Buying a home or apartment can be scary, especially if you’re not familiar with all the details. Home loans may seem like a simple thing, but there’s so much more to them than just handing over some cash and getting your keys back. If you’ve already got the green light from your bank and are ready to get started on looking for a home that meets your needs, this guide will help you get things moving in the right direction. Here are five things you need to know before taking out a home loan

1. You’ll Need To Know Your Money Habits Before You Start

Before you start looking into loans, it’s a good idea to get a very clear idea of how much you plan on putting down. If you’re looking to buy a home with a loan, your down payment is a huge factor in the overall cost of the transaction. In most cases, the less you put down, the greater the interest you will pay. Before you head down the path of applying for a loan, make sure you have a good idea of how much you can afford to put down. You don’t want to put down only a little, and then find yourself with a big interest bill at the end. When it comes to home loans, putting less down may end up costing you more money in the long run.

Also Read: Tips And Tricks To Reduce Interest Paid On Home Loan EMIs

2. You’ll Need A Good Understanding Of Mortgages

Before you get started on your home loan application, you’ll need a better understanding of how mortgages work. Typically, a lender will give you a mortgage to help finance the purchase of a house. The mortgage loan gives you the money to own the property and can help make your purchase more affordable. In a typical mortgage scenario, you will borrow some money and place it into an agreement with your lender.

You will then give the lender the right to take possession of your house if the house value falls below the amount you owe on the mortgage. In the event of a foreclosure, your lender will take the house back, and you will then have to make the payments to the lender. When it comes to mortgages, there are different types of financing available. But before you can make a decision, you need to have a basic understanding of each kind of mortgage.

Here are some of the most common types of mortgages that you are likely to come across: –

Purchase Money Mortgage: This type of mortgage is used when buying a new home. You will typically take out this mortgage to cover the cost of the house.

Also Read: How Exactly Does Home Loan Enhance Your Credit Score?

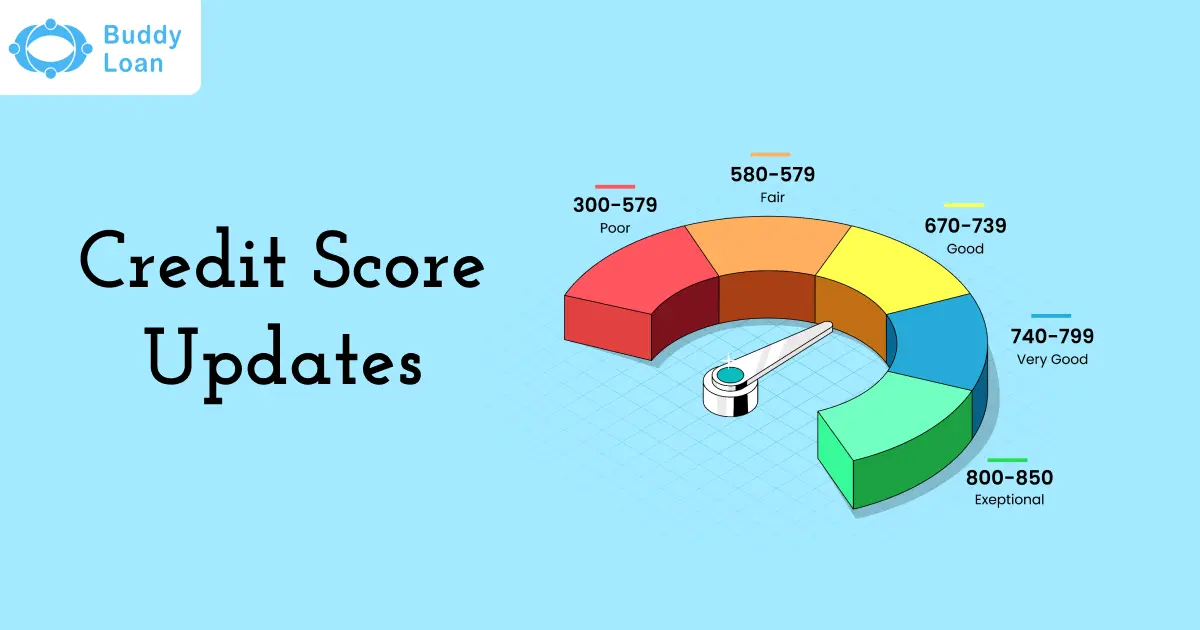

3. Credit Scores Matter A Lot When You’re Buying Real Estate

Buying a home or an investment property is a major investment. It can help you build wealth, but you need to be very careful when making this purchase. In many cases, you may be financing a large percentage of your income over the course of a few years. If you are not careful, buying a home may end up costing you a lot more than you expected. If you’re planning on taking out a home loan, it’s important to keep in mind that the lender may look very closely at your credit report and credit score when deciding whether or not to approve you for a loan. These factors will have a major impact on the amount of money you are approved to borrow.

It’s important to keep in mind that your credit score plays a huge role in your ability to borrow money, so it’s important to keep it in good shape. There are a number of different things that can impact your credit score.

Some of these things include paying off old debts, keeping your credit card balances low, making on-time payments, and keeping your credit utilization ratio low. The lower your credit utilization ratio the better.

4. Fannie Mae, Freddie Mac And The Difference

Home loans are typically issued by banks and other financial institutions. While this type of lending is regulated, the process can be fairly complicated for a first-time home buyer. When you are buying your first home or investing in an apartment building, it’s important to understand the process and know the differences between different types of financing. There are a number of different types of financing available when you are buying real estate. But before you make a decision on which kind of mortgage to take out, you need to have a better understanding of the pros and cons of each kind of financing.Fannie Mae and Freddie Mac are government-sponsored, mortgage-guarantee institutions. They provide low-cost financing to qualified borrowers. Mortgage insurance is required when you use a loan from Fannie Mae or Freddie Mac. If you don’t make payments on time, your loan will go into default, and the owner of the property will end up paying off the lender.

5. Know What Term Covers When Looking For A Loan

When you are making the decision on which type of loan to take out, you need to keep in mind what the term covers. It may seem like the shorter the better, but you’d be surprised at the difference a long or short term loan can make. For example, a 30-year loan may be the shortest term available, but it may be the most cost-effective. A 15-year loan may be the longest term available, but it may be more expensive. It’s important to keep in mind what the term length covers when you are looking for a home loan. Depending on the type of loan you end up taking out, a shorter term may not be as cost-effective.

6. Understand The Importance Of Down PAYMENT

One of the most important things you need to keep in mind when taking out a home loan is the down payment. Usually, you will need to make a down payment of at least 10%. Sometimes, lenders will ask for a minimum down payment of as little as 3%. However, for the most part, 10% is the minimum amount you should be putting down. You don’t need to put down a large amount of money, but you do need to put down something. It’s important to keep in mind that a lower down payment will increase your monthly payments. This is because the down payment amount is paid off before the loan is fully repaid. When you take out a loan with a lower down payment, you will have to pay more money as your monthly payments and will take longer to repay the loan.

Documents Required to Avail of a Home Loan

| Identity Proof (any one) | Residence Proof (any one) | Other Documents |

| Driving License | Copy of Electricity Bill/Water Bill/Telephone Bill | Employer Identity Card |

| PAN | Copy of valid Passport/Aadhaar Card/Driving License | Duly filled loan application form affixed with 3 passport size photographs |

| Voter ID | Loan account statement for the previous 12 months if the applicant has any other ongoing loan from other banks/financial institutions | |

| Valid Passport | Bank account statements for all the bank accounts owned by the applicant for the last six months |

Home Loan Eligibility

| Eligibility Criteria | Requirement |

| Age | Minimum Age: 18 years and Maximum Age: 70 years |

| Resident Type | The applicant must be (any one): Resident Indian Non-Resident India (NRI) Person of Indian Origin (PIO) |

| Employment | The applicant can be (any one):

|

| Net Annual Income | At least Rs.5-6 lakh depending on the type of employment |

| Residence | The applicant must have (any one):

|

| Credit score | A good credit score of at least 750 or more obtained from a recognised credit bureau |

Also Read: Why Does Your Credit Score Matter When Applying For A Home Loan

Final Tips

There are a lot of factors to think about when it comes down to getting a home loan. Before you make a final decision, make sure you understand the process and know what it will cost you in the long run. It’s important to take the time to think things through, even if it takes longer to get things done. There are a lot of factors to think about when it comes to getting a home loan and understanding what they are can only help you out in the long run.

Having any queries? Do reach us at info@buddyloan.com