In unexpected situations, your funds and cash reserves sometimes prove to be insufficient. The only way out is to use loans offered by banks and financial organizations. Despite the availability of too many loan products on the market, small ticket personal loans are pretty popular among a large number of people. Through this financial scheme, needy individuals can get small funds below ₹1 lakh with great ease and meet all emergency financial commitments that you can’t postpone further in any case.

Presently, the entire world is combatting the coronavirus epidemic. The financial havoc caused by coronavirus has dramatically increased the demand for instant personal loans. The best thing is that flexi personal loans are available online. Such a credit arrangement is a lifesaver for many individuals who live from one paycheck to another and have no additional income and savings. So, it becomes easier for you to apply for the loan and get the desired amount after completing all formalities.

Digital Personal Loans – Key Factors in Bank Decisions

When you apply for an instant digital loan, banks and financial organizations pay attention to many things.

Income Level

Remember, a source of income is the main criterion that determines a person’s ability to pay. You should have enough income every month to make monthly repayments and meet all your essential needs without any difficulty. Your employer must confirm the payment.

Work Experience

Banks and financial organizations prefer applicants who have worked with one particular organization for many years. If the borrower frequently changes jobs, this is not evidence of their trustworthiness.

The Availability of Other Credits

If a person has active loans, this may indicate that they spend more money than their income. This doesn’t speak in their favor and may be a reason for refusal.

Credit Discipline

If you took a loan in the past and returned it on time, it works in your favor when banks consider your application for digital personal loans. The lender contacts recognized credit lending agencies and extract your previous credit records to analyze credit discipline.

The Presence of Current Delinquencies

If a person is overdue under other contracts, their new loan may get denied.

Age, Marital Status, and Education

Banks and financial organizations are more willing to cooperate with people under the age of 60. It also matters whether a person is married, what education they have, and what position they hold.

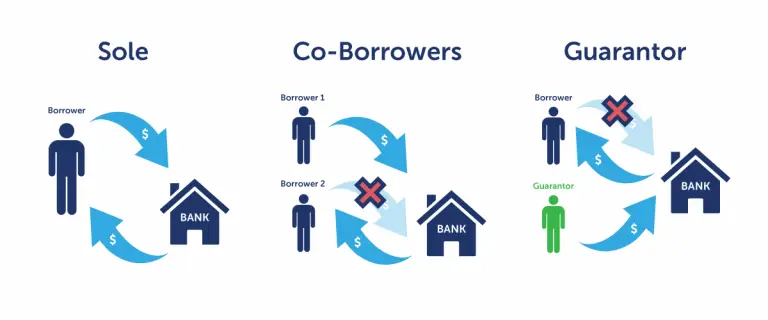

The Availability of Collateral and Guarantors

By providing the financial institution with a deposit and information about guarantors, you can increase the chances of approval of the loan.

Increase Your Chances of Getting Approved For Small-Ticket Personal Loans?

All financial organizations and banks issue loans only after checking your financial situation, credit history, work experience, and other things. If a person has everything in order with this, they are much more likely to receive money. You need to be well-prepared before heading towards the bank to apply for an instant personal loan. Here are some tips that may work in your favor.

Also Check: Tips To Get Your First Personal Loan From Banks and NBFCs in India

Prepare Before Applying for Small-Ticket Personal Loans

Taking a loan is always a responsible undertaking and requires a professional approach, a lot of consideration, and careful handling of the borrowed money. That is why before applying for flexi personal loans, you need to do some homework seriously. First of all, determine whether you need financial help from external sources. If available funds and savings are insufficient for meeting an emergency financial commitment, then taking personal loans becomes mandatory. Next, decide how much money is sufficient for you. Third, analyze your overall financial condition, income, repayment capabilities, and other things carefully. Finally, be ready to answer questions asked by banks’ representatives and convince them with your answers.

Loan Eligibility Criteria & Documentation

To get approved for digital personal loans, you need to meet the eligibility criteria and submit all documents asked by banks and financial organizations. Non-compliance with these norms will provoke the bank to quash your application for the loan without consideration. Different banks come up with unique eligibility criteria for small ticket personal loans. In general, you need to meet the following terms and conditions to qualify for the loan:

- The applicant must have Indian citizenship,

- The applicant’s age must be between 20-60 years,

- Stable employment with a prestigious company, central or state government organization, or any recognized business entity. The applicant must have records to prove their monthly income,

- The applicant must have an active bank account that accepts online payments. After loan approval, many banks transfer the approved loan amount to the borrower’s bank account digitally and

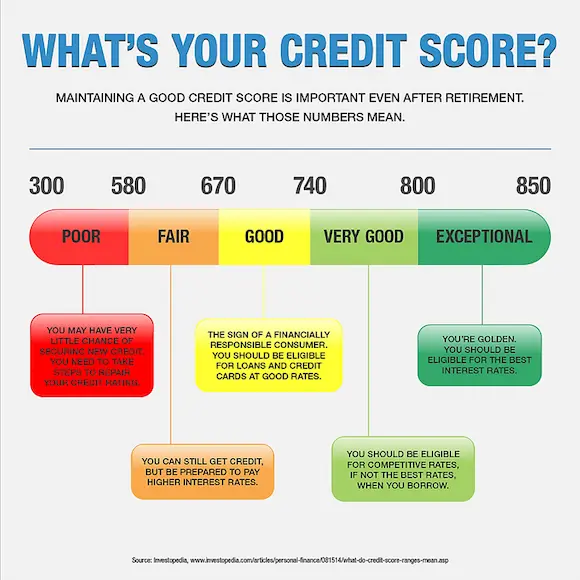

- You need to have a minimum CIBIL Score of 700 or more while applying for an instant digital loan.

Documents Required

- Personal identification proof,

- Permanent residence proof,

- Proof of educational qualification and employment,

- KYC documents (Aadhar card, voter ID card, passport, electricity or gas connection papers, etc.)

- Employee ID card,

- Last six months’ salary slip. Self-employed individuals need to arrange documents (GST, sales tax, bank statements, tax filing papers) to prove their sources of income.

Comparison of Banks – Does It Work In Your Favor

Before choosing a bank, it is essential to decide what you expect from it. A contract with a bank is often a union for many years and usually comes with obligations to be fulfilled. That is why you need to compare different banks before applying for small-ticket personal loans. You should disagree with the first bank that comes along, even if your best friend recommended it, you liked the ad, or your inner voice tells you so. Study the offers of several banks, evaluate the cost of services, the income on deposits, and the quality of service. This way, you can find a personal loan with the most favorable conditions for you.

Remember, fake banks are scarce but still possible. Be alert you are dealing with a bank or a financial institution with an unknown name. Don’t communicate with such a bank if it does not have a Reserve Bank of India license. When choosing a bank, you should carefully study the location of branches and ATMs, the possibilities of online banking and correlate this with your needs.

Try to evaluate the quality of the service a bank offers. Read reviews on the Internet and ask friends who use the bank’s services if they are satisfied with the service or not. Please check the bank’s website carefully to see if it has all the necessary information and whether it is easy to find answers to your questions. Call the bank’s hotline to check how long you will have to wait for a response. It will not be superfluous to go to a bank branch and evaluate how they work with customers.

Get a Personal Loan Quickly from Your Existing Bank

If you need small ticket personal loans urgently, it is better to consider the offers made by your existing bank. First, suppose you are a salary client of the bank. In that case, this automatically increases the chances of approval of the application since the bank immediately sees your income level and can be sure of the accuracy of this information. In most large banks, applying for a loan for existing customers is simplified as much as possible. The application is reviewed within a few minutes, and you don’t need to go to the office to receive money. Thus, if you are already a bank customer, you get an instant digital loan by applying online and following the due process.

A Healthy Credit Score Matters A Lot

The time required to review the questionnaire depends on many factors. If the client had already got a loan before and paid it off on time, the verification process will take a little time. Sometimes it takes only 10 minutes to get approved, but it will take 2-3 days in other situations. The websites of credit institutions contain information about the minimum and maximum terms for reviewing an application- from 10 minutes to 7 days. However, some organizations may extend this period when making a loan secured by the property. A person with a good credit score can quickly get approved for the loan. On the contrary, individuals with bad credit scores may face rejections.

The time required to review the questionnaire depends on many factors. If the client had already got a loan before and paid it off on time, the verification process will take a little time. Sometimes it takes only 10 minutes to get approved, but it will take 2-3 days in other situations. The websites of credit institutions contain information about the minimum and maximum terms for reviewing an application- from 10 minutes to 7 days. However, some organizations may extend this period when making a loan secured by the property. A person with a good credit score can quickly get approved for the loan. On the contrary, individuals with bad credit scores may face rejections.

Find A Co-Borrower Or Guarantor

The chances of approval of a loan application are also increased by a co-borrower or loan guarantor. A guarantor is a person who undertakes to pay off the borrower’s debt if the borrower is unable to do so himself. Thanks to the guarantor, not one person is responsible for the repayment of the loan debt, but two, which reduces the risk of non-repayment of money and increases the probability of approval of the requested amount. Of course, not everyone is suitable for the role of a guarantor. The guarantor must have a regular official income and a good credit history. The co-borrower plays a similar role on loan. However, he takes on even more obligations. The co-borrower pays off the loan from the beginning and fully shares the responsibility for repaying the borrowed amount.

What Contributes To A Bank’s Positive Decision?

For a bank to approve your application for small-ticket personal loans, you must meet its requirements. The decision on the application is influenced by the credit history and the availability of income certificates confirming the receipt and amount of salary. If a potential borrower has several incomes, banks may consider his application first of all. To receive a large amount of money, you will need liquid property. You can not do without data on official work, marriage certificates, documentation confirming real estate ownership, and a car.

Credit organizations rarely pay attention to the client’s age. But more often, loans are granted to individuals aged 25-45 years. Such citizens are considered financially stable. An additional advantage is an information about higher education. When visiting the bank’s office in person, external factors can play a crucial role. Correct speech, pleasant appearance, manners-all this affects the decision of the bank employee.

Steps to Take If Your Flexible Loan Application Is Denied

There are many reasons why one or more banks rejected your application for digital personal loans. Wrong information in the loan application, fake documents, overdue payments on past loans, and no credit history information are prominent reasons behind your loan application’s rejection. Don’t get dejected if banks quash your application for small ticket personal loans. Taking help from experts helps a lot.

Working with NBFCs – The Easy Way to Get Instant Digital Loans

Always keep in mind that different banks have different sets of requirements to qualify for the loan. It is essential to comply with their norms if you seek instant approval for your application. It would be helpful if you work with an NBFC (such as the buddy loan). They have a team of experts who are always ready to answer your questions and concerns and help you get the best instant personal loan quickly and smoothly. After receiving your request, their loan specialists assist you in the entire loan application and acquisition process. They complete all formalities as per the standard procedure and increase your chances of getting a personal loan. Expert intervention, knowledge, and guidance make your life easier and keep you stay aloof from time-consuming formalities while getting a personal loan.

Also Read: Discover The Possibilities For A Quick Personal Loan Online With Low Interests

Conclusion

For many people, small-ticket personal loans are pretty helpful. With the help of a reliable NBFC, they can quickly get the required money and meet all emergency financial needs without asking for financial support from anyone. Happy borrowing! You need to analyze your needs honestly and have a responsible approach towards the loan application, acquisition, and repayment process to bring your life back on the right track after financial havoc.

Flexi loan interest rates keep going up and down. So, analyze this factor while applying for the loan and choose a suitable offer with the lowest possible interest rate.

Having any queries? Do reach us at info@buddyloan.com

Frequently Asked Questions

In simple words, small ticket personal loans are credit arrangements that allow eligible borrowers to get funds below ₹1 lakh for meeting almost all emergency and unavoidable financial needs. People who don’t have alternative sources to arrange the much-needed additional funds can benefit from this credit arrangement.

A small-ticket unsecured loan offers money without collateral, benefiting those with no assets; requires stable income and proof of repayment ability for approval.

Yes, taking a small ticket personal loan is safe if you abide by the standard rules and regulations while applying for the loan, work with a trustworthy NBFC (for instance, Buddy Loan), and pay off the borrowed money on time. Understanding all terms and conditions of the loan, timely repayment, and staying away from unlawful financial activities are crucial to happiness and mental peace.