Before filing your Income Tax Returns, it is important to check Form 26AS. This form is an important document that offers you a detailed summary of all your tax related information associated with your PAN for a financial year to verify your tax credits.

Checking your Form 26AS helps to ensure that the taxes deducted by various entities including your employer, banks and other institutions are accurately reported helping you avoid double taxation, discrepancies in tax paying and potential notices from the Income Tax Department.

Form 26AS consists of important information like Tax deducted at source (TDS), tax collected at source (TCS), advance tax, self-assessment tax paid, and high-value transactions. You can easily access the form through TRACES and net banking, making it easy for you to manage your taxes effectively in compliance with tax regulations.

Form 26As also allows you to view the statement of your Foreign Remittances, Mutual Fund Purchases, Dividends, Income Tax Refunds and more.

Table of Contents:

- ⇾ Importance of Form 26AS

- ⇾ Components of Form 26AS

- ⇾ Details of Tax Deducted at Source (TDS)

- ⇾ Details of Tax Collected at Source (TCS)

- ⇾ Details of Refunds Paid

- ⇾ Details of TDS

- ⇾ Details of Transactions or Demand Payments

- ⇾ Details of TDS or TCS Refunds Paid

- ⇾ Guide to Download Form 26AS

- ⇾ Steps to Download Form 26AS from TRACES Portal

- ⇾ Steps to Download Form 26AS via Net Banking

- ⇾ Essential Tips for Using Form 26AS Effectively

- ⇾ Frequently Asked Questions

Importance of Form 26AS

Form 26AS is an important document that should be accessed by all taxpayers. The form is important for various reasons, these are:

- Tax credit verification: It helps you make sure that the taxes deducted are accurately reported and credited to your account. Helping you avoid any potential discrepancies with tax management.

- Filing ITR accurately: Since the form gives you an overview of your tax information in detail, it makes it easier for you to match the tax details and credits entered in your Income Tax Returns.

- Tax payment proof: Form 26AS acts as proof of all the taxes that have been collected or deducted for you. It can be useful in case disputes or clarifications with the Income Tax Department.

- To claim refunds: If the total tax deducted exceeds your tax liability, the Form can be proof to claim for refunds.

- Accurate record of transactions: With mutual funds, bond investments and other high value transactions being recorded in the Form, it will help you make sure that the transactions recorded are accurate when you file for taxes.

- No double taxation: The form helps you avoid paying double taxes as accurate records are detailed.

- Reduces the risk of penalties: Regularly reviewing your form will help you avoid penalties or legal issues.

- Resolves discrepancies: Form 26AS helps you resolve any differences that you find in the form and your records. Ensure that the details match the taxes declared in your ITR.

Are you looking for a personal loan?

Components of Form 26AS

Form 26AS provides you with comprehensive information about all your tax-related transactions. The Form consists of 10 (I - X) parts that provide details about different components such as TDS, TCS, and other payments. The details of the components are given below:

Details of Tax Deducted at Source (TDS)

Part I: This section provides details of the tax deducted at source on salary, business income, professional fees, interest income, and other relevant sources. It has a detailed report of the TDS made by various deductors on your behalf.

PART-II: This section includes information where no TDS has been deducted due to the submission of Form 15G or 15H. These forms are usually submitted by senior citizens or individuals whose income is below the basic exemption limit, thus exempting them from TDS.

PART-III: This part of Form 26AS offers the details of transactions under Proviso to Section 194B/194R/194S. It reports the TDS on payments made in kind, for example, cars won in lotteries or getting foreign trips as a result of meeting company targets. Ensuring the TDS for non-monetary transactions has been taken into account.

PART-IV: Part IV offers details of TDS under Section 194IA/194IB/194M/194S. This section is particularly for Sellers, Landlords, Contractors, Professionals, or Sellers of Virtual Digital Asset. It will have details on the TDS of specific transactions like the sale of house property, rent payments exceeding ₹50,000 in a month, payments to contractors or professionals exceeding ₹50 lakhs, and sales of virtual digital assets like cryptocurrencies and NFTs.

PART-V: This section of Form 26As details the Transactions made by sellers of virtual digital assets under Proviso to Section 194S as per Form 26QE. It shows the information on various transactions related to virtual digital assets like cryptocurrency or NFTs.

Details of Tax Collected at Source (TCS)

PART-VI: This part details the information of Tax Collected at Source(TCS) under various sections of 206C. TCS is applicable to the sale of certain goods and services, and this section provides a comprehensive view of taxes collected on your behalf.

Details of Refunds Paid

PART-VII: The details of any tax refunds paid back to you will be available in this section. With information that primarily comes from the Central Processing Centre (CPC), helping you track the refunds issued to them during the financial year.

Details of TDS

PART-VIII: This part contains the details of TDS 194IA/194IB/194M/194S for buyers or tenants of property, individuals making payments to contractors or professionals, and buyers of virtual digital assets. It has detailed information on TDS made by you to the significant transactions recorded.

Details of Transactions or Demand Payments

PART-IX: This consists of details of transactions or demand payments under Proviso to Section 194S as per Form 26QE for buyers of Virtual Digital Asset.

Details of TDS or TCS Refunds Paid

PART-X: TDS or TCS defaults is provided in detail in this section. Any TDS or TCS defaults identified after processing TDS returns is given here, excluding demands raised by the assessing officer. This part is crucial for identifying and resolving any discrepancies in TDS or TCS

Not sure of your credit score? Check it out for free now!

Guide to Download Form 26AS

Downloading your Form 26AS can be easily done through the TRACES portal or Net Banking. Given below are the steps you can follow.

Steps to Download Form 26AS from TRACES Portal

Step 1: Visit the e-filing TRACES website - https://www.tdscpc.gov.in/app/login.xhtml

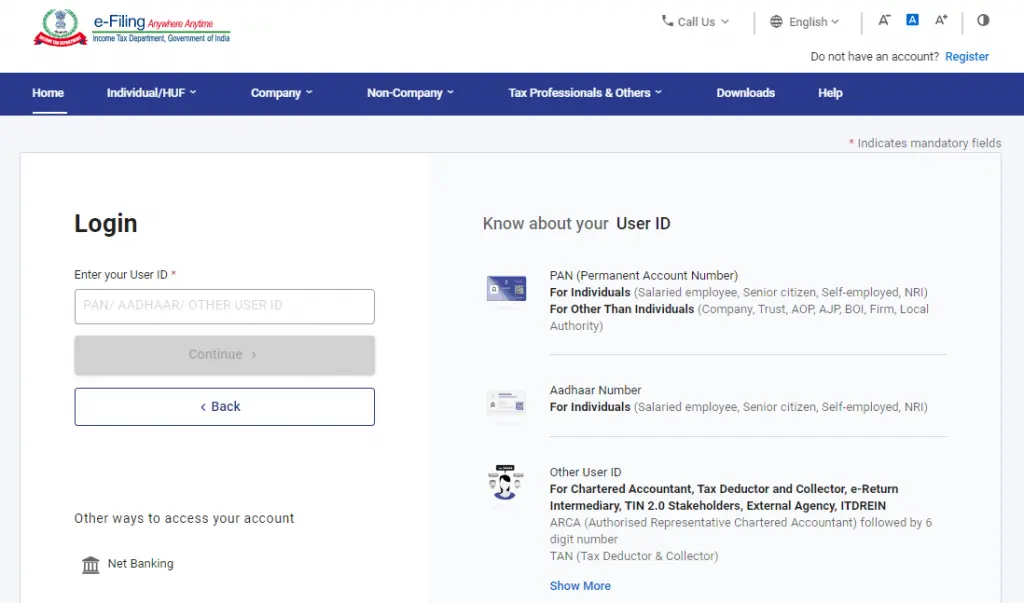

Step 2: Log in using your User ID (PAN or Aadhaar number). If an error a message appears saying the User ID is invalid, then you can try using a different ID.

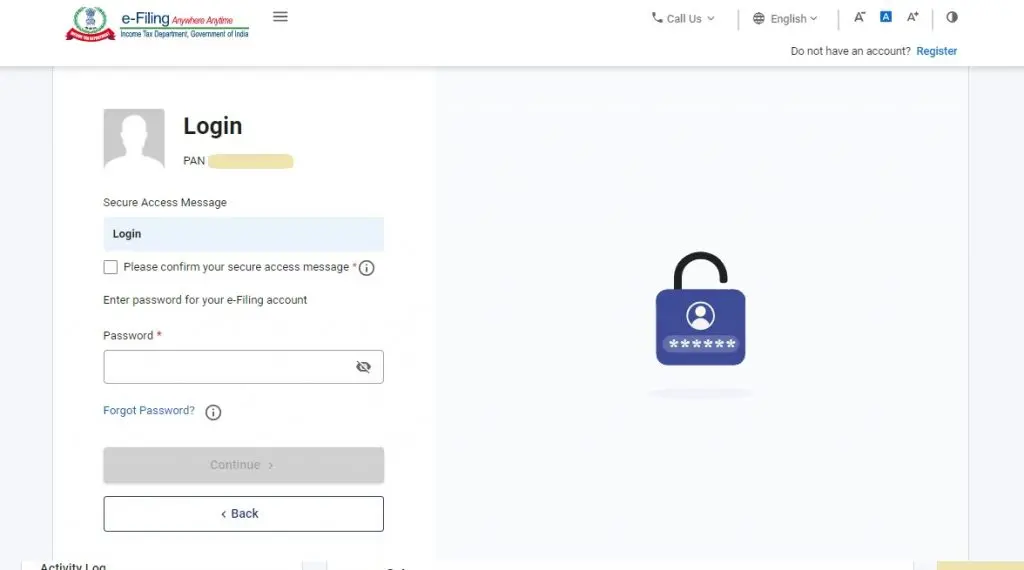

Step 3: Enter your password and continue.

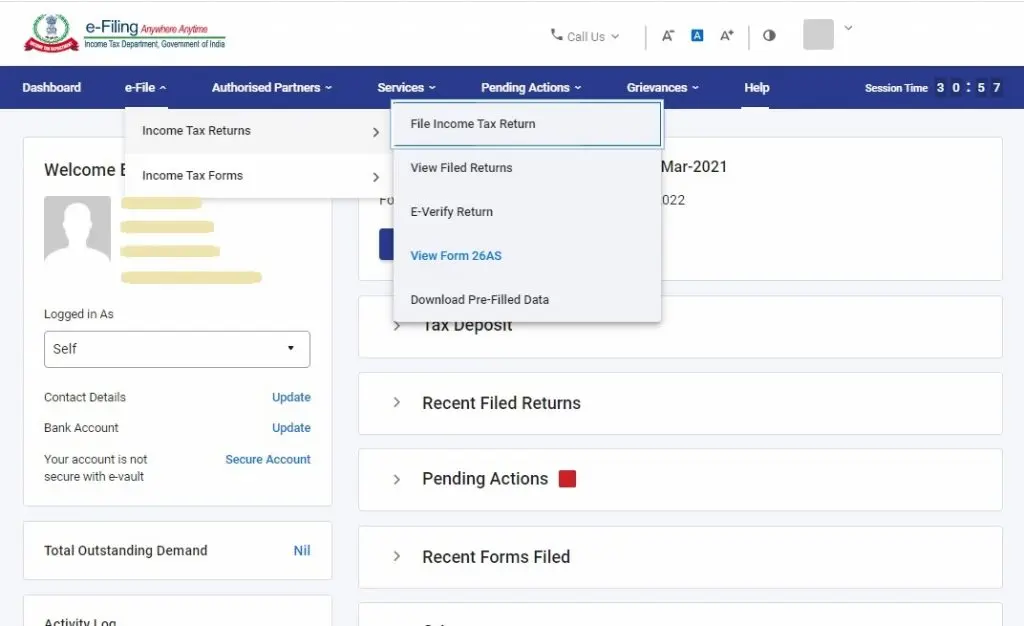

Step 4: Select ‘e-File’, ‘Income Tax Returns’ and then ‘View Form 26AS’.

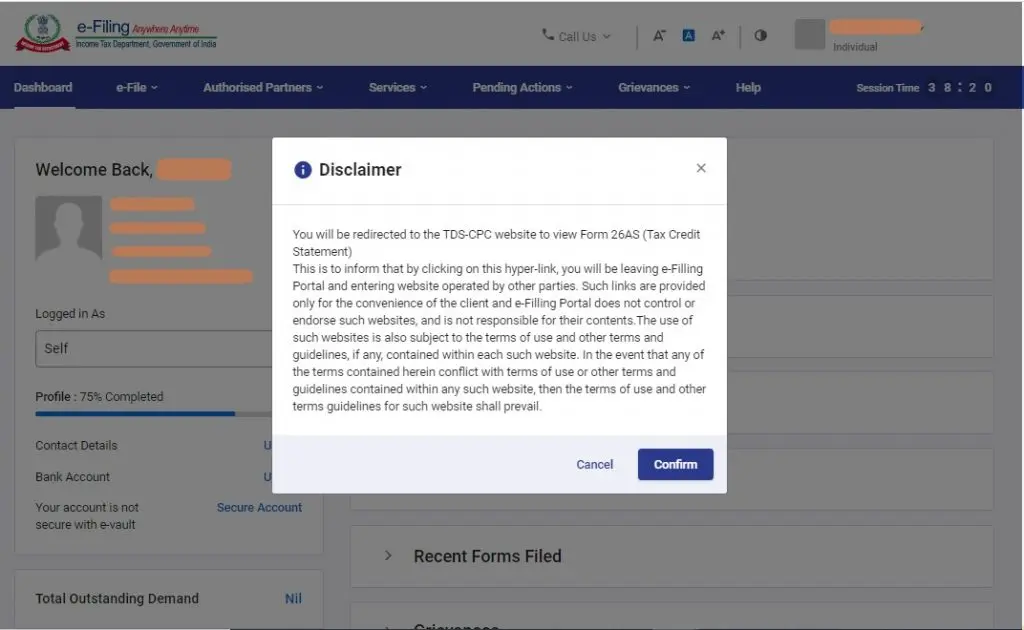

Step 5: Read the disclaimer then click ‘Confirm’ and you will be redirected to the TRACES website.

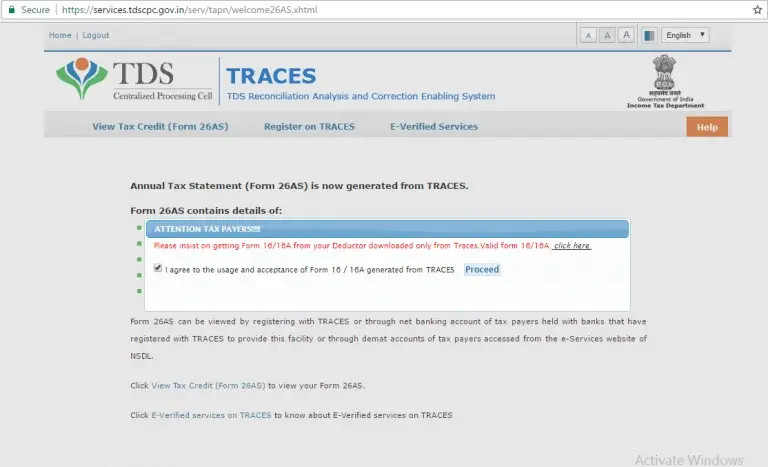

Step 6: Tick the box to agree to the usage of Form 16, 16A and then click ‘Proceed’.

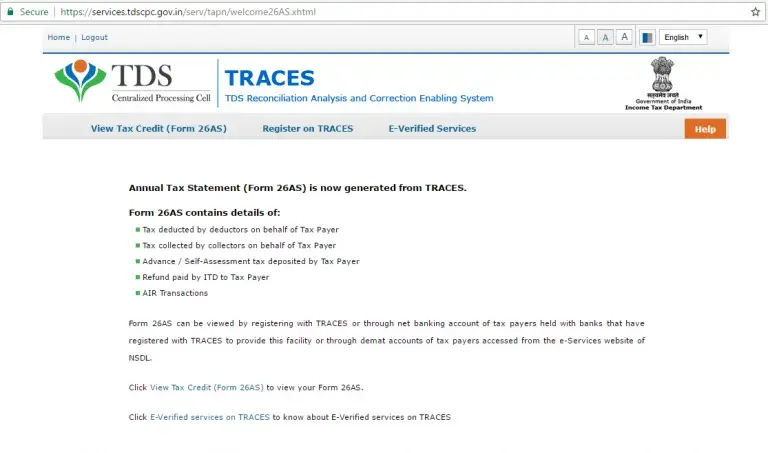

Step 7: You can then click on ‘View Tax Credit (Form 26AS)’.

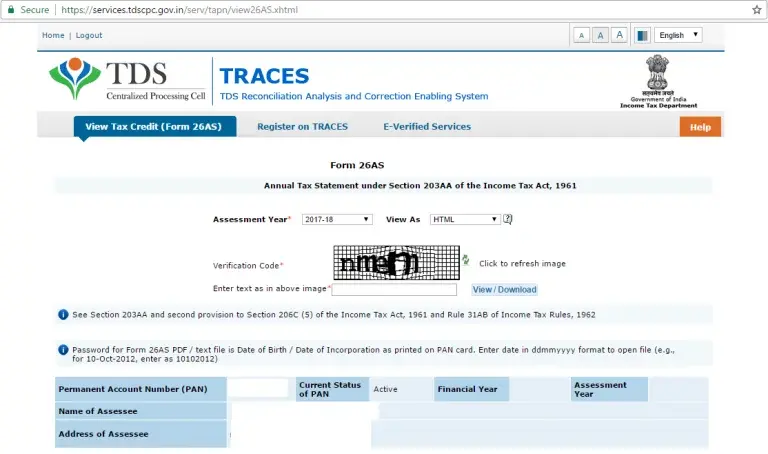

Step 8: Choose the assessment year and the format to view Form 26AS. Then enter the verification code and click on the ‘View or Download’ button. The Form will be available to you.

Steps to Download Form 26AS via Net Banking

- Step 1: Log in to your net banking account.

- Step 2: Select the ‘Income Tax Services’ section.

- Step 3: Click on the option to download or view Form 26AS.

- Step 4: Choose the assessment year for which you want to download Form 26AS.

- Step 5: Read and accept the terms and conditions related to accessing your Form.

- Step 6: Click on download or view Form 26AS.

You can also check other related Tax Forms and Information

Essential Tips for Using Form 26AS Effectively

When checking Form 26AS, it is important to know what to look out for, this will make your job much more efficient while ensuring that the details are correct. Here is an idea of what you should focus on:

- Carefully verify the TDS entries made by your employer on salary income, to make sure it matches your records.

- Review the entries made for tax collected at source, especially on high-value goods and make sure it is the correct amount collected.

- Check the details of advance tax payments or self-assessment tax payments made during the financial year to ensure each transaction is correctly reflected.

- Check the details of any tax refunds and make sure the amount matches the amount in the Income Tax Returns.

- If you have sold property, check the TDS entries made by the buyer under Section 194IA, making sure that the amount deducted is the same as the transaction details.

- Check for any defaults in TDS or TCS payments that have been reported in the form and immediately address the issue to avoid penalties or notices from the Income Tax Department.

Do you need an instant loan?

Frequently Asked Questions

Form 26AS is a detailed statement showing your tax-related information like TDS, TCS, and advance tax paid by a taxpayer.

Log in to the Income Tax e-filing portal, select ‘e-File’, then "View Form 26AS" under "My Account" to check tax-related details.

You can download Form 26AS from the TRACES portal or from your Net Banking Account.

Form 26AS is important as it provides tax-related information that helps you file for taxes with accuracy.

Form 26AS provides information like TDS, TCS, advance tax, and others.

Yes, Form 26AS is required for accurate income tax filing as it verifies tax credits and income details.

Yes, Form 26 AS shows you details of property transactions.

To correct errors in Form 26AS you can contact your deductor (i.e, employer, bank, etc.) to correct the errors found in Form 26AS related to TDS or tax payments.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users