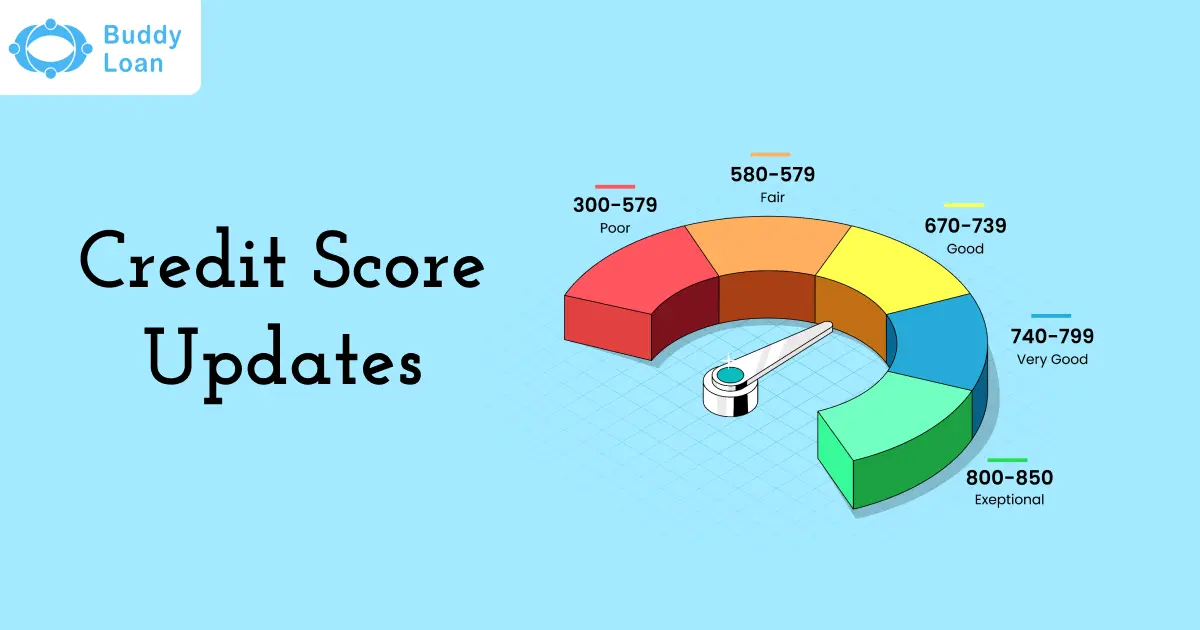

Nowadays, having a good credit score has become necessary for managing financial health. Hence, whether you are applying for a loan, credit card, or want to get a low-interest rate on your loan, a good credit score is essential.

You must have also come across the credit score of 750 mentioned in various places, and you must have thought what it is and why everyone talks about it. So if you are wondering what constitutes, and how can you achieve it. To make it easier for you, in this article, we have covered all the detailed information related to credit score.

Good Credit Score

An individual with 750 or higher is considered a good score. Will help you overcome most of your financial problems without pressing you to reduce your spending or deplete your savings.

You can even say that having a good credit score significantly impacts your future loan acceptance prospects and inquiries. It also improves your chances of granting a loan request by making a strong image as a borrower. Therefore, it’s essential to be aware of factors that affect, such as timely and complete payment of equated month loan requests granted by making a strong image as a borrower lender can trust.

Essential To Have a Good Score

If you have a good score, it can benefit you in many ways. It can help you borrow money quickly and cheaply and qualify you for credit cards. If you have a good credit history, it will show the lenders that you have a good habit of repaying your payment and debts. They become reassured that you are a responsible person and a desirable customer, and in the future, you are also going to make all your payments on time.

- It can qualify you to get attractive credit cards and loan deals.

- You can also get a decent interest rate on loan.

- It might allow you to negotiate the credit terms up to a certain margin to get a good loan deal.

- If you have a good credit score, then you may be offered a high credit limit and receive loan approval quickly.

- You can have access to new credit in the event of a crisis if you don’t have an emergency fund or it runs out.

Also Read: Want to Achieve a Good CIBIL Score? Here are some practical tips

0

Bad

Check your Credit Score for Free

Your credit score is updated monthly and gives you insight into your creditworthiness. Take control of your financial future today.

Credit Score is Considered Good By Lenders

Most lenders and financial institutions around 750 and more. However, the definition of “good credit” may vary significantly from lender to lender, as every financial institution or credit card company sets its standards when deciding whether or not to grant you credit and at what interest rate.

If you want to check your free credit score and get personalised insights, you can do that from Buddy Score.

Factors Can Affect Your Credit Score

Maintaining a good score is not as difficult as one thinks. You have to keep your eye on the factors that affect.

- Will affected by your payment history.

- Utilization can also affect,

- If you have a mix of credit types

- If you apply for credit frequently and recently, it also gets impacted.

Also Read: 10 Essential Habits for a High Credit Score

Improve Your Credit Score

It takes consistency, discipline, and good credit habits to develop a good credit rating. These are the steps you can take to establish a good credit rating:

1. Try to pay your bills on time

Your payment history is the most significant factor contributing to your credit score. The damage that a missed or late payment can do to your credit score can last for up to seven years.

2. Maintain a credit card balance well below your credit limit

It would help if you aimed for a credit utilization of no more than 40%. High utilization lowers your credit score, but the damage fades after you reduce your balances and the lower utilization appears on your reports. It is also possible to lower utilization by getting a higher credit limit or becoming an authorized user on a lightly used card that has a large credit limit.

3. Keep credit accounts open unless for high fees or poor service

Maintaining older accounts may help your average account age and slightly influence your score. In addition, closing an account decreases your overall credit limit and increases your credit utilization.

4. Do not apply for several credit cards at once

You may experience a temporary dip in your credit score due to credit checks for credit decisions, and several can be cumulative in a short period. Therefore, it’s essential to do your research before applying for a credit card.

5. Keep Checking Your Credit

You should monitor your credit reports and dispute the information you believe is incorrect or too old.

Also Read: 3 Best Solutions for Credit Report Problems

Conclusion

A good credit score is critical for your lenders to evaluate your creditworthiness. Most of the time, people are unaware of their credit score until their loan gets rejected. Hence you must keep checking. It can give you the chance to improve it and help you save lots of money on your interest rate. It can even add your odds for qualifying for a loan and improve your financial health.

However, You can improve by applying for a personal loan through Buddy loan. They prioritize the customer’s needs and are known for their services. They also offer you an instant personal loan at a minimal document and low-interest rate.