An urgent financial need can arise at any point in your life. But, if you have a poor credit score, getting a personal loan might be difficult. This article will thoroughly discuss the ways to get you an urgent loan, even if you have a bad credit score. Keep reading!

Imagine a situation where you are selected for your dream institute and you have to pay the first slot of your fees or you are planning an event, but you do not have the kind of budget to carry out the event. Or you are having a medical emergency and are in a need to pay hospital bills, but somehow you cannot arrange that sum of money. That’s when an urgent loan can come as a saviour.

Getting an urgent personal loan might be challenging and tricky when you have a bad credit score. That is why we have curated a list of ways you can find lenders who can provide urgent loans under emergency conditions. These lenders typically require a substantial down payment or high-interest rates. So, it is essential to look for lenders who offer loans with lower interest rates and lower down payments. You can compare interest rates from different Banks and financial institutes that can offer you loans on your credit score.

Credit Score & Its Importance

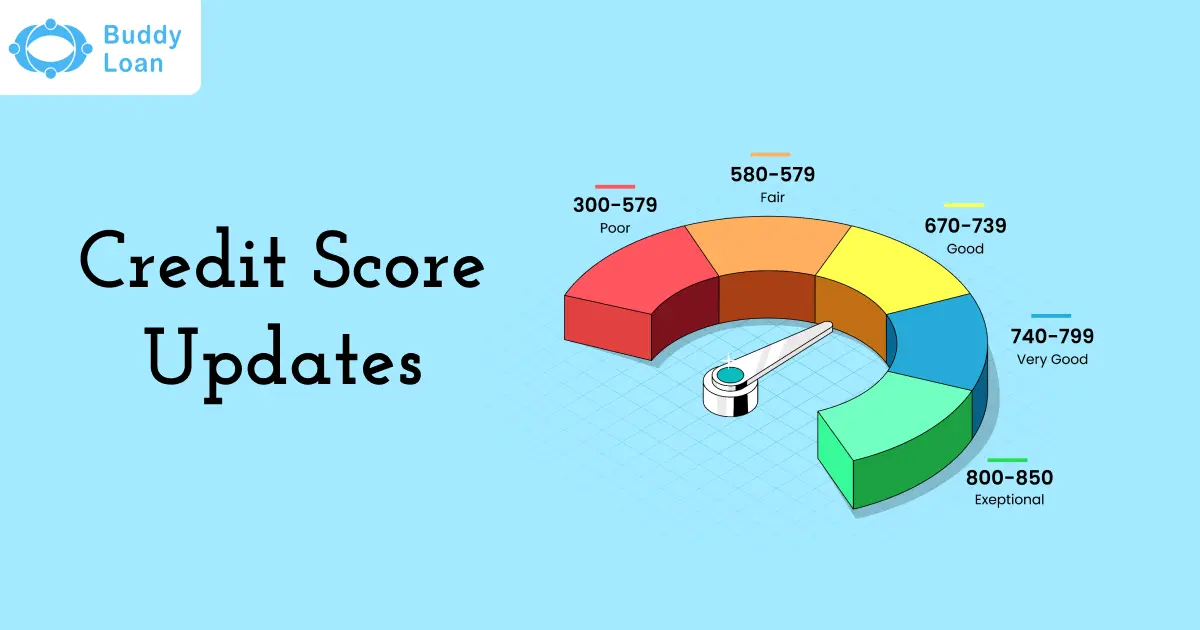

A credit score is a working report of your credit behavior where you can understand a person’s spending habits by looking at their credit score.

A higher score shows the responsible credit behavior of an individual. Eventually, it helps you to get better interest rates while requesting a loan from potential lenders and creditors. The credit score ranges from 300 to 900. Refer to the table below to better understand the concept of credit score.

| Credit score range | Status | Meaning |

| 720 or higher | Excellent | Financially responsible borrowers, with good money management skills. Eligible for Home Loans, Car Loans at low-interest rates, Ex. 4% p.a. |

| 690 – 719 | Good | Borrowers are eligible for a lower interest on financial products like credit cards and loans. |

| 630 – 689 | Fair | Borrowers will still get loans, but with more strict terms and conditions. |

| 629 or below | Poor | Borrowers can obtain unsecured credit cards, interest rates are higher. Annual fees are applicable. |

A higher credit score can help you get approval for a higher loan amount with low interest and your choice of repayment tenure. Eventually, it helps you with loan eligibility and an increase in your credit card limit. When you need a loan urgently, a good credit score is your best friend.

Habits That Give You Low Credit Score

Missing your Deadlines:

Your payment history reflects directly in your credit report. If you have a habit of missing your deadlines, it will lower your credit score in the long run. It shows that the borrower is not responsible for their credit. So, to ensure approval of your application, always meet your deadlines.

A High Outstanding on Your Credit Card:

We love to go on shopping sprees, festivals, new collections in the market, and holidays; you need a wardrobe for that, Right? Well, that can put a huge outstanding on your credit card. Even if you make all the payments in time, a high debt reflected on your credit card can affect your credit score. Keep your credit card usage low, the least you can do is keep your balances below 30% of your credit limits. Banks usually provide attractive offers from time to time to new and existing customers. That can help you to avail good cashback. Plan your spending wisely and make the most of your card without affecting your credit score.

An Unhealthy Mix of Credit:

Good mix categories include secured Credit such as Car loans, home loans, or mortgages with unsecured Credit like credit cards and debt consolidation loans. If your credit score reduces your chances of getting a credit card or an instant personal loan, you can get more types of Credit products to your mix. This way, you will reduce your reliance on only one type of Credit.

Not Using your Credit Card:

If your card is sitting idle in your pocket, it can affect your credit score in the long run, as some Banks and Financial Institutions charge maintenance fees for that. While you must be curbing your expenditure, your bank can charge you money for no activity.

Well, you can use your card for a Netflix subscription, pay your monthly OTT bills and enjoy, remember to put a timer on your cell phone or auto payment options so that you will remember your payments.

A Systematic Guide to avail an Urgent loan with Bad Credit:

It is true that with a low credit score, the chances of availing of a personal loan go down. But this cannot prove that you can never hold the chance to get one. Through some simple steps, you can easily avail yourself of an urgent personal loan in no time.

Your Salary Can Support EMIs:

If recently you have received a hike in your salary, or you have developed a new source of income, you can present your salary slips to Banks or NBFCs to avail of a personal loan. With a stable source of income, you can have the trust of the Bank that you won’t be losing out in paying EMIs or will be a defaulter altogether. However, you may end up paying more interest rates, but it will surely increase your creditworthiness.

Don’t Limit your Search to Banks:

When you have a bad credit score, the chances of getting a loan rejection from banks are higher. Thus, you can go forward with a loan application through new-age NBFCs. They provide loans to people who have bad credit scores also. You might get a higher interest rate or a minor tenure for your loan. So when you need urgent loans and want a personal loan with bad credit, you have to broaden your search to know about all other sources.

Buddy Loan, one of the largest loan aggregators in the market, can help you to plan your loan journey effectively, without losing yourself in the mix of different offers and interest rates in the market, and will keep you updated with the latest, that experts in the market are discussing. If you are in need of a loan urgently you can Apply for personal loan with Buddy Loan.

Have a Good Stead with Your Lender:

If you have a bad credit score, you can consult your bank or lender with whom you have a long relationship and explain yourself for getting an urgent loan for your emergency. They can help when you show them evidence of your income and job stability. Once they are on good terms with your repayment capacity, you can easily avail of a hassle-free loan.

Add a co-applicant:

Despite having a low credit score, you can still apply for a loan online by adding a co-applicant with a good credit score. You can request your family member or friend, with a stable income and responsible credit report, to become your co-applicant.

As a higher credit score lowers the risk factor of your application, you can easily avail of a personal loan. Before approving your loan, lenders will verify your credit history, report, and income details to ensure they can pay back even if the primary applicant failed to pay back.

Opt for a smaller loan:

If you have bad credit or no credit, it’s better, to begin with, a small loan. Because it’s easier to repay the loan as the EMI and tenure will be less. Paying it back on time will gradually increase your credit score and benefit your future transactions. Although the tenure period differs from one lender to another, it generally varies between three months to a maximum of two years. Some lenders can offer small loans for a short period of 15 days as well.

Analyze your Credit Report carefully:

Sometimes, the reason for loan rejection or low credit score lies in your credit report. The error may be due to failure while updating the latest information against your record. The factors that can affect your credit score are:

History of payment:

The history of payments showcases the pattern or habit of the applicant. If they make payments on time, do they miss deadlines? If they miss the deadline, how many days do they take to pay the required amount?

Ability to bear the loss, i.e., Credit Exposure:

It is the maximum amount of loss an applicant can bear if he or she fails to pay the credit amount.

Type of Credit:

Either you took revolving credit or installment or non-installment type credit. That speaks a volume about the applicant’s credit habits.

Credit Utilization Limit:

Your credit utilization ratio is one of the most critical factors of your credit score—keeping it low is key to top scores. Your credit utilization ratio should be 30% or less; the lower you get it, the better it is for your credit score.

You can calculate the credit utilization limit by dividing the amount to be paid by the available credit limit. It accounts for 25% of your credit report, so something to be taken seriously.

Credit Inquiries:

After applying for any credit product like a loan or credit card, Banks or financial institutes thoroughly investigate the applicant’s background. These inquiries are profoundly detailed and take time. During this inquiry, if banks discover that the applicant is also applying for loans and credit cards in other banks, that can affect the applicant’s credit score. It can be challenging for the applicant to get lower interest on the loan or a personal loan altogether. One has to be clear of their motives from the very beginning to avoid any difficulties in the later stages.

Credit Mix:

Credit Mix is a mix of secure as well as unsecured loans. In a situation where the lender pledges particular assets of the applicant, that is called Secured Loan. It includes home, car, and other bigger loans that are big in terms of amount and repayment tenure. On the other hand, unsecured loans do not require any asset as a security from the applicant. If your financial history is clean and you have a good credit score, banks may offer you loans without any collateral.

Try to make a copy of the credit report at least once a year and ensure it is free of errors. Build a healthy credit score to ensure your success rates in future borrowings.

A Few Suggestions to take care of

You need emergency funds for medical bills, home repairs & renovation, paying dues, etc. When applying for an instant personal loan with bad credit, there are a few things to remember:

- First, make sure you compare interest rates and fees from multiple lenders. With interest rates, you should also compare the charges different lenders charge. While comparing different offers, you should consider interest rates and annual percentages, i.e., APR.

- The interest rates usually depend on your credit score which determines your creditworthiness and the market conditions. APR on the other hand deals with the interest rates and fees while the consumer is borrowing. One has to be aware of the closing costs, costs that are put on interest rates at the time of closing deals. Closing cost is more important than the differences one observes in the interest charged on different products by different banks.

- Second, ensure the lender you choose is reputable and has a good customer service reputation. Customer service prepares the borrowers for the application process and answers any questions that the client may have during the process.

- The client must understand every detail of the procedure. It makes the process smooth and transparent. It not only helps the borrowers throughout the entire application process but also answers the queries of the client, which they can have during the whole paperwork.

Also Read: Procedures to Get an Instant Loan With Low Credit Score.

How to Stop your Credit Score From Going Down?

- A high credit score is a plus point for everyone who prefers loans and credit cards. Particular things could lower your credit score if you don’t maintain it properly. Check your credit score absolutely free with Buddy Loan

- Always keep your credit utilization under 30% of your total limit. Avoid unnecessary expenses and make sure to pay your dues on time.

- Only when you need extra financial support, then only go for a loan. Likewise, multiple loans from different lenders will negatively impact your credit score. Because whenever you apply for a loan, the lender will make a hard inquiry over your credit to decide your eligibility. So with more loans, more hard inquiries will follow, which is unsuitable for your credit score.

- Most importantly, if you opt for a loan and cannot repay them properly on time, it will eventually lower your credit score.

- Thus, frequent checks on your credit score will allow you to be alert about payments and can help you to know if any fraudulent activities occur in your account. It’s better to be cautious because cases of fraud activities and reports are on the rise.

Points to Remember Before Applying For An Urgent Loan

For getting instant online loan approval, you have to take care of certain details

Eligibility Criteria: Before applying, know if you are qualified for the eligibility criteria mentioned by your bank/lender.

Credit Score: You must have a score above 700 to get qualified for the loan. Moreover, you are able to get low-interest loans with a high credit score. So, it is better to be aware of your creditworthiness. Check your credit score using Buddy Score and get an instant credit report.

Documents: You have to submit valid documents such as an Aadhaar card, PAN card, passport, voter ID, bank statements, etc. while applying for an urgent loan. If you are an existing customer, then you can easily avail of a pre-approved personal loan without documents as lenders will already know your financial ability.

Debt-To-Income Ratio: Lenders analyze your debt-to-income ratio to know how you can manage your debts according to your current income. They can get to know about your loan repayment capacity.

EMI: Before applying for a loan, make a detailed plan for the loan amount and how much you can pay monthly over a certain tenure. Thus, calculate the EMI you can afford per month without disturbing your monthly budget.

Avoid These Mistakes While Applying For An Urgent Loan

While applying for an urgent loan with bad credit, you should avoid a few mistakes to save yourself from any troubles.

Loan Agreement: Without reading the complete application and “Terms And Conditions”, you should not apply for a loan. It might create legal issues in the future.

Loan Amount: Choose the loan amount according to your requirement and budget, and decide the EMI you can pay. It will help you from any debt burden.

Hard Inquiry: Avoid simultaneously applying for loans at various banks or lending institutions. The reason is that a hard inquiry is reflected in your credit report each time a lender checks your credit score. As a result, it will affect your credit score negatively.

Loan Purpose: You must clearly understand the purpose of taking a loan amount. If you are not, you might take more than your actual loan budget and ultimately go under debt burden.

Some Key points to keep in Mind:

- Never miss your payments.

- Maintain your credit card utilization ratio below 30%. Only during emergencies use a credit card, rather than using it for every payment.

- Get a mixed variety of credits like secured and unsecured loans.

- Don’t apply for multiple loans in a short time limit. First, research and compare, then choose the one that suits you.

- Stay active with regular borrowings and transactions in your credit. Check credit reports periodically to know the happenings in your history.

- Even if you choose a long-term and small EMI, you can pay your dues more than the maximum or can do prepayment to avoid more interest from piling up.

- You can manage your credit score with score builder loans, which are exclusively designed for new credit users with no credit history.

Also Read: Tips and Tricks To Build Credit Scores From Bad to Good

In Conclusion

Financial emergencies can come at any time without a warning. During those situations, a personal loan will be helpful. You can get an urgent loan with a bad credit score using the tips mentioned above, but you may have to pay a higher interest rate. Hence, you can increase your credit score by maintaining your credit for better chances of loan approval in the future. Before applying for a loan with bad credit, consider financial advice from experts to avoid any mistakes.

Buddy Loan, one of the largest loan aggregators in the market, can help you to plan your loan journey effectively, without losing yourself in the mix of different offers and interest rates in the market and will keep you updated with the latest, that experts in the market are discussing. It can help you get quick and unsecured loans even with an average credit score.

Having any queries? Do reach us at info@buddyloan.com