Have you ever wondered how banks decide whether to approve your loan or credit card application? The answer lies in your credit information report. In India, credit information companies (CICs), commonly known as credit bureaus, collect, maintain, and analyze your credit data to generate your credit score and detailed reports. These reports play a crucial role in determining your financial credibility.

In this blog, we’ll explore what credit information companies do, introduce the 4 credit information companies in India, and explain how they operate. By the end, you’ll understand the importance of credit bureaus like Experian Services India Pvt Ltd, CRIF Highmark, and others in shaping your financial journey.

More About the Credit Information Companies

Credit information companies are organizations authorized by the Reserve Bank of India (RBI) to collect and provide credit information on individuals and businesses. These companies compile data on your loans, credit cards, and repayment behaviour from various banks and financial institutions. They generate:

- Credit Reports: Detailed documents that show your credit history.

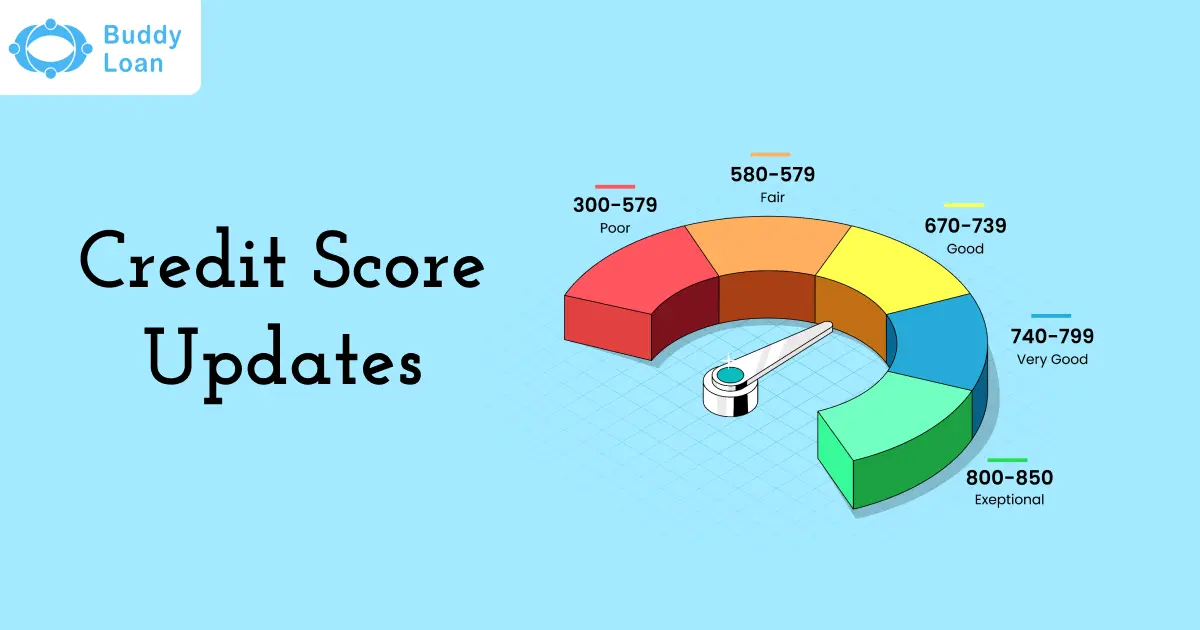

- Credit Scores: A numerical value that represents your creditworthiness, typically ranging from 300 to 900.

Lenders use these reports and scores to assess the risk of lending money to you. The higher your score, the better your chances of getting loans approved with favourable terms.

List of Credit Information Companies in India

In India, there are four major credit information companies licensed by the RBI. Each has unique features and services. Here’s a detailed overview:

| Credit Information Company | Fee for Credit Report & Score |

| TransUnion CIBIL | ₹550 for a one-time report and score |

| Experian Services India Pvt Ltd | ₹399 for a one-time report and score |

| Equifax Credit Information | ₹400 for a one-time report and score |

| CRIF Highmark | ₹399 for a one-time report and score |

Note: You are entitled to one free credit report per year from each credit information company as per RBI guidelines.

1. TransUnion CIBIL

- It is the oldest and most widely used credit bureau in India.

- Provides CIBIL Score ranging from 300-900.

- Offers credit reports for both individuals and businesses.

- Detailed insights into repayment history and overall credit behaviour.

2. Experian Services India Pvt Ltd

- Offers Experian Credit Score India and comprehensive credit reports.

- Globally recognized and widely trusted credit bureau.

- Provides specialized services such as identity verification and fraud prevention.

- Offers customized credit risk solutions specifically designed for businesses.

Also Read: Experian Credit Information Report

3. Equifax Credit Information

- Provides comprehensive credit reporting and detailed analytics.

- Offers valuable insights for both consumers and businesses.

- Focuses on risk management and fraud detection solutions.

- Provides detailed portfolio management services to help manage credit risk effectively.

Also Read: Equifax Credit Score And Crif Highmark Credit Score

4. CRIF Highmark

- Known for its high-quality data and advanced credit analytics.

- Provides CRIF Highmark Scores and detailed credit reports.

- Offers credit reports for individuals, MSMEs (Micro, Small, and Medium Enterprises), and commercial entities.

- Specialized in delivering industry-specific credit solutions for more targeted insights.

Also Read: CRIF Full Form – Understanding CRIF Credit Reports & Scores

Know How Credit Information Companies Work

Credit information companies follow a systematic process to create your credit report and credit score. Here’s a step-by-step overview:

1. Data Collection:

- CICs collect information from banks, NBFCs (Non-Banking Financial Companies), and other financial institutions.

- This data includes details of loans, credit cards, repayment history, defaults, and outstanding balances.

2. Data Analysis:- The collected data is analyzed to assess your credit behaviour. Factors like timely payments, credit utilization, and loan inquiries are evaluated.

3. Report Generation:- Based on the analysis, a credit report is generated, summarizing your credit history. The report includes your personal details, loan accounts, payment history, and any defaults or late payments.

4. Credit Score Calculation:- A credit score ranging from 300 to 900 is calculated. Higher scores indicate better creditworthiness.

5. Report Access:- Lenders access these reports to decide on loan approvals, interest rates, and credit limits.

Rules & Regulations of Credit Information Companies

Strict regulations govern credit information companies in India to ensure accuracy, transparency, and privacy. The key regulatory framework includes:

1. Credit Information Companies (Regulation) Act, 2005 (CICRA): This act provides guidelines for registering, operating, and regulating CICs.

2. Reserve Bank of India (RBI) Guidelines: RBI monitors and ensures that CICs comply with data accuracy and privacy standards.

3. Fair Practices Code: CICs must follow ethical practices, including providing accurate data and resolving disputes efficiently.

4. Consumer Protection: Consumers have the right to access their credit reports and dispute inaccuracies. If errors are found, CICs are required to correct them promptly.

Who Can Access Your Credit Report

Your credit report is sensitive information, and not everyone can access it. Here’s who can legally access your credit information:

1. Banks and Financial Institutions: To evaluate your loan or credit card application.

2. Non-Banking Financial Companies (NBFCs): For offering personal loans, business loans, or other financial products.

3. Individuals: You can request your own credit report from any of the credit report agencies in India like CIBIL, Experian, Equifax, or CRIF Highmark.

4. Employers (Limited Cases): Some employers may check credit reports for roles involving financial responsibility.

5. Insurance Companies: To assess the risk before issuing insurance policies.

Conclusion

Credit information companies in India play a vital role in shaping your financial profile. They provide crucial insights to lenders, helping them assess your creditworthiness. The four major credit agencies in India—TransUnion CIBIL, Experian Services India Pvt Ltd, Equifax, and CRIF Highmark—each offer unique services and detailed credit reports.

Understanding how these companies work, knowing the Experian report credit process, and staying informed about your credit score can help you maintain a healthy financial profile. Regularly checking your credit reports ensures accuracy and helps you address issues promptly.

By staying on top of your credit information, you can improve your chances of securing loans, getting lower interest rates, and achieving your financial goals with ease.

Download Personal Loan App

Get a loan instantly! Best Personal Loan App for your needs!!

Looking for an instant loan? Buddy Loan helps you get an instant loan from the best-verified lenders. Download the Buddy Loan App from the Play Store or App Store and apply for a loan now!

Having any queries? Do reach us at info@buddyloan.com

Frequently Asked Questions

Q. Which credit bureaus operate in India?

A. The major credit bureaus in India are CIBIL (TransUnion), Experian, Equifax, and CRIF High Mark.

Q. How do credit information companies work in India?

A. They collect financial data from lenders, analyze it, and provide credit scores and reports to assess creditworthiness.

Q. Why are credit scores important in India?

A. Credit scores help lenders evaluate a borrower’s repayment capacity, impacting loan approval and interest rates.

Q. How can I check my credit score in India?

A. You can check your score online via official websites of credit bureaus or platforms like Paisabazaar and BankBazaar.

Q. Do Indian credit bureaus provide free credit reports?

A. Yes, each bureau provides one free credit report annually under RBI guidelines.

Q. How do credit scores affect loans in India?

A. Higher credit scores lead to easier loan approvals and lower interest rates, while low scores reduce borrowing options.

Q. Can credit scores be improved in India?

A. Yes, timely repayments, reducing credit utilization, and correcting errors can improve your score over time.

Q. How do errors in credit reports get fixed in India?

A. Dispute errors with the concerned credit bureau by submitting a correction request along with relevant proof.

Q. What data do Indian credit bureaus collect?

A. They collect data like loan accounts, credit card usage, repayment history, defaults, and inquiries from financial institutions.