Do you know how simple errors from your end can affect your entire financial health report? Simple or small activities can become a reason for credit scores to drop. Here in this article, we discuss some common reasons that cause your credit score drop and how you can seamlessly avoid those. So, let’s understand more about the possible problems hurting your credit score through this article.

Your credit score is a significant element in determining your overall financial health. It also determines how well you manage your money and how well you spend on fees, EMIs, interest over time. The main purpose or benefit of having a good credit score is that you are most likely to get a loan at a lower interest rate. Also, a good credit score allows you to avail credit cards with the best rates and terms.

A credit score is a numerical indicator of your financial health and activity. The overall credit report indicates your credibility and how well you managed your past loans and interests. The entire procedure of borrowing a loan becomes very smooth if you have a good credit score. Hence that’s the reason why you should maintain a good credit score. But you might have heard that making timely monthly payments is one of the best habits to inculcate to maintain good credit. But the truth is , that isn’t the only thing to remember, as there are other steps to be taken to build or improve your credit score.

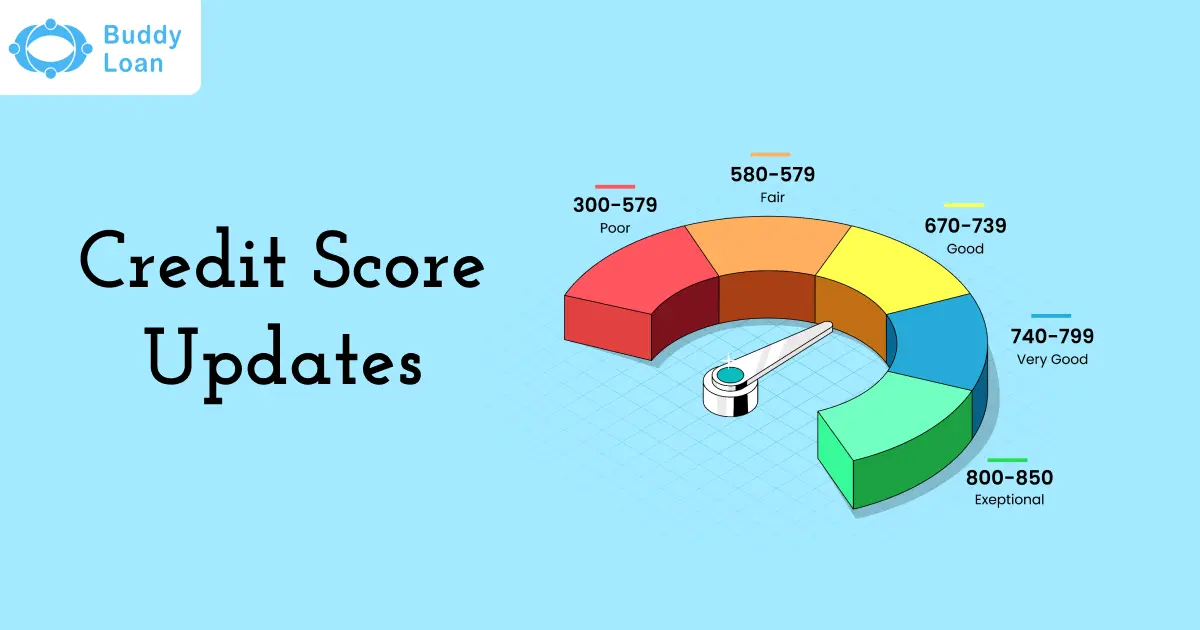

Credit Score

A credit score is a three-digit number that determines your creditworthiness. But have you check your credit score yet?

If not, then you should monitor it immediately, and you can do that by logging into the Buddy Score website and receive detailed status about your credit score. However, there are specific actions that will impact your credit score and eventually affect your loan approval duration. If you don’t have a good credit score, there might be certain activities from your end up that might be affecting it negatively.

Also, you can refer to the table below to better understand different credit score ranges and what they mean.

Credit Score Table

| Credit Score | Rating |

| 300 to 600 | Very low |

| 601 to 700 | Low |

| 701 to 760 | Fair |

| 761 to 800 | Good |

| Above 800 | Excellent |

Hence, before taking steps for improvement, let’s understand what mistakes you might be committing unknowingly.

Actions Hurting Your Credit Score

Making Fewer Payments –

This includes one of the most common mistakes that easily hurt your credit score. If you have any outstanding dues, it is important to ensure that you continue making payments on the stipulated time. Otherwise, this will be the top reason for credit scores to drop.

Making Credit Cards Max Out –

This is another very simple yet strong reason that impacts your credit card negatively. In this scenario, one can assume that you have utilized too much credit on your cards which can be negative for the lenders. Keeping your entire credit card balance below your credit limit will be a good idea.

Making Way For Hard Inquiries –

Applying for new credit cards can lead your lender to impose hard inquiries on your Credit Report. That will eventually lower your credit score but temporarily. If you plan to apply for new credit, you should try to do it once so that you don’t have to come under one hard inquiry on your report.

Debt-To-Income Ratio –

This ratio is analyzed by dividing the total monthly payments. Lenders use this ratio to understand how much debt one can afford to pay. If your ratio is too high, it can indicate that you have overextended and may have trouble making your payments on time. You have to pay down your debt to lower your DTI.

A Mix of Different Debts –

It is recognized as good if you have loan debt on top of credit card debts. If you only have credit card debt, then it may look risky to the lenders. So, to improve your mix of debts, you should try paying off your credit card dues by taking out a small loan. Also, if you are looking to avail a quick instant small loan you login to the Buddy Loan website.

Hence, these are the common reasons for a credit score drop. However, another reason your credit score falls is ignoring or being lazy to check your credit score status. You can check credit scores online as there are online resources to get a free credit score evaluation. Those websites not only provide analyses of your credit score but also provide you with practical suggestions to improve the same.

Also, the next section will discuss about the ways to check credit score online

Ways To Check Credit Score Online

- You will have to log into any website that provides credit score online. You can also log in to Buddy Score website to check your credit score.

- To get your credit score report, you must provide your Name, email id, and password.

- Follow the step by attaching your ID proof,i.e.,- a PAN card. Adhaar or Voter ID)

- You must provide your PIN code, DOB information, and your number.

- Once you have provided all the information, you should click “Continue” to proceed with the next step.

- Once you receive an OTP on your phone, type in the OTP carefully as part of the verification process.

- After filling in the required documents, you will land on the website with ‘member login credentials. And finally, your credit score will display on your screen.

The next section will talk in detail about how you can make conscious steps to ensure improvement in your credit score.

Steps To Improve Your Credit Score

1. Responsible Paying Skills –

Good-paying skills will help improve your credit score. Cleaning dues at the right time every month or year is very important for your credit score. So putting reminders or writing down the due dates will help you from forgetting instead will assist you in completing the payments.

2. Reducing Credit Card Bills –

One of the easiest and quickest actions one can take to elevate their credit score in one go. The constructive step that you can take is to pay down debts. The lesser are the piles of debts, the closer you get to getting loan approval quickly.

3. Accuracy In a Credit Report –

Having an inaccurate credit score can impact one’s credit file. So, periodically checking credit reports ensures accurate information that is displayed on the file. If you have seen any discrepancies that are not from your end, then you can raise a quick dispute. After you raise the dispute and inform the concerned authority and the lender, inform them.

4. Credit Inquiries-

These kinds of investigations are done based on your credit report and if you have applied for any credits. To save yourself from hard inquiries, you can always make your inquiry if you check your credit report constantly. Whenever you check your credit score it is recognized as a hard inquiry, and a hard inquiry usually impacts negatively on your credit score, which stays for the time being. These hard inquiries also tend to disappear over time.

5. Monitor Your Credit Report

Along with credit score, some common mistakes can also affect your credit report. A credit report is the amalgamated report of your credit score and overall credit history. Hence checking your credit report once a year is also equally important. You might not know, so actions might also affect your credit report.

This section will discuss how to spot the errors in your credit report and how you can improve them after you spot them.

6. Errors

There are clear moments where you can find the errors, but sometimes you might get confused by the familiarity of the Name. Basic errors can also occur when you have provided a misspelling of your Name and address or phone number. These simple errors should be taken into immediate consideration and resolved or rectified.

Hence, your Name or incorrect contact information like an address or phone number can create future hazards.

7. Errors Related to Your Account

Account-related errors will occur whenever you tend to give incorrect information about the status of your account.

Any discrepancies, inaccuracies, and late payments should technically alarm you, and if no prompt action is taken from your side, you will default on all your payments. That can cause a serious drop in your credit report.

Other scenarios like these can also cause mistakes.

-Debt might have been recorded more than once.

-When closed accounts are mentioned as open

Ways To Fix Your Credit Report Error

As a customer, you should always have a copy of your credit report and claim a copy of your credit report once a year. You can also do it through many best sites to check your credit report online, which will help you obtain a credit report quicker and easier.

Analyze Your Credit Report to Confirm Mistakes:

You should review and analytically check your credit report. Scrutinizing and finding the errors or gaps in your credit score. Personal information can cause errors, but there might not be an overall effect. However, resources or the bureau will inform you if any impact is detected.

Hence, you have to be aware of your credit report errors, and there are some alerts stated below to avoid the mistakes.

Common Mistakes That Can Occur In Your Credit Score.

- Don’t give the wrong information or details like Name, current and previous addresses, etc., incorrect.

- You have to be aware of bankruptcies along with foreclosures or any discrepancies.

- Ensure the details about open and closed accounts and payment history are mentioned clearly.

- After you have discovered or detected the mistakes in your credit report, you have to inform the concerned bureau to rectify them as soon as possible.

- If you found the error on your credit report, you should make sure to inform the concerned bureau to get it rectified.

Hence, you should review it with your credit report once a year to help you identify and rectify mistakes quickly. Also, the following steps mentioned below will help you monitor your credit report.

Conclusion

One of the major mistakes you make that hurts your credit score is not monitoring your credit score. You as a customer are entitled to get a free credit score and reports file from major agencies or online resources. The article aims to provide important information about the significance of credit score and how you are possibly hurting it.

The article provides quick ways to spot the problem areas and rectify them at the earliest. The easy and quick steps to check your credit score should help you access your credit report.

Hene, once after knowing how you are hurting your credit score, you should start taking constructive steps to improve it.

Download Personal Loan App

Get a loan instantly! Best Personal Loan App for your needs!!

Looking for an instant loan? Buddy Loan helps you get an instant loan from the best verified lenders. Download the Buddy Loan App from the Play Store or App Store and apply for a loan now!

Having any queries? Do reach us at info@buddyloan.com

Frequently Asked Questions

Q. Can constantly checking your credit score harm your overall credit report?

A. No, it won’t. Instead, monitoring your credit score frequently helps you to prevent future hazards.

Q. What are the benefits of having a good credit score?

A. Having a good credit score secures easy loan approval, lower interest rates, fewer document requirements, lender trust, and extended repayment terms.