Credit scores continue to play a vital role in the financial aspect of our lives. How exactly? You may wonder. Well, lenders usually determine whether an individual is worthy enough to avail of a loan through an extensive credit history analysis. For decades, a good credit score has been a crucial eligibility criteria for loan approval and credit cards. Now, the horizon for credit scores has only broadened with banks using it to determine the interest rates for personal loans. This blog will explore how credit scores affect personal loan interest rates, what a good score indicates and the steps you can take to improve it for better future prospects.

The Basics Of How Credit Scores Work

Credit scores are a numerical representation of the creditworthiness of an individual. It is measured by factors such as:

- Payment history

- Credit usage

- Length of credit history

- Credit variation

Note: In India, many bureaus collect the credit history of individuals such as CIBIL, Experian, Equifax, and CRIF High Mark.

Understanding Credit Scores

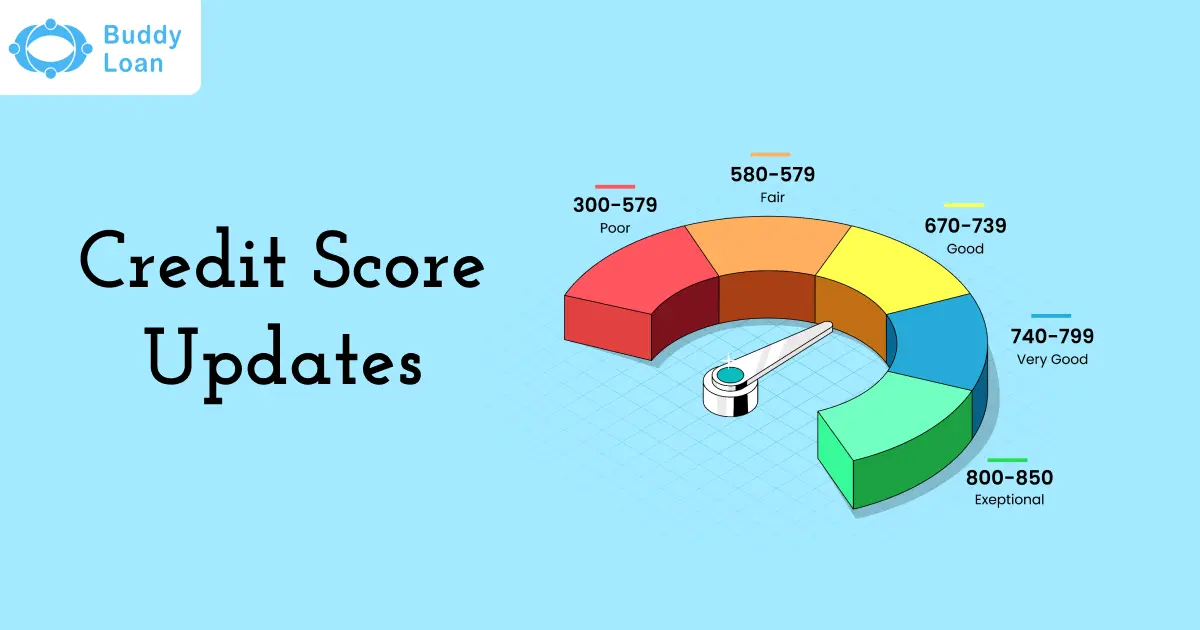

Lenders categorise borrowers into credit score levels to streamline their lending decisions. These levels range from excellent credit to poor credit given to individuals based on their credit history. The categories differ from one lender to another; however, they follow a similar pattern.

- Excellent credit scores: Scores that are 750 and above are considered excellent scores.

- Good credit scores: Individuals having scores of 700-749 are considered reliable and have good scores.

- Fair credit scores: 650 – 699 is considered a fair score.

- Poor credit scores: A poor score is in the range of 550-600. Individuals with poor credit scores will face challenges with loan applications.

Impact Of CIBIL Score on Loans

Credit Information Bureau India Limited (CIBIL) is a leading credit bureau in India. Banks and financial institutions usually refer to the scores given by CIBIL to determine a borrower’s creditworthiness. A CIBIL score will play a significant role in assisting lenders in deciding on loan acceptance or rejection, interest rate, loan amount, and more.

Relation Between CIBIL Score And Rate of Interest

Lenders have been practising risk-based pricing regarding interest rates for personal loans. They will closely analyse your CIBIL score before deciding on an interest rate for your loan. This is because a CIBIL score is given to an individual based on their past repayment habits and credit history. It indicates their financial responsibility where lenders determine the risk of lending to the individual.

A high CIBIL score portrays a solid repayment of past loans and good financial habits. In comparison, a low score indicates irregularities in their past repayments of loans or credit card bills. Based on their CIBIL scores, lenders will determine whether they are low-risk or high-risk borrowers, thereby deciding on the interest rate for personal loans.

How Low CIBIL Score Can Have An Impact On The Loan Interest Rate?

Lenders usually provide high-interest rates for low CIBIL scores. A low score will also negatively impact your loan application, as lenders will only accept it if the score is up to their satisfaction. A loan rejection will further downgrade your credit history. Therefore it is advisable to only apply for a personal loan if your CIBIL scores are high.

Can An Excellent Credit Score Lower The Interest Rate?

Yes, an excellent credit score will get you a lower interest rate. Borrowers with great scores will be less likely to default on a loan. A high score will also give you the power to negotiate your loan terms, improving your chances of getting attractive and favourable loan terms and interest rates.

Tips To Improve Your Credit Score So You Can Get Best Rates On Your Personal Loans

You can improve your credit score to get better personal loan interest rates. Below are the tips on how you can get a better credit score:

- Make timely repayments: Paying your EMI, credit card, and utility bills before the due date will improve your credit score.

- Keep a low credit card balance: Having a credit card balance below 30% of your credit limit and using credit responsibly will positively affect your score.

- Avoid defaulting on a loan: Always take a loan that you are sure you can repay. Make a repayment plan and stick to it to improve your creditworthiness.

- Avoid taking on too many loans: Refrain from taking too many loans within a short period of time. Every loan application will result in a hard inquiry on your credit report, which lowers your credit score.

- Maintain a diverse credit mix: Having different types of credit will positively impact your score. It demonstrates your ability to handle credit responsibly.

- Regularly check your credit: Regularly checking your credit report will help you identify errors or discrepancies. These accuracies must be reported and corrected.

Also Read: How To Improve Your Credit Score With A Personal Loan Using These Tips

Coclusion

Your credit score will affect the interest rate on your loan, so being financially responsible will get you the best rates and loan terms in the market. A high credit score will get you low-interest rates, while a low credit score will get you high-interest rates. Having an excellent score will also be beneficial as loans become more affordable and the overall cost of borrowing is significantly reduced. Understanding how credit scores affect personal loan interest rates will help you make active efforts towards improving your financial situation.

Download Personal Loan App

Get a loan instantly! Best Personal Loan App for your needs!!

Looking for an instant loan? Buddy Loan helps you get an instant loan from various lender options. Download the Buddy Loan App from the Play Store or App Store and apply for a loan now!

Having any queries? Do reach us at info@buddyloan.com

Frequently Asked Questions

Q: Can I get a personal loan with a low credit score?

A: If you have a low credit score, you can get a personal loan, however, the interest rate will be high.

Q: How can I improve my credit score to get better personal loan interest rates?

A: To improve your credit score you can manage your credit responsibly, make timely repayments, reduce debt, and regularly monitor your credit report.

Q: Can I negotiate the interest rate on a personal loan based on my credit score?

A: Yes, you can negotiate the interest rate on a personal loan if you have a good credit score.

Q: Does a single late payment impact personal loan interest rates significantly?

A: Yes, even a single late payment can reflect on your credit history, thereby impacting personal loan interest rates in the future.

Q: How long does it take to improve a credit score?

A: It can take about 4-12 months for a credit score to improve.

Q: How does my CIBIL score affect my loan interest?

A: Your CIBIL score directly affects your interest rate, as a high CIBIL score will get you low-interest rates while a low score will get you higher interest rates.

Q: Does a higher credit score lower interest?

A: Yes, with a higher credit score you will be able to get low interest rates.