A good CIBIL score is very important in today’s world, whether you need it for financial requirements, to impress a potential employer, or to get better insurance options. So, maintaining and checking your CIBIL score is a necessary and healthy practice. Having a good CIBIL score comes with serious benefits. In this write-up, you can find out how to check CIBIL score for free using your pan card. Read on to learn more about checking the credit score and how important a PAN is.

Every financially independent Indian desire a good credit score. It is highly beneficial for both their private and professional life. A good credit score will only be achieved through constant practice of borrowing and good repayment habits. One of India’s most trusted credit bureaus is CIBIL. It collects information about your financial history by recording the repayment of loans and credit cards and then provides the credit score. CIBIL ratings are based on the financial history of each individual, and there are many ways to get your CIBIL score by PAN card. You can either request your report from CIBIL’s official website or get it through other banks, NBFCs, or loan aggregator websites like Buddy Loan. Click here to get your free credit report

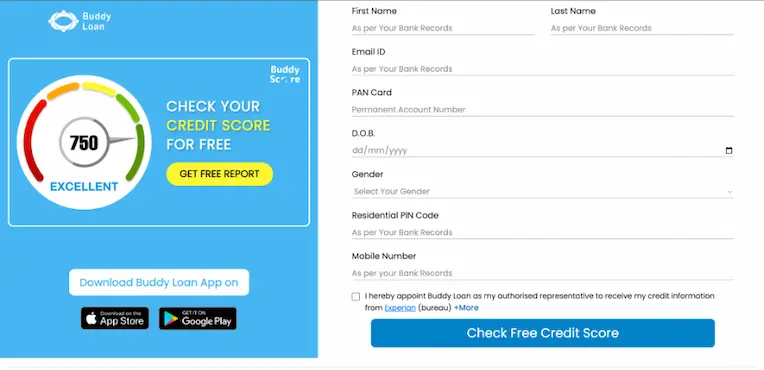

Buddy Loan is an online loan aggregator whose lenders give out loans at a low interest rate of 11.99%. They also have Buddy Score, a free credit score report providing service to make you aware of your credit health or credit history before you apply for a loan.

Simply having a CIBIL score is not enough, it should be good enough for lenders to consider you credit-worthy, but what exactly is a good credit score? Read on to find out more.

Also Read: Good Credit Score But Still Rejected Loan Top 10 Reasons For Loan Rejections

Considered a Good CIBIL Score

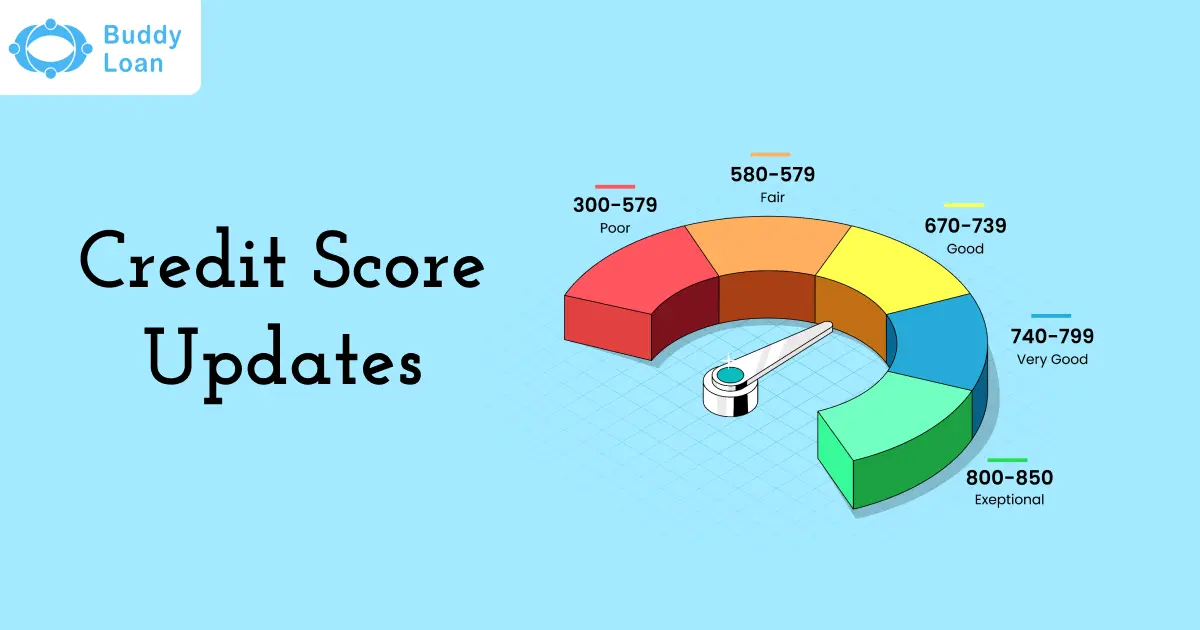

A CIBIL score range is a three-digit number that ranges from 300 – 900. The range provides information on the creditworthiness of an individual based on their financial history. The score you get from CIBIL determines how likely you are to repay your loans on time. The higher the score, the better your chances of getting a loan approved even with a lower interest rate.

A CIBIL score lying in the range of 700 – 900 is considered a good one. You can get faster loan approvals, lower interest rates, and higher loan amounts with a score in this range. Banks and lenders consider 750 to be the best CIBIL score.

As mentioned above, there are many benefits of having a good credit score, and these are explained below in detail.

Also Read: Know The Different Types Of Credit Score

Benefits of a Good CIBIL Score

Getting emergency funds to use when you need them the most can be extremely helpful. That is why having a good CIBIL score is very important. In emergencies, you may need to avail of credit, and one of the major benefits of a good CIBIL score is quick approval of loans. There are many benefits of having a good CIBIL score.

These are:

Quick Approvals

A credit score of 750 and above is a great indicator of how responsible a borrower is. This gives banks and lenders the confidence to trust such individuals, thereby giving them quick loan approval.

Lower interest rates and processing charges

When you have a high CIBIL score rating, you can get comparatively lower interest rates on your loans. The lower the interest rate is, the lower the EMI you will have to pay. The processing fee for the loans will also be significantly lower. This is because of your creditworthiness as a borrower.

Great credit means pre-approved loans

A number of banks will offer pre-approved loans to an existing customer with an excellent credit history. Pre-approved loans come with many benefits, such as an easy application process, instant processing, great interest rates, and little to no documentation required. The funds can be used for any purpose. It is a great way to get emergency funds at low-interest rates.

Longer loan tenure and higher loan amount

With a good CIBIL score, you can opt for loans with a longer repayment tenure. This will mean that you will have a lesser burden on the EMI payments to be made each month. You can also get loans of a higher amount with a great CIBIL score. A great CIBIL score indicates that the borrower is responsible and has good repayment habits. This gives banks and lenders the confidence to give them loans of higher amounts.

Positively impacts your career

When you hold a good credit score rating, recruiters will be immediately interested in such a candidate. This is because to have a good credit history, they will have to be a disciplined and responsible person with how they utilise their finances. This behaviour will naturally show in other areas of their life too. Hence, a good CIBIL score will positively impact your career.

Additional benefits

There are many other benefits to having a good CIBIL score, such as getting a higher credit limit on credit cards and cashback offers. If you have a high credit score lenders will be more attentive to your requests and queries. You can negotiate loan features like tenure, EMI, and other additional fees.

Being credit conscious comes with great benefits, but avoid being overconfident. Avoid borrowing credit too frequently and from too many different borrowers, as this may have a negative impact on your credit history. Always maintain a good credit score and remain conscious of your spending habits. With a good credit score, you can enjoy many benefits and advantages.

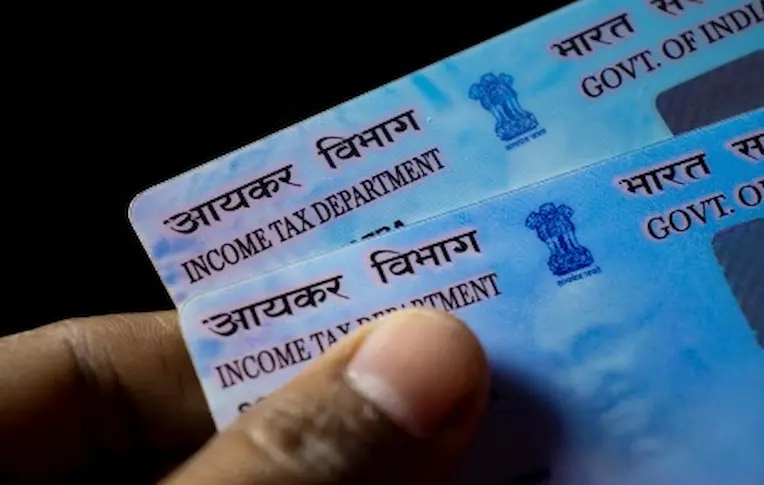

Moreover, you can check your CIBIL score using your PAN number! Wondering How? Read further to know! Before going further, let’s look at the importance of a PAN number!

Also Read: Top 5 CIBIL Score Improvement Factors

PAN Number Important

A PAN card is important as all financial transactions require a PAN number. It tracks money that comes and goes through every individual’s accounts. The number is important when paying income tax, receiving tax returns, and receiving information from the Income tax department. Some uses and advantages of a PAN are:

- A PAN card is required when you’re opening a bank account.

- While filing for IT returns.

- Apply for a new loan.

- Get new gas and telephone connection.

- Purchase and sell new property.

- Get new debit or credit cards.

- Open a fixed deposit account.

- Make insurance premium payments.

- While paying taxes, PAN is required to be quoted.

- It is also required when paying income tax.

- PAN details are necessary when registering a business.

- A PAN card can be used as an identity card as it has all the necessary information like name, date of birth, and address.

- Tracking your taxes can be done through a PAN card.

- It cannot be misused by anyone else as it is a unique alphanumeric given to each individual.

A PAN is highly important in financial transactions; therefore, it is necessary to have one. It is also very important when applying for a new loan. As a PAN holds primary financial information on all past transactions, it is crucial when checking for your credit score.

Now that you know the importance of a good CIBIL score and a PAN number, let us look at how to check your credit or CIBIL score for free using PAN!

Also Read: PAN Card Is So Important for Loan Approvals

Check Our CIBIL Score For Free Using PAN

There are various websites on how to check your CIBIL score free using your PAN card number. Banks with online websites, such as ICICI Bank, offer free CIBIL score reports on their websites. Similarly, loan aggregator websites like Buddy Loan will also offer to provide a credit score using PAN number. Below is a guide on getting a free credit score from Buddy Score.

1. Visit the Buddy Loan website and click “check free credit score.” It will take you to another webpage as Buddy Score.

2. Enter basic information including

- Name

- Email address

- Date of birth

- Gender

- Residential pin code

- Mobile number.

- PAN card number.

3. When all the required fields have been filled in, and the terms and conditions have been read, click on “Check free credit score,” and you will receive the score.

Checking your credit score has become much easier now. Regular checking will help you maintain a good CIBIL score; as you know, a good CIBIL score comes with many benefits.

Note: You can also check your CIBIL score using the official website. However, you might have to pay either for a monthly or annual subscription.

Also Read: Difference Between Credit Score and CIBIL Score

Check The CIBIL Score (With Monthly/Annual Subscription)

A CIBIL score is a gateway to financial freedom, so it is important to have a good one. Understanding your score will help you get ahead in life. With proper knowledge, you will be able to maintain your score and tackle future financial emergencies without stress. One of the best ways to begin a healthy financial journey is to check your CIBIL score regularly. There are many ways on how to check CIBIL score. Checking your score from the official CIBIL website is one of them.

CIBIL offers three different subscription plans to customers willing to keep track of their CIBIL score. They can also get other benefits such as regular credit reports, access to their CIBIL dashboard, a score simulator that can help them build a credit score, personalised loan offers, and a 24/7 credit monitoring alert available only for standard and premium subscribers.

The basic subscription plan is for 1 month at a fee of 550 rupees. The standard subscription plan is for 6 months at a fee of 800 rupees, and the premium plan is for 12 months at a fee of 1200 rupees. If you want to get your CIBIL score and report from the CIBIL website, then below is a step-by-step guide on how to check CIBIL score from the website:

Steps

1. Go to the CIBIL website: At the official website, click on “Get your CIBIL score,” and it will take you to the subscription page. On the subscription page, you can scroll down and click on “Get started,” and you will have to create your account.

2. Create your account with CIBIL: To create your account you will have to enter all the necessary information that has been asked. Enter your email address, name, ID proofs, date of birth, and phone number. Once you have filled in all the details you can click continue.

3. Verify your account: This is a necessary security step where you will get an OTP on your registered mobile number. Enter the OTP and continue.

4. Pay the subscription fee: Once the account has been verified, you will need to pay the subscription fee of your choice, and then you will be able to view your credit score along with your credit report.

Checking your credit score and history from CIBIL is easy and efficient. However, it comes with a cost. If you only want to check your credit score once then you can choose the basic subscription. However, if you need to check your CIBIL score and report more than once then choosing the other two plans may be more beneficial and cost-effective.

Also Read: CIBIL Score: Full Form, What is CIBIL Score, How to Check CIBIL Score

In Conclusion

A good CIBIL score cannot be built in a day, and it takes years of borrowing and regular repayments to have a great CIBIL score. In order to have and maintain a good score, you should be well-disciplined and have good financial habits. An important part of maintaining a good score is regularly checking it; now you know how to check CIBIL score on your own. Use Buddy Score to get your free credit score at any time.

Having any queries? Do reach us at info@buddyloan.com

Q. What is a PAN number?

A. Permanent Account Number (PAN) is a crucial 10-digit alphanumeric identifier issued by the Income Tax Department to prevent tax fraud and store tax-related data.

Q. I got a new PAN card. Will it affect my credit score?

A. Replacing a lost PAN card doesn’t alter your credit score with the same number; however, changing it may affect your credit due to linked transactions.

Q. How to resolve errors in your CIBIL report?

A. Thoroughly review your CIBIL report, identify errors, raise disputes, wait for acknowledgment, and get the error-free report.

Q. How to check CIBIL score free on the Buddy Score?

A. To get your free CIBIL score, visit Buddy Loan’s website, click check free credit score input details accurately, and receive your score.