NPS Tier 2 is a voluntary investment opportunity for NPS Tier 1 subscribers under the National Pension System (NPS). It is intended to offer an additional investment option for individuals who are planning for a financially secure retirement. The account complements the Tier 1 account, offering flexibility and liquidity without any exit restrictions.

NPS subscribers can invest any amount without any limit, making it a great account to build a retirement corpus. Moreover, government employees can benefit more as NPS Tier 2 offers tax deductions up to ₹1.5 lakhs. So, if you are an NPS subscriber, consider investing in NPS Tier 2 as it offers you flexible, low-cost investment options with easy access to funds.

In the Budget of 2024, a new rule was added to the NPS; NPS Vatsalya Scheme. This scheme allows parents or guardians to open an NPS account for their minor children. Which will then be converted to a regular NPS account when they turn 18. This is done to help contribute to the kid’s future retirement ensuring future financial security.

Table of Contents:

Features of NPS Tier 2

NPS Tier 2 offers you a flexible way to increase your savings for retirement. Here are the features of the account:

- Voluntary Contribution: NPS Tier 2 is a flexible, voluntary savings account that allows pensioners and individuals to invest beyond their NPS Tier 1 contributions.

- Minimal Subscription Requirement: To open the account, you must deposit ₹1000 with a minimum subscription of ₹250 per year.

- No Withdrawal Restrictions: Unlike NPS Tier 1, subscribers can withdraw funds from the Tier 2 account at any time without restrictions, making it ideal for short-term financial goals.

- Unlimited Contributions: There is no cap on the maximum contribution, allowing subscribers to invest any amount as per their financial capacity.

- No Lock-In Period: While NPS Tier 1 has a lock-in period until retirement, Tier 2 offers liquidity with no lock-in requirements.

- Low Management Costs: The fund management charges are minimal, making NPS Tier 2 a cost-effective investment vehicle.

- Investment Options: Subscribers can choose between active and auto choice for fund management, allowing control over equity, corporate, and government bonds.

- Tax Benefits: Unlike Tier 1, there are no tax benefits for most individuals, except for government employees who can claim deductions under Section 80C for contributions up to ₹1.5 lakh.

- Easy Portfolio Switching: Investors have the flexibility to switch between various investment schemes and fund managers, enabling them to adjust their portfolios as per market conditions.

Are You Looking For a Personal Loan?

Eligibility to Open an NPS Tier 2 Account

To open an NPS Tier 2 account, you will need to fulfill the following conditions:

- You must be an Indian citizen.

- You must subscribe to NPS Tier 1 and have an active PRAN number.

- Minors can invest if their parents or guardians open an account on their behalf.

- You must deposit ₹1000 to open the account with a minimum of ₹250 as a subscription fee every year.

Understanding NPS Tier 2 Investment

You will get two investment options when subscribing to NPS Tier 2, these are:

- 1. Active Choice: This option lets you pick how much money goes into different types of investments, such as:

- Equity (E): Invest in stocks.

- Government Securities (G): Safe government bonds.

- Alternate (A): Special investments like real estate or commodities.

- 2. Auto Choice: This option is automatic where the system chooses the investment option for you. They will invest in high-yield investments in the first few years, after which, as you get older, it shifts your money from risky investments like stocks to safer ones like bonds. This is to ensure that your return is protected from market fluctuations.

With NPS Tier 2, you can keep investing until you turn 60, or you can delay withdrawals for 10 more years without needing to add more money. This plan helps balance risk and return as you approach retirement.

Investment Limits for NPS Tier 2

In an NPS Tier 2 account, there are no upper limits on the amount you can invest. However, the minimum initial contribution required to open a Tier 2 account is ₹1,000. After that, a minimum contribution of ₹250 is needed for subsequent investments.

Unlike Tier 1, there are no tax benefits or restrictions on withdrawals in Tier 2, making it a flexible investment option. You can invest as much as you want based on your financial goals, allowing you to use it for both short-term and long-term financial planning.

Not sure of your credit score? Check it out for free now!

NPS Tier 2 Return Rates

NPS Tier 2 accounts have shown impressive returns in 2024, especially under Scheme E, which primarily focuses on equity investments. Top pension fund managers have consistently delivered strong performance. For instance:

- Aditya Birla Sun Life Pension Management Ltd. generated a 1-year return of 34.13%, with a 5-year average of 19.96%.

- HDFC Pension Management Co. Ltd. generated a 1-year return of 34.25% and a 5-year return of 20.22%.

- The ICICI Prudential Pension Fund Management stands out with a 1-year return of 36.06% and a 5-year return of 20.81%.

These strong returns make NPS Tier 2 accounts attractive for individuals seeking flexible, high-return investments with long-term potential. Here are the range of NPS Tier 2 return rates:

| Yearly Returns | Percentage |

|---|---|

| 1-year return | 32.15% – 40.81% |

| 3-year return | 19.31% – 20.66% |

| 5-year return | 19.03% – 20.81% |

| 7-year return | 14.62% – 15.86% |

Check more on NPS from the links below:

Steps to Open NPS Tier 2 Account

To open an NPS Tier 2 account, you will need to have an NPS Tier 1 account with an active PRAN number. After that, you can just activate your NPS Tier 2 account. Below are the steps on how you can do it.

Online Method for Opening an NPS Tier 2 Account

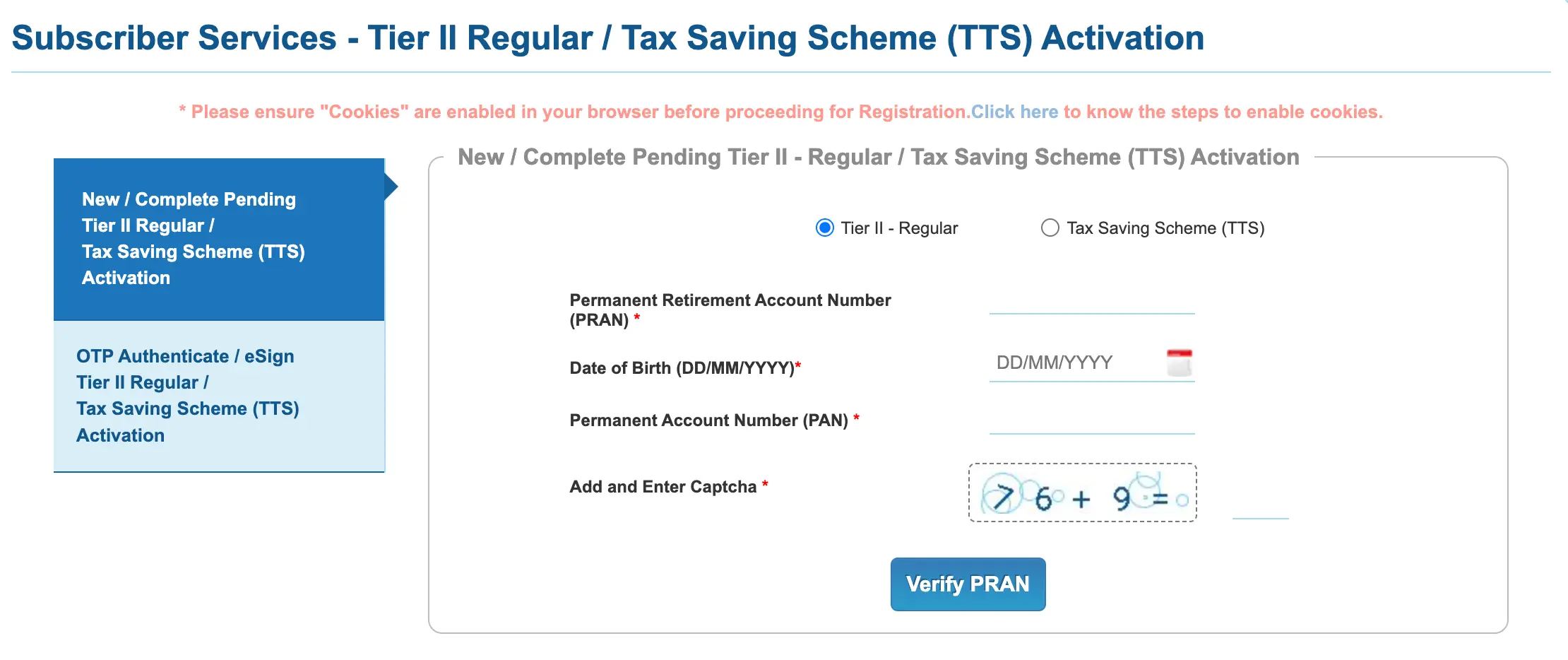

Step 1: Visit the Protean website - https://enps.nsdl.com/eNPS/NationalPensionSystem.html

Step 2: Click on National Pension System (NPS) and select ' Activate Tier II/TTS account.

Step 3: Enter your Permanent Retirement Account Number (PRAN), Date of Birth, and Permanent Account Number (PAN), and add and enter the Captcha.

Step 4: Click on ‘Verify PRAN’.

Step 5:Once verified, you can make the deposit amount of ₹1000 and your NPS Tier II account will be activated.

Offline Method for Opening an NPS Tier 2 Account

To open an NPS Tier 2 account offline, follow these steps:

Step 1: Locate and visit the nearest Point of Presence Service Provider (POP-SP), typically a bank or authorised NPS service provider.

Step 2:Obtain the NPS Tier 2 application form. Fill in your personal details, including your Permanent Retirement Account Number (PRAN).

Step 3:Provide the necessary KYC documents like identity proof, address proof, and PRAN details.

Step 4:Make the initial deposit, usually a minimum of ₹1,000, via cheque or demand draft.

Step 5:After submission, you will receive an acknowledgment receipt, and your Tier 2 account will be activated within a few days.

Do you need an Emergency loan?

Frequently Asked Questions

Tier 2 in NPS is a voluntary, flexible savings account under NPS that you can activate if you have an NPS Tier 1 account. It offers liquidity without the withdrawal restrictions of the Tier 1 account.

There are many differences between NPS Tier 1 and Tier 2, these include NPS Tier 2 offering unlimited withdrawals and tax benefits only for government employees, unlike Tier 1, which is restricted until retirement and offers tax incentives.

Yes, you can withdraw money from your Tier 2 account at any time.

Yes, the NPS Tier 2 account offers tax benefits to government employees with deductions of up to ₹1.5 lakhs.

Yes, minimal charges like account maintenance fees and transaction charges apply, but they are generally lower than traditional investment options.

Tier 1 is better for long-term retirement savings with tax benefits, while Tier 2 offers liquidity and flexibility for short-term goals. Investing in both will help you build a proper retirement corpus in the long run.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users