The National Savings Certificate (NSC) is a savings scheme certificate offered by the Post Office to encourage the habit of saving among individuals in rural and semi-urban areas. It is a fixed-income investment scheme that offers tax-saving benefits as well as guaranteed returns.

You can invest in the NSC scheme with a minimal deposit amount of ₹1000 and earn an attractive interest rate of 7.7% p.a. for a fixed tenure of 5 years. You can invest in the scheme online through banks, however, NSC transfer online is still not possible. You can transfer an NSC account to another individual or to another Post office to make the savings schemes more accessible and convenient.

The National Savings Certificate offers tax benefits under Section 80C of the Income Tax Act, 1961 allowing tax deductions for deposits up to ₹1.5 lakh annually.

NSC Transfer

The National Savings Certificate (NSC) offers you a reliable way to earn high interest on your savings as well as a convenient way to transfer your account. Offering you flexibility and security to manage your funds. You can transfer an NSC account to another Post office as well as to another person under certain conditions.

Given below are the detailed steps on how to transfer your National Savings Certificate account.

NSC Transfer to Another Post Office

When you have an NSC account at your local Post Office, but you are relocating due to work or marriage or for any other reasons, managing your account can become a challenge. For this, the Post Office has offered a convenient solution where you can transfer your account to the nearest Post office in your new residence. Making your account easily accessible especially when it is almost time to collect your maturity amount.

Below are the steps to transfer an NSC account:

- Step 1: Visit the Post Office where your NSC account was opened.

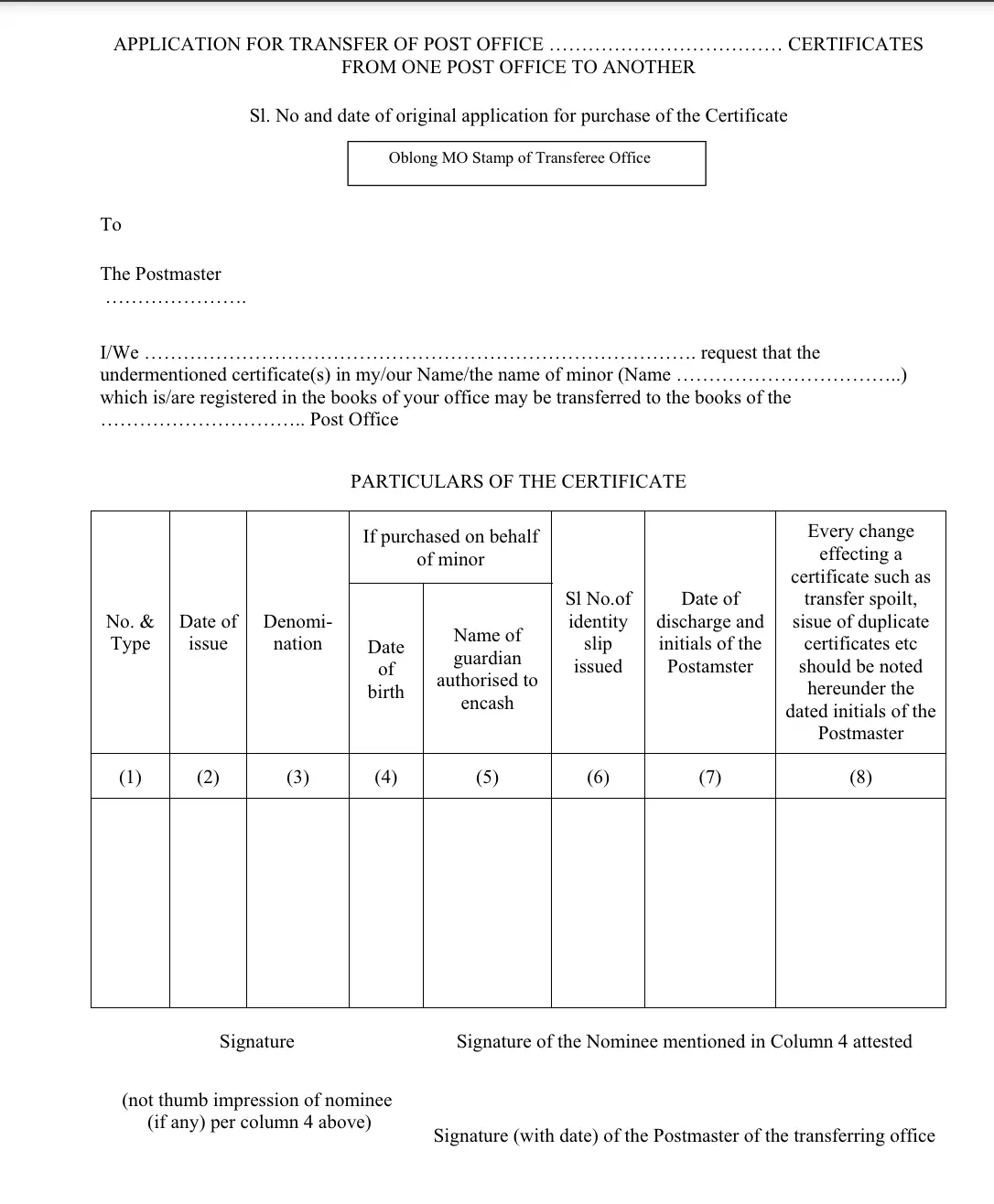

- Step 2: Fill out Form NC-32, which is a form that is specifically required to initiate the transfer of NSC accounts. You can download the NSC transfer form from the official website.

- Step 3: Fill in all the necessary information such as your personal information, and certificate details, along with details of the Post Office where the NSC was issued.

- Step 4: You will need to sign the form, once it is completed. If it is a joint account then all account holders must sign the form. However, if one account holder has passed away then only the survivor’s signature will be required.

- Step 5: You can then submit Form NC-32 to the Post Office along with certain KYC documents to verify your information.

- Step 6: Once the verification is complete, the Postmaster will sign it and send it to the post office at the new location.

- Step 7: The new Post Office will then complete the transfer process.

Do you need an instant loan?

NSC Transfer from Person to Person

The Post Office offers you an easy way to transfer NSC to another person in case of a change in life circumstances. However, the transfer must meet certain conditions, these are:

- On the death of the account holder: Upon the demise of the account holder, the nominee or legal heir will be given the NSC account.

- On the death of one account holder in a joint account: In case one holder passes away, the NSC account will be transferred to the surviving account holder.

- On order by the court: The NSC account will be transferred if the court issues an order.

- On pledging the account to a specified authority: The NSC account will be transferred if the account holder initiates a transfer to an individual or entity as security.

Steps to transfer the account from person to person

If the conditions for transferring the account are fulfilled, the process for transferring can begin. Here are the steps to transfer an NSC account:

- Step 1: Visit the Post Office where the account is held.

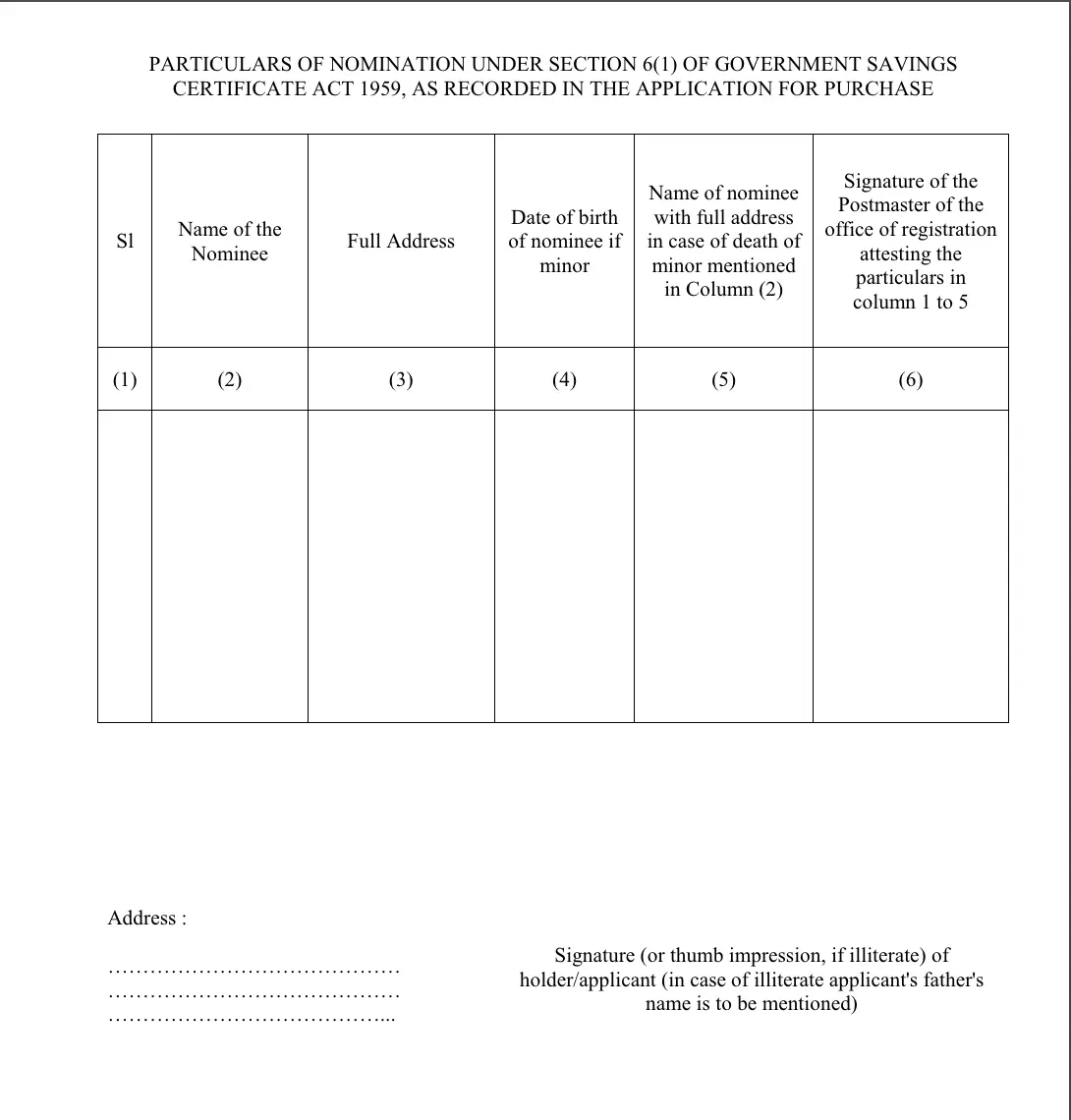

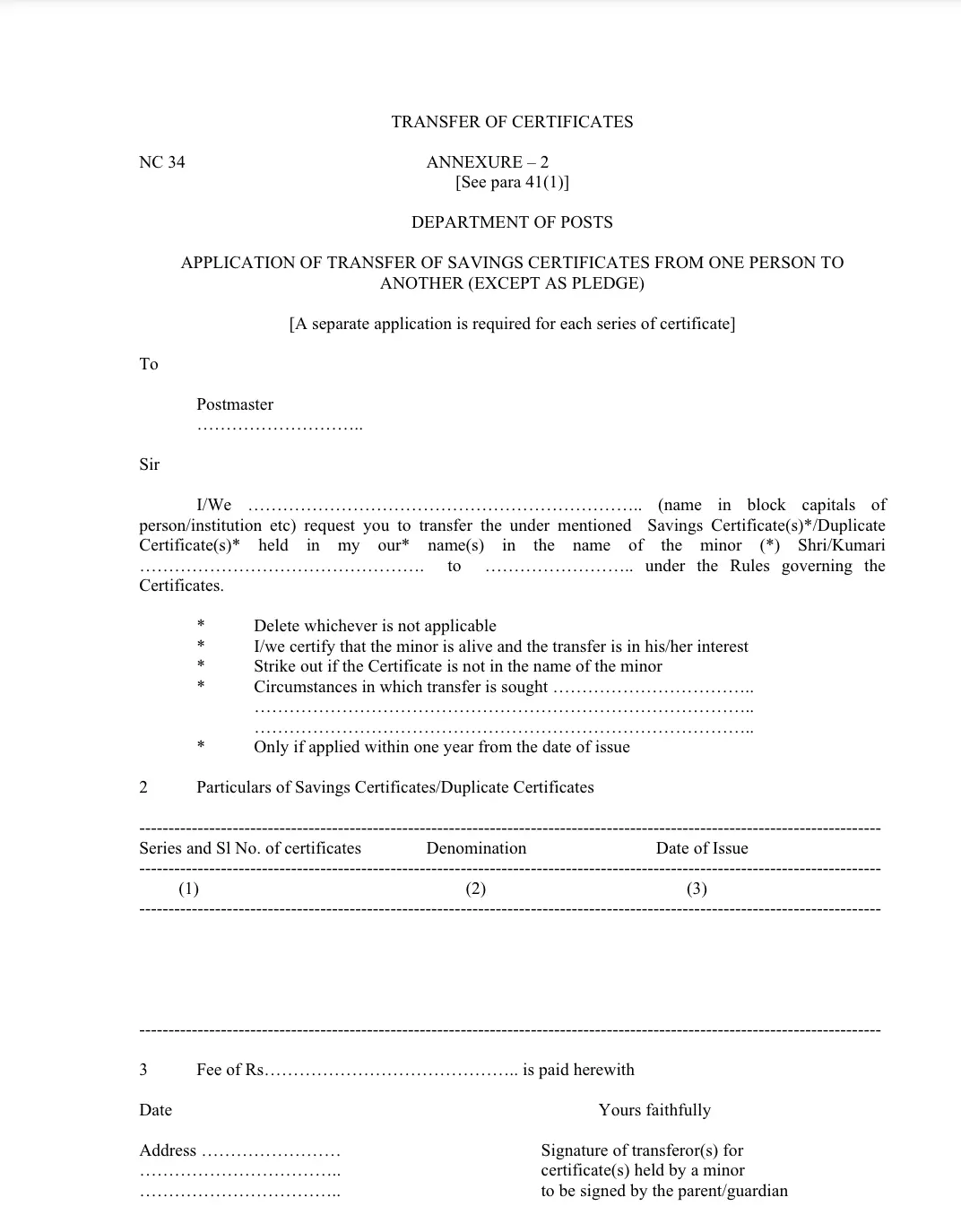

- Step 2: You will need to fill out Form NC 34 which you can download from the Post Office website.

- Step 3: Fill in all the necessary information such as your personal details, certificate, transferee (the person you are transferring the account to) details and the reason for transfer.

- Step 4: Both you and the transferee must sign the form before submission. In case of a minor, then the guardian can sign.

- Step 5: The postmaster will then verify the form and documents provided and then complete the transfer process.

Transfer NSC Account by Pledging

Transferring an NSC account to a specified authority as security to avail a loan in times of financial need can also be done. The transfer has a specified procedure to make sure that there is proper management of the NSC account.

Here are the conditions that are necessary for the transfer to qualify:

- President of India or Governor of a State

- RBI or Scheduled Banks or Cooperative Banks or Societies

- Public, Private Corporations or Government Companies

- Local Authorities

- Housing finance company approved by the National Housing Bank

Don't know your credit score? You can find out for free!

Steps to Transfer NSC Account Through Pledging

If the above conditions are fulfilled, you can transfer your NSC account by following the steps below:

- Step 1: Visit the Post Office and fill in the application form to pledge the NSC.

- Step 2: Complete the application with all the required details and submit it to the Post Office for verification.

- Step 3: The form and documents provided will be verified by the Postmaster. Once the application is accepted, he/she will endorse the NSC records as ‘Transferred as security to…’

If the pledge is still in effect upon the maturity of the NSC, then the maturity amount will go to the pledgee (The person to whom the NSC was transferred as security). However, If the loan has been repaid before the maturity date, the pledgee can request the Post Office to release the pledge and the Post Office will endorse the account records and certificate as ‘Re-transferred to…’ the original account holder.

NSC Account Transfer Form

There are two NSC account transfer forms that you need; Form NC-32 and Form NC-34.

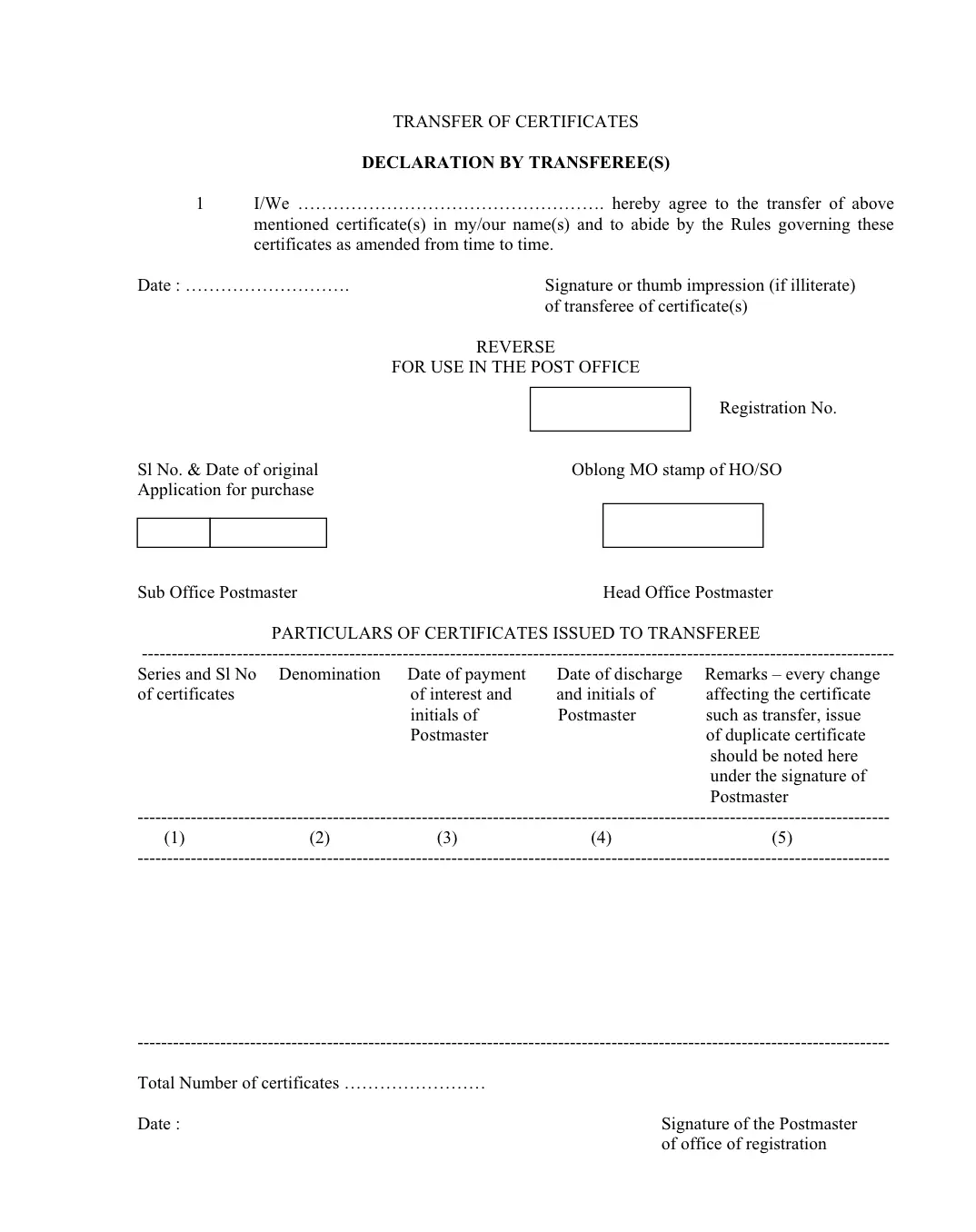

Form NC-32 is the form to fill up and submit to initiate the transfer of an NSC account to another Post Office in case of relocation. You can download the NSC transfer form PDF to transfer your account to another post office branch by clicking on the linked page. The form is given below for reference:

Form NC-34 is the form you need to fill and submit if you want to transfer your NSC account to another person. You can download the NSC Transfer Form to transfer your NSC to another person from the linked text. The form is given below for your reference:

Documents Required to Transfer NSC Account

The documents required to transfer NSC account are:

- Identity Proof: Voter ID, PAN card, Aadhaar Card.

- Address Proof: Utility Bills, Rental Agreement, Passport, etc.

- Certified Declaration

- Passport Size photograph

Check more on National Saving Certificate from the links below:

| NSC Interest Rate | NSC Tax Benefits |

| NSC Rules and Guidelines | Documents Required for NSC |

| Post Office NSC | NSC Post Office Application Form |

| NSC Maturity Certificate | NSC as Security for Your Loans |

| NSC Premature Withdrawal | NSC Calculator |

Compare NSC with other investment options from below:

Ready to take the next step?

Besides NSC, you can also check other saving schemes for returns. Check the table below with links for details:

Frequently Asked Questions

NSC can be transferred from one person to another by submitting Form 32 to the Post office where th eNSC was issued.

Currently, NSC transfer online is not possible.

NSC can be transferred in case of the death of the account holder, death of one account holder in case of a joint account, on order by the court or on pledging the account as security.

Upon the death of the account holder, the account will be transferred to the nominee or to the legal heir.

Yes, NSC can be transferred to another Post Office.

The NSC offers tax benefits under Section 80C of the Income Tax Act, 1961 which allows deductions up to ₹1.5 lakh annually.

The current interest rate offered for NSC is 7.7% p.a.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users