify the mistakes by submitting the form and following the steps below:

Step 1: Visit the NSDL website to apply for the PAN update online.

Step 2: Select your citizenship and enter your category (individual, company, etc.) and title such as Smti, Shri or Kumari. Fill in the application form and enter all your details in the required fields.

Step 3: Check for errors before submitting the correction form, make sure you check your information for mistakes and fix them. Make sure you select the corresponding box next to that field on the left side of the form if you only need to change specific information on your PAN card.

Step 4: Once you recheck and review, you can submit the form if there are no errors.

Are you looking for a loan?

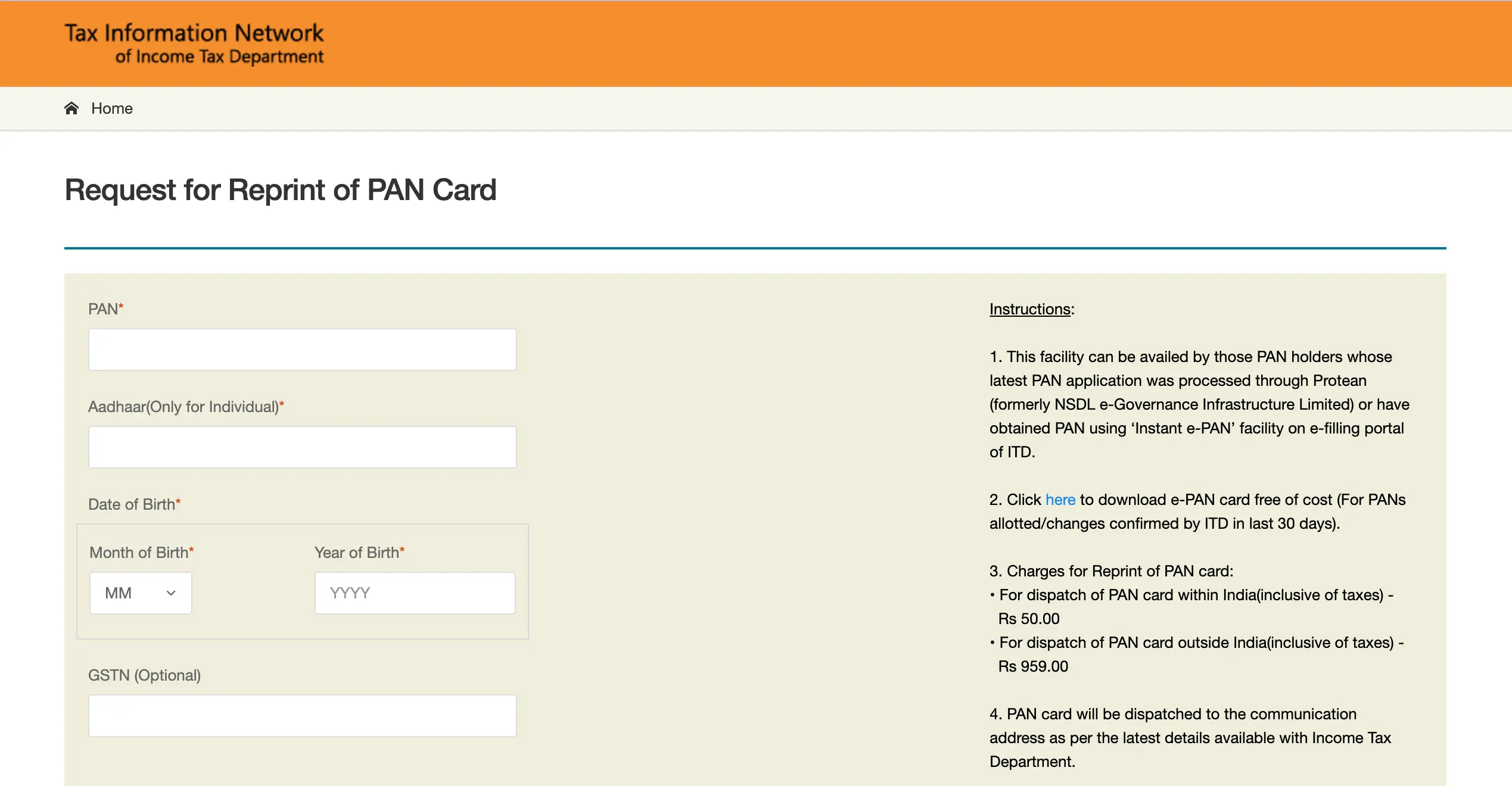

Steps to Apply For a Duplicate PAN Card

In case you misplaced your PAN card, you can apply for a duplicate card or a reprint of it, here are the steps that you can follow:

Step 1: Visit the NSDL website. Under ‘New Facilities’ click on ‘Reprint of PAN Card'

Step 2: Enter your Permanent Account Number (PAN), Aadhaar number, Date of Birth and GSTN.

Step 3: Read and understand the Privacy Policy of Protean and then tick the box for agreement. You can then validate the reCaptcha by ticking the box then click on ‘Submit’.

Step 4: Make the required payment amount and your request will be processed.

Step 5: Once your application is verified, your new PAN card will be dispatched.

Take the next step! Apply for a loan now!

If you are looking for more information on different PAN card loans, feel free to check out the links below:

PAN Card Customer Care Number

You can contact PAN Customer Care for queries on your PAN card application, corrections & more. Check the PAN customer care content details below.

| PAN Card Agency | Customer Care Number |

|---|---|

| NSDL (Protean eGov Technologies Limited) | 020-27218080 |

| UTIITSL PAN Assistance Center | 033-40802999 |

Frequently Asked Questions

You can check the status of your PAN card through the NSDL website, by entering your token or acknowledgement number and captcha. You can also check through your mobile number.

Yes, you can apply for a PAN card online through NSDL and the UTIITSL website.

Yes, you can download the PAN card for free from the NSDL and UTIITSL website.

You can download the normal PAN card through the NSDL or UYIITSL website.

You can download the e-PAN through the NSDL website or through Digilocker.

Yes, you can get a duplicate PAN card by reprinting your existing PAN.

You can get the original PAN card by applying online through NSDL. Usually a PAN card will be dispatched in 15 days.

No, it is currently not possible to download a PAN card without OTP.

To check your PAN card status by mobile number, you can SMS your acknowledgement or token number to 57575 NSDL PAN or call the number 020-27218080.

If you lose your PAN card, you can immediately lodge a police complaint, inform the Income Tax department and apply for a duplicate PAN card through NSDL.

Several documents are required for a PAN card application based on the different categories like Indian individuals, HUFs, Other business entities, Foreigners, etc. Check the documents section above for more information.

No, there is no age limit for applying for a PAN card, even minors can apply with the help of parents or guardians.

Yes, NRIs can apply for a PAN card.

Yes, you will need to pay ₹101 plus GST for applying for a new PAN card as an Indian citizen.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users