When you apply for a personal loan, the first thing that lenders check is your credit score. The lenders bear a high risk when lending the money because you do not provide collateral when taking a personal loan. Therefore, they use the credit score to ensure that you can repay your dues on time.

To better understand credit scores, let us take a look at what a credit score is and why it is essential.

What is a Credit Score?

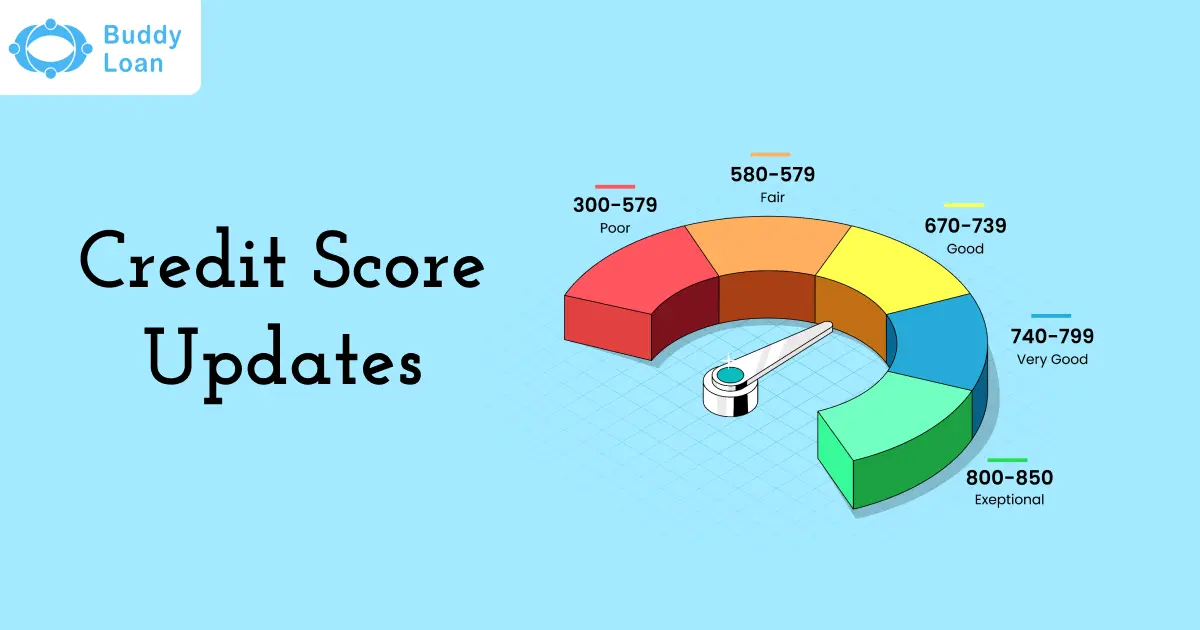

A credit score indicates the creditworthiness of an individual, and it is a three-digit number ranging from 300 to 900. This credit score is generated based on your transaction history, repayment history, existing credit, etc. Generally, a score above 750 is considered good. Hence, a credit score is the main deciding factor for lenders before offering a loan.

Why is a Credit Score Important?

A good credit score is essential for various reasons. Here are a few reasons why a credit score is important when applying for a personal loan.

Loan at Low-Interest Rates

Having a good credit score will help you get a loan at lower interest rates than other loans such as credit cards. As a result, you can quickly repay your debt without defaulting.

Instant Approval of Loans

The lenders approve your loan application instantly when you have a high credit score.

Power to Negotiate

A person having a credit score near 900 has the power to negotiate lower interest rates. Hence, a good credit score increases the bargaining power of the borrower.

High Loan Amount

The lenders decide based on your credit score and monthly income. Therefore, having a high credit score will help you quickly get an enormous loan. If the borrower’s credit score is poor, the lenders will charge higher interest rates to approve the loan.

Credit Cards

A high credit score above 750 makes you eligible for credit cards with the best perks and discounts.

Customer Value

Since a credit score indicates the creditworthiness of an individual, banks, and NBFIs prefer offering a loan to someone who has a high credit score.

Also Read : How Can Your Actions Impact Your Credit Score

Credit Score Table

| Credit Score | Credit Rating |

| 300 to 600 | Very low |

| 601 to 700 | Low |

| 701 to 760 | Fair |

| 761 to 800 | Good |

| Above 800 | Excellent |

Factors That Impact Your Credit Score

Here are a few common factors that affect your credit score:

Payment History

It indicates your transaction history and accounts for 35% of your FICO score. If you miss any payments or have unpaid balances, it will reduce your credit score. Moreover, lenders give importance to your payment history to ensure that you can repay your debts on time when approving your loan application.

Credit Utilization Ratio

The credit utilization ratio (CUR) is the ratio of the amount payable divided by your credit limit. If you use your credit beyond the maximum limit, your credit score will reduce. As a result, lenders will have trust issues about your ability to repay your debts on time. Therefore, always keep your credit utilization below 30% of your income.

The Number of Credit Inquiries

Making multiple hard inquiries will harm your credit score. Because each time you inquire, the lender does multiple background checks creating an impression that you might not repay your dues on time. Ultimately, it affects your credit score, accounting for 10% of your FICO score.

Length of Credit History

Lenders check your credit history to know your credit behavior. Your credit score will increase when you maintain a long and consistent credit history. It also accounts for 15% of your FICO score.

Credit Mix

You can quickly increase your credit score by managing a diverse credit mix such as student loans, car loans, credit cards, etc. The credit mix accounts for 10% of your FICO score.

Also Read : Know The Different Types Of Credit Score

Tips And Tricks to Improve Your Credit Score

If you are worried about your credit score, here are a few tips and tricks that will help you improve your credit score quickly.

Check Your Credit Report

Your credit report is viable for errors. Hence, regularly checking and reviewing your credit report once a year is essential. Your credit score will improve when you report the errors on time and get them corrected. You can also check your credit report instantly by using buddy score to know your creditworthiness.

The Utilization of Credit

The credit utilization ratio shows how frequently you use your credit for managing expenses. Hence, you utilize your credit below 30% of your income to maintain a good credit score.

Maintain Your Old Accounts

Do not close your old accounts unless it is indispensable. Keep your old accounts open, as having a long and consistent credit history will increase your credit score.

Clear Pending Debts

Start repaying all your past debts to increase your credit score. You can also easily consolidate your debts using a personal loan with low-interest rates.

Set a Reminder

Missing out on payments can drastically affect your credit score. Therefore, you can set a reminder to pay your debts on time without fail to avoid this.

Diverse Credit Mix

Have two or more other credits, such as education loan, car loan, etc., to improve your credit score because it shows how well you can manage your credit expenses.

Avoid Applying For Multiple New Credits

Applying for several accounts in a short duration can negatively affect your credit score. Therefore, it is advisable to avoid using various loans from different lenders simultaneously.

Be Persistent

It takes time and effort to improve your credit score. Thus, you must be patient, track your credit report regularly, and make payments on time to gradually boost your credit score.

Summing Up

Having a good credit score comes with many benefits when applying for a personal loan. However, one must also consider various factors that can positively or negatively impact your credit score. It is also essential to review your credit report regularly once a year to rectify any errors that occur. You can also check your credit report instantly using buddy score to know your creditworthiness. To improve your credit score smartly, you can consolidate your existing debts by availing of an instant personal loan using Buddy loan.

Having any queries? Do reach us at info@buddyloan.com

Frequently Asked Questions

Q. What is the difference between a credit score and a credit report?

A. A credit score evaluates your past credit transactions ranging from 300 to 900 (with 900 being the highest and 300 being the lowest). In comparison, a credit report shows your overall credit score.

Q. How long does it take to improve my credit score?

A. Generally, it takes around three to six months for your credit score to improve gradually.

Q. How often should I check my credit score?

A. You can check your credit score once in three to four months to keep track of your credit history.

Q. Do I have to pay any fees to check my credit score?

A. You can check your credit score for free without paying any additional charges.

Q. Where can I check my credit report?

A. You can check your credit report instantly using Buddy Score to know your creditworthiness.