The Pradhan Mantri MUDRA Yojana (PMMY) was initiated on April 8, 2015, to offer loans up to ₹10 lakhs to non-corporate, non-farm small/micro enterprises. The main purpose is to meet the financial needs of the micro-enterprise, business activities, and other entrepreneur segments. The MUDRA loans are offered in association with Banks/NBFCs, accessible both online and offline. These loans are unsecured, and the interest rate is competitive.

Continue reading to learn how to apply for a MUDRA Loan online and offline through leading Banks or NBFCs.

Small business owners, entrepreneurs, and individuals involved in income-generating activities in sectors such as manufacturing, trading, and services are eligible for MUDRA loans.

Table of Contents:

Highlights of MUDRA Loan

Before getting into the details, let’s go through the highlights of the MUDRA loan below:

| MUDRA Interest Rates | Depends on the Lender |

| Loan Amount | Upto 10 Lakhs |

| Loan Category | Shishu, Kishore & Tarun |

| Loan Type | Collateral Free Loan (without Security) |

| Loan Facility | Cash Credit, Overdraft & Term Loan |

| Repayment Tenure | Depends on the Lender |

| MUDRA Processing Fee | Zero (For the Shishu category) As per Lender (For Kishore & Tarun category) |

Read More

Read Less

Ready to take the next step? Apply for a Business now!

Apply for MUDRA Loan Online

Applicants can submit their applications for MUDRA loans through the online process by adhering to the steps mentioned below.

- Step 1: Visit the official website of the eligible Bank/NBFC that provides MUDRA loans, as per the guidelines of the RBI.

- Step 2: Obtain the loan application form from the official website of the bank.

- Step 3: Complete the application form with the necessary information and attach the required documents.

- Step 4: Submit the application form online on the official website of the bank to receive a reference ID or number.

- Step 5: A representative from the bank will get in touch with you to proceed with the loan formalities, so it is important to keep the reference ID number readily available.

- Step 6: Once the loan application form and attached documents are reviewed and verified, the loan amount will be sanctioned and subsequently disbursed by the bank into your bank account.

Apply for MUDRA Loan Offline

If you prefer to apply for a MUDRA loan offline, you can follow the steps below:

- Step 1: Visit your nearest bank branch that is authorized by RBI to offer MUDRA loans under PMMY.

- Step 2: Fill out and submit the loan application form, along with all the necessary documents, at the bank's counter.

- Step 3: Complete all additional loan formalities and procedures with the bank.

- Step 4: Once all the documents are checked and verified, the loan application will be approved.

- Step 5: After approval, the requested amount will be disbursed to the specified bank account within the specified working days.

Not sure of your credit score? Check it out now!

Apply for MUDRA Loan Through Udyami Mitra Portal

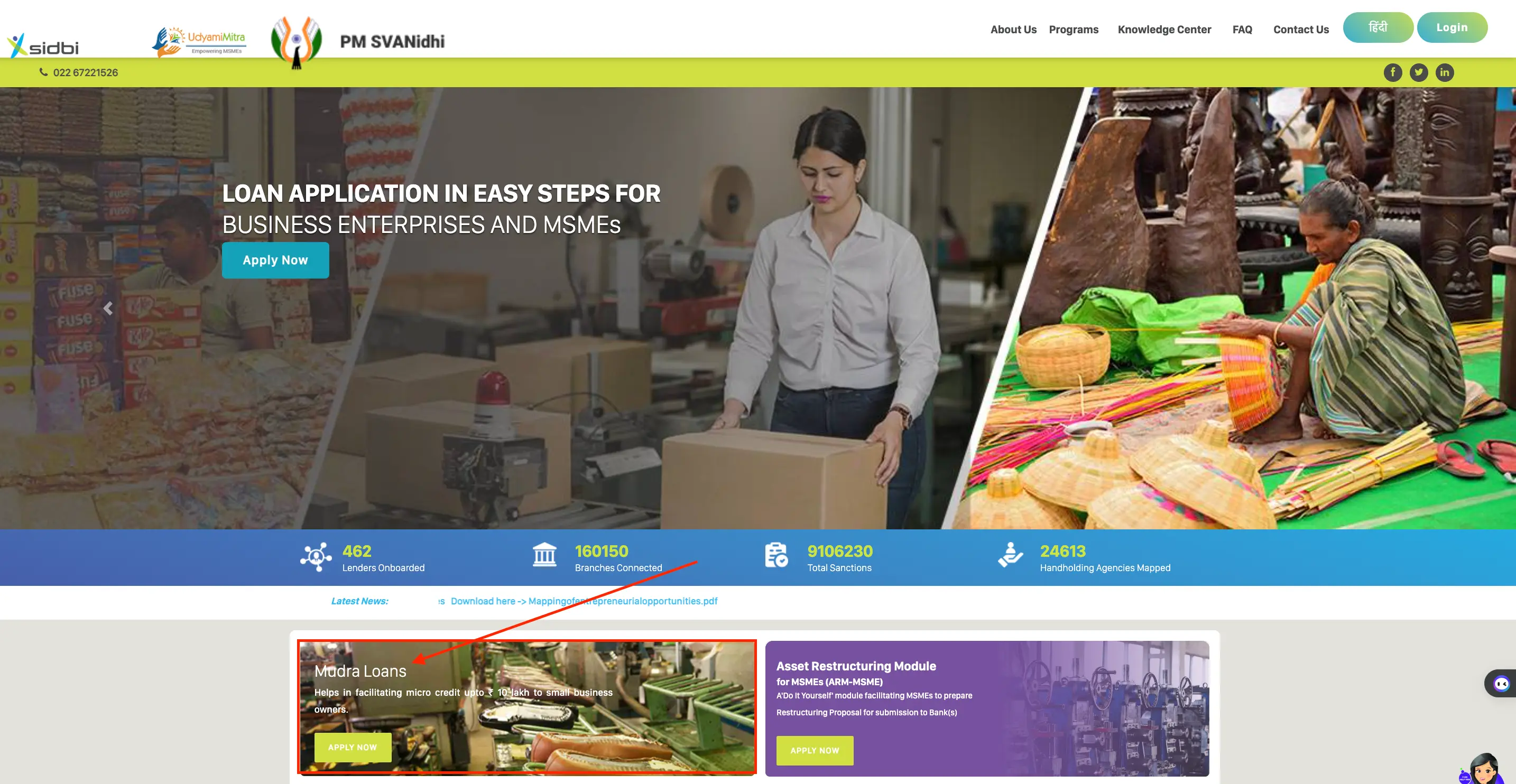

Borrowers also have the option to submit online applications for MUDRA loans on the Udyami Mitra portal (www.udyamimitra.in).

- Visit the official website of the Udyami Mitra portal and select “MUDRA Loans”.

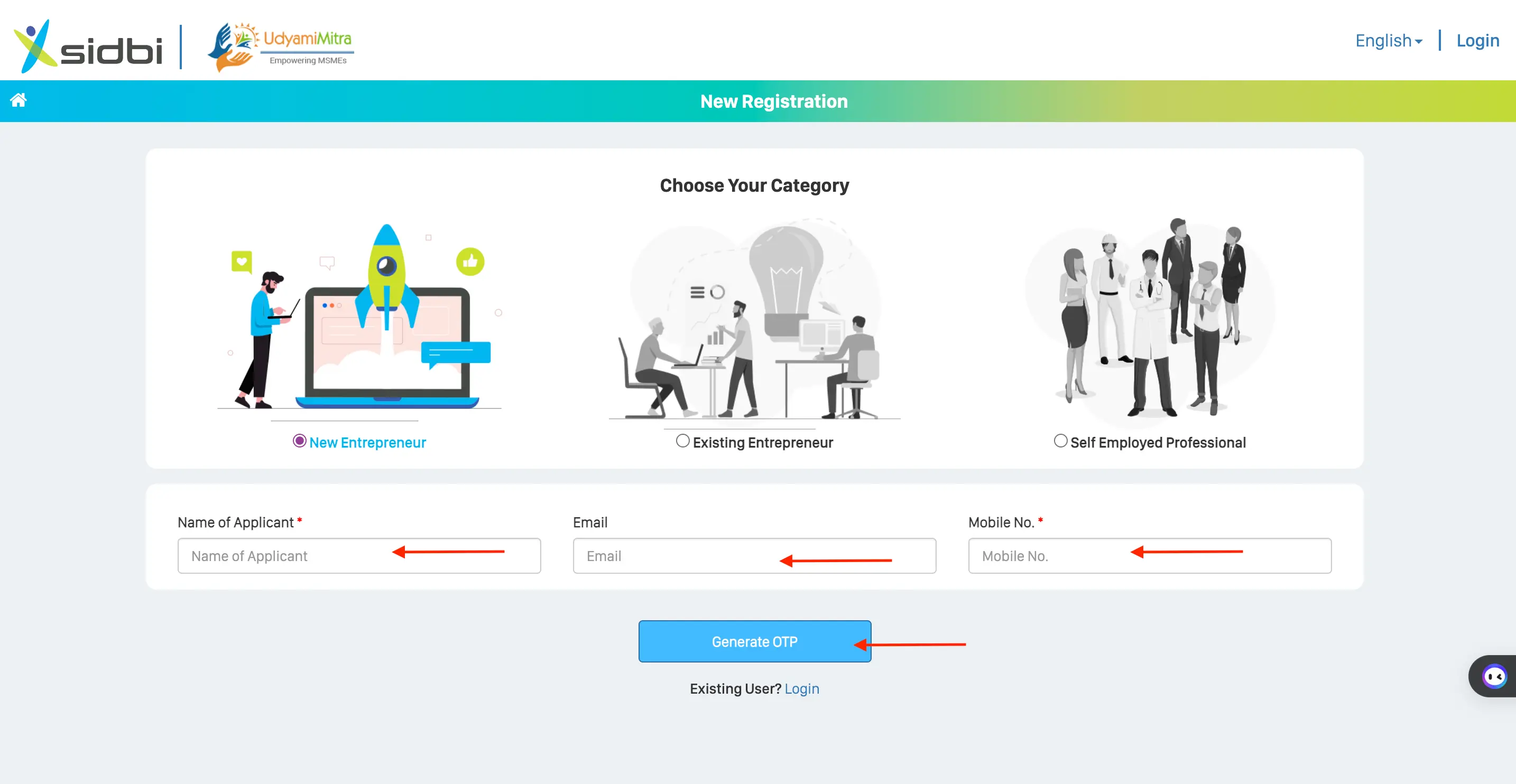

- You will be redirected to the New Registration page. Choose your Category among the options: New Entrepreneur, Existing Entrepreneur, or Self Employed Professional.

- Next your enter name, email address, and mobile number and click on “Generate OTP”.

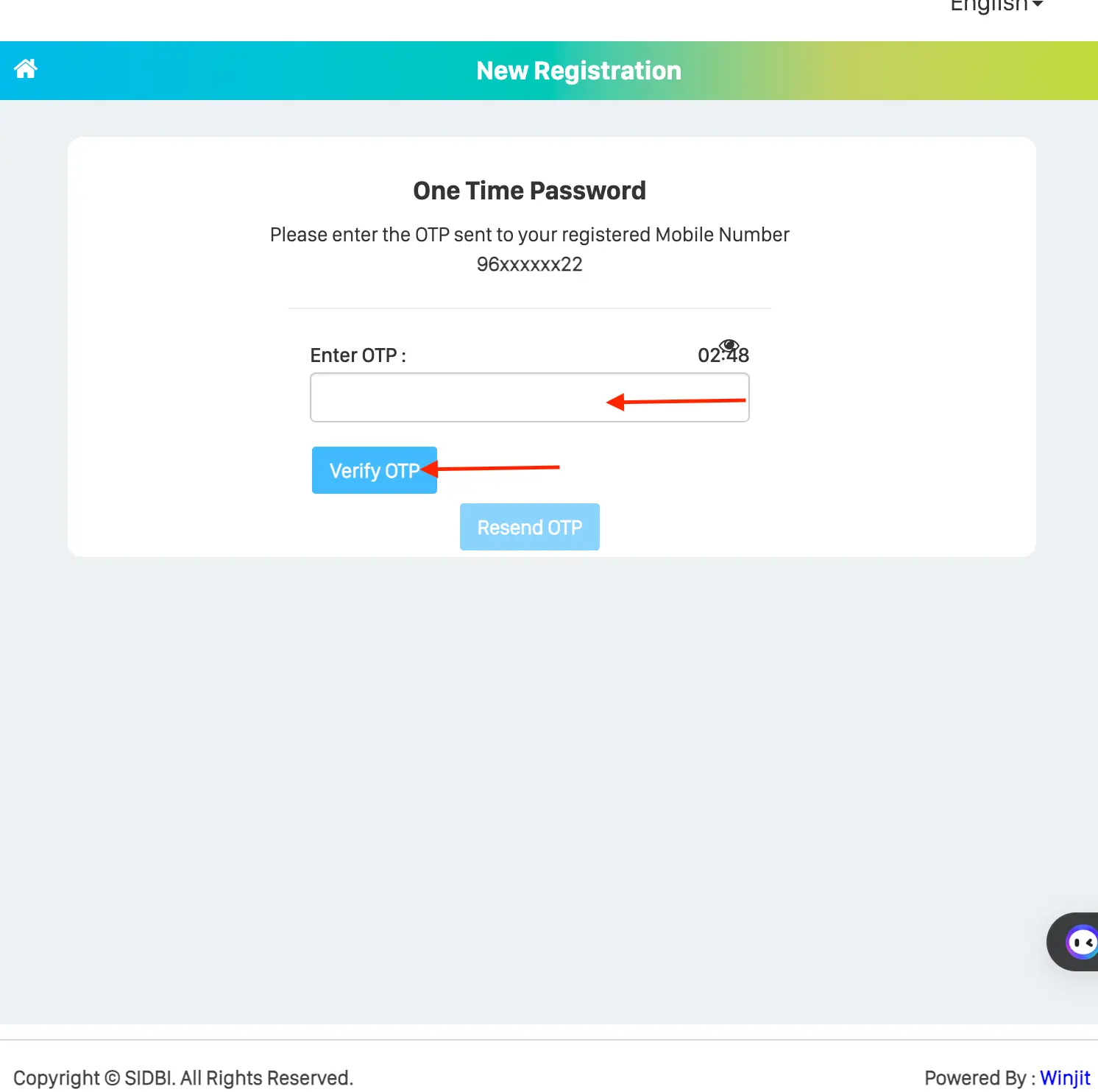

- Enter the OTP and click on “Verify OTP”.

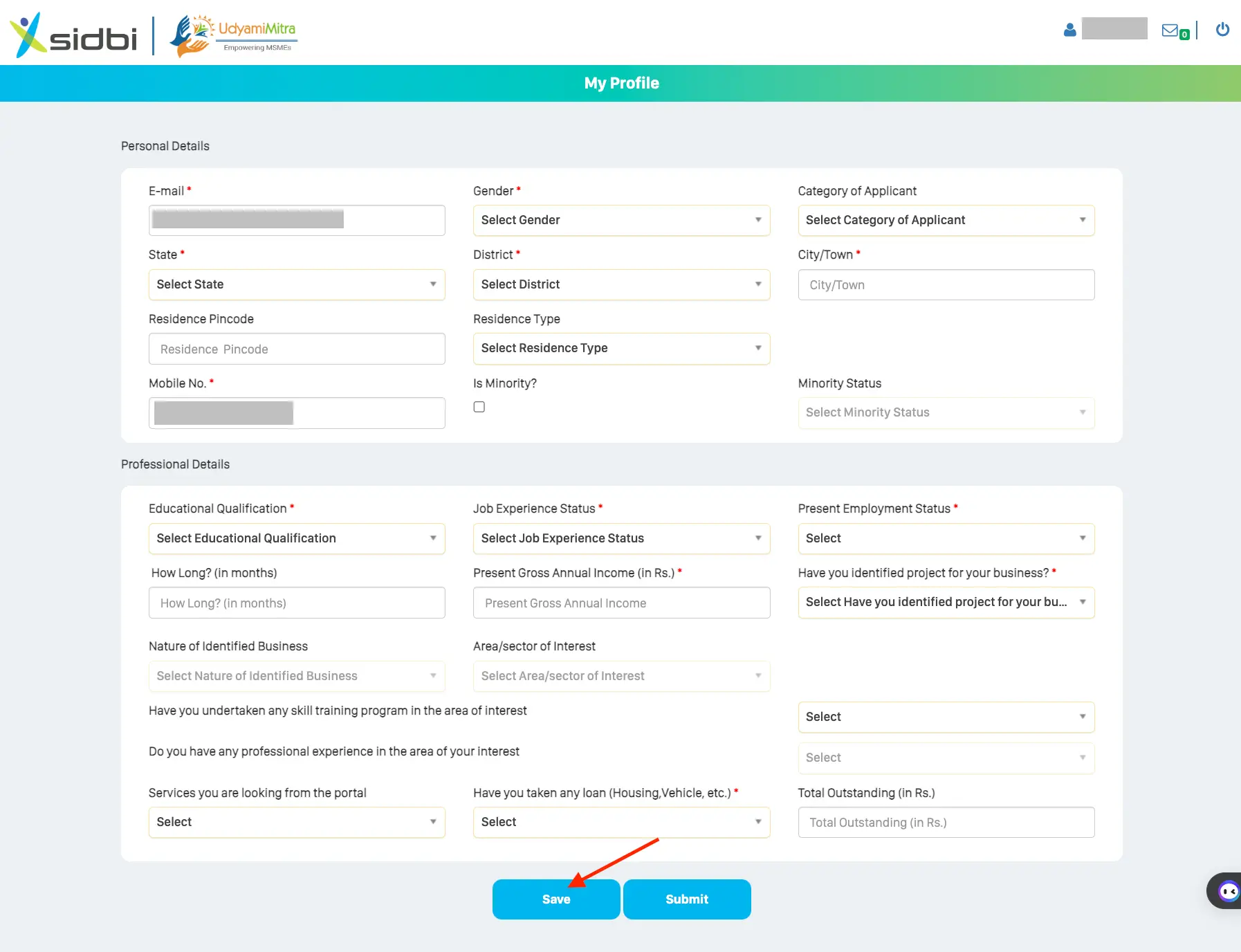

- Fill in all the necessary personal and professional information. Verify all the details provided, ‘Save’ and click on ‘Submit’

- Your profile creation is now complete. You can log in to the website again and apply for the MUDRA loan by submitting the necessary documents.

- Once the loan application is submitted, your loan application will be verified.

- If your loan application is approved, you will receive the loan amount in your bank account.

Are you looking for a business loan?

Check MUDRA Loan Application Status

Once you have applied for a MUDRA loan from a bank or a Non-Banking Financial Company (NBFC), you can track the status by logging into the official website of the bank using your login details. Alternatively, you can also inquire about the status by visiting the bank and speaking with a representative.

It's important to note that MUDRA loan is a refinancing facility and does not provide direct loans to microenterprises or individuals.

Business Loan Interest Rates From Top Banks and NBFCs

Various lenders provide business loans. Here is a comprehensive list of current interest rates for business loans provided by top banks and NBFCs to make informed financial decisions for your business ventures.

| Bank/NBFCs | Interest Rate |

|---|---|

| Axis Bank | 14.95% - 19.20% p.a. |

| Bajaj Finserv | 9.75% - 30% p.a. |

| HDB Financial Services Ltd. | Up to 36% p.a. |

| HDFC Bank | 10% - 22.50% p.a. |

| IDFC First Bank | 10.50% p.a. onwards |

| Indifi | 1.50% per month onwards |

| Mcapital | 2% per month onwards |

| NeoGrowth Finance | 19% - 24% p.a. |

| Tata Capital | 12% p.a. onwards |

| UGRO Capital | 9% - 36% p.a. |

Read More

Read Less

Note: The interest rates are subject to change. Please visit the official website for updated rates.Check out other details on Mudra Loans below:

Mudra Loan EMI Calculator

Calculate your EMI with ease for your Mudra Loan with SBI. Just enter the loan amount, interest rate, & tenure to check your EMI. Utilize the Mudra Loan EMI calculator as per your needs.

| Monthly EMI | ₹86 |

| Principal Amount | ₹1,000 |

| Total Interest | ₹32 |

| Total Amount | ₹1,032.00 |

| Year | Month | Principal (A) | Interest (B) | EMI (A+B) | Balance | Loan Paid to Date (%) |

|---|---|---|---|---|---|---|

| 2025 | 06 | 81 | 5 | 86 | 919 | 8.10% |

| 2025 | 07 | 81 | 5 | 86 | 838 | 16.20% |

| 2025 | 08 | 81 | 5 | 86 | 757 | 24.30% |

| 2025 | 09 | 82 | 4 | 86 | 675 | 32.50% |

| 2025 | 10 | 82 | 4 | 86 | 593 | 40.70% |

| 2025 | 11 | 83 | 3 | 86 | 510 | 49.00% |

| 2025 | 12 | 83 | 3 | 86 | 427 | 57.30% |

| 2026 | 01 | 84 | 2 | 86 | 343 | 65.70% |

| 2026 | 02 | 84 | 2 | 86 | 259 | 74.10% |

| 2026 | 03 | 85 | 1 | 86 | 174 | 82.60% |

| 2026 | 04 | 85 | 1 | 86 | 89 | 91.10% |

| 2026 | 05 | 86 | 0 | 86 | 0 | 100% |

Types of Businesses Eligible for MUDRA Loan

The MUDRA Loan Eligibility program covers a wide range of business activities to support micro-entrepreneurs in various sectors, fostering economic diversity and sustainability. It aims to empower individuals engaged in different businesses, leading to job creation and inclusive economic growth.

There are 3 types of Mudra loans:

- Shishu: Loans up to ₹50,000.

- Kishor: Above ₹50,000 and up to ₹5 lakhs.

- Tarun: Above ₹5 lakh and up to ₹10 lakhs.

Here are some key business activities included in the Pradhan Mantri MUDRA Loan scheme:

- Manufacturing Enterprises: Small manufacturing units, food processing units, automobile repair workshops, machine/equipment repairing units, etc.

- Trading Activities: Retailers, vendors, small distributors, etc.

- Service Sector: Beauty parlors, internet cafes, tailoring shops, coaching centers, health units like clinics, pathological labs, hygiene services, etc.

- Transport Sector: Operators of taxis, tempos, trucks, boats, electric rickshaws, etc.

- Agro-Based Activities: Farmers engaged in agricultural or horticultural or pisciculture activities, agro-processing units, cattle rearing, beekeeping, poultry farming, etc.

- Artisans: Handicraft makers, handloom workers, artisans producing ethnic products, etc., with the support of capital tools and finance.

- Food producers: Private limited companies and start-ups.

Small businesses involved in manufacturing, trading, and services in rural or urban areas are eligible for funding through the MUDRA scheme.

Apply for a Business now!

Know more about different types of business loans offered as per the government schemes by various banks & other private lenders. Check more on this from the links in the table below:

Read More

Read Less

Frequently Asked Questions

You can apply for a MUDRA loan online through the official website of participating banks or their online loan application portals. Offline applications can be submitted at the nearest bank branch offering MUDRA loans.

Individuals looking to avail of an SBI e MUDRA loan of ₹50,000 should meet the eligibility criteria set by the State Bank of India, which typically includes factors like credit history, income stability, and other requirements specified by the bank.

Small business owners, entrepreneurs, and individuals involved in income-generating activities in manufacturing, trading, and services are eligible for MUDRA loans.

No, MUDRA loans are not interest-free. Interest rates are applicable as per the guidelines of the participating financial institutions.

Generally, a good credit score is not mandatory for availing a MUDRA loan. However, individual banks may have their own criteria regarding creditworthiness for loan approval.

The period for Mudra loans can range up to 7 years.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users