In the world of finance, the term CIBIL score often comes up during loan or credit card applications. But what does CIBIL stand for, and why is it so important? The full form of CIBIL is Credit Information Bureau (India) Limited. Established as India’s first credit information company, CIBIL collects and maintains credit-related data on individuals and businesses. This data is used to generate the CIBIL score, a three-digit number that represents a person’s creditworthiness.

This blog will explain the full form of CIBIL in banking, the meaning of a CIBIL score, its importance, and how you can check your score. Whether you’re new to credit or looking to improve your score, understanding these concepts is key to managing your finances effectively.

More About CIBIL & CIBIL Score

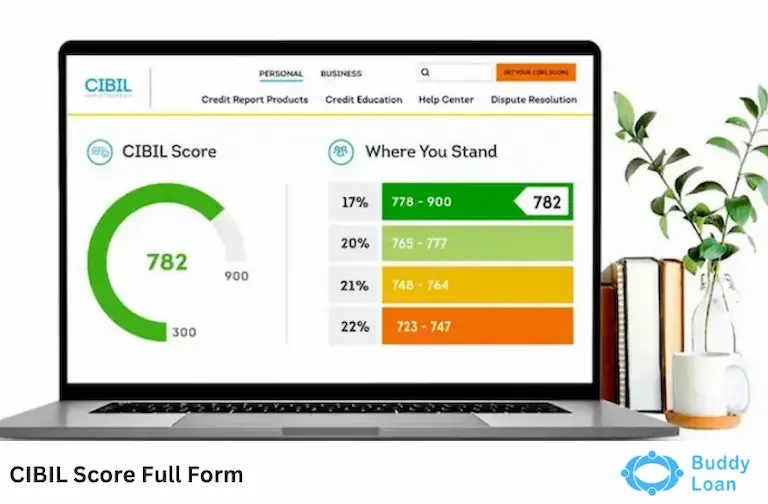

CIBIL (Credit Information Bureau India Limited) is one of India’s leading credit information companies, providing detailed credit reports and scores to help lenders assess a borrower’s creditworthiness. A CIBIL Score, ranging from 300 to 900, plays a critical role in determining loan approvals and interest rates, with higher scores indicating stronger financial health.

Understanding CIBIL

CIBIL is one of the four credit bureaus in India, alongside Experian, Equifax, and CRIF Highmark. It operates under the regulation of the Reserve Bank of India (RBI) and is powered by TransUnion.

What is a CIBIL Score?

A CIBIL score is a three-digit number ranging from 300 to 900. This score is derived from your credit history and repayment behavior. The higher the score, the more creditworthy you appear to lenders.

CIBIL Score Ranges:

| CIBIL Score Range | Remark | Insight |

| NA/NH | No Credit History | Indicates no loans or credit cards in the past. Suitable for new borrowers. |

| 300-549 | Poor | Reflects irregular repayments, high defaults, and high-risk behavior. |

| 550-649 | Fair | Indicates some repayment issues. Borrowers may get loans but at high-interest rates. |

| 650-749 | Good | Suggests responsible repayment behavior. Lenders are more likely to approve loans at fair terms. |

| 750-900 | Excellent | Demonstrates strong credit history and repayment discipline. Eligible for the best loan offers. |

Understanding How the CIBIL Score Calculated

Your CIBIL score is calculated based on several factors that collectively determine your creditworthiness. Here’s a breakdown of the key components:

1. Payment History (35%)

- Late payments or defaults negatively impact your score.

- Regular, on-time repayments boost your score significantly.

2. Credit Utilization Ratio (30%)

- This measures how much credit you’ve used compared to your total credit limit.

- Example: Using ₹30,000 out of a ₹1,00,000 limit equals 30% utilization, which is considered healthy.

- High utilization (above 50%) can lower your score.

3. Credit Mix (15%)

- A balanced mix of secured loans (e.g., home loans) and unsecured loans (e.g., credit cards) improves your score.

- Too many unsecured loans may negatively affect your rating.

4. Credit History Length (10%)

- The longer your credit history, the better it is for your score.

- Lenders prefer borrowers with a proven track record of responsible credit usage.

5. New Credit Inquiries (10%)

- Multiple credit inquiries in a short period indicate credit hunger, which can reduce your score.

- Apply for loans or credit cards only when necessary.

Reasons Why CIBIL Score Important

Your CIBIL score plays a pivotal role in your financial life, influencing various aspects of credit and lending. Here’s why it’s so important:

1. Loan Approvals

- Most lenders require a minimum CIBIL score of 750 for loan approval.

- A high score increases the chances of approval and faster processing.

2. Better Interest Rates

- Borrowers with excellent scores (750-900) are offered loans at lower interest rates.

- A poor score can lead to higher rates, making loans more expensive.

3. Credit Card Eligibility

- Banks check your CIBIL score before issuing credit cards.

- A higher score can unlock premium cards with better rewards and higher limits.

4. Helps Build Financial Credibility

A good score reflects your financial discipline, making you a trustworthy borrower in the eyes of lenders.

5. Supports Online Reputation in Banking

With digital tools, many platforms allow you to check your CIBIL score online, making it easier to maintain your financial health.

6. Reduces Financial Stress

Knowing your score helps you plan better and avoid loan rejections, improving your overall financial stability.

Also Read: Steps To Remove Suit Filed in CIBIL Report

Steps to Check Your CIBIL Score

Checking your 750-900 is an essential step to stay informed about your credit health. You can do this easily through online platforms. Here’s a step-by-step guide:

Steps to Check Your CIBIL Score Online

1. Visit the Official CIBIL Website:- Go to their main websites

2. Create an Account or Log In

- If you’re a new user, register by entering your Name, PAN Card Number, Email ID, and Mobile Number.

- Existing users can simply log in.

3. Verify Your Identity:- Enter the OTP sent to your registered mobile number or email to complete verification.

4. Access Your Score:- Once verified, you can view your CIBIL score and detailed credit report.

What to Do If You Have a Low CIBIL Score

If your CIBIL score is below 650, don’t panic. There are practical steps you can take to improve it over time. Here’s how:

1. Pay EMIs and Bills on Time

- Timely repayment is one of the most effective ways to boost your score.

- Set up payment reminders or automate your bill payments.

2. Reduce Your Credit Utilization

- Keep your credit utilization ratio below 30%.

- Example: If your credit limit is ₹1,00,000, avoid using more than ₹30,000.

3. Avoid Multiple Loan Applications

- Applying for several loans or credit cards in a short span creates hard inquiries, which can lower your score.

- Space out your applications.

4. Clear Outstanding Dues

Settle any overdue amounts on your loans or credit cards to prevent further penalties.

5. Check Your Report for Errors

- Dispute inaccuracies or incorrect entries in your report by contacting CIBIL customer support.

- Example: A closed loan may still appear as active, impacting your score.

6. Diversify Your Credit Mix

Maintain a balanced mix of secured (home loans) and unsecured (credit cards) loans.

7. Be Patient

Building or improving your score takes time. Consistently good financial behaviour will yield positive results.

CIBIL Customer Support

If you encounter issues related to your CIBIL score or credit report, reaching out to CIBIL customer support can help resolve them efficiently.

How to Contact CIBIL Customer Support

1. Online Dispute Resolution:

- Visit the official website

- File a dispute if you find errors in your credit report, such as incorrect loan details or mismatched personal information.

2. Email Support:

- Send your query to info@cibil.com.

- Include your registered details and report reference number for faster resolution.

3. Phone Support:

- Call +91-22-6140-4300.

- Available Monday to Friday, 10:00 AM to 6:00 PM IST.

4. Mailing Address:

- TransUnion CIBIL Limited,

One Indiabulls Centre, Tower 2A, 19th Floor,

Senapati Bapat Marg, Elphinstone Road,

Mumbai – 400 013.

Common Issues Resolved by CIBIL Support:

- Incorrect credit account details.

- Disputes regarding loan repayment status.

- Difficulty accessing your credit report or score.

Also Read: Steps to Check Your CIBIL Score on Paisabazaar

Conclusion

Your CIBIL score is more than just a number—it’s a reflection of your financial discipline and plays a critical role in your ability to access credit. Understanding the full form of CIBIL, how the score is calculated, and its importance is vital for anyone looking to manage their finances effectively.

By regularly checking your credit score, addressing any discrepancies, and maintaining good financial habits, you can ensure a strong credit profile. Tools like online platforms for checking your CIBIL score and the support provided by CIBIL make this process seamless.

A good CIBIL score opens doors to better loan offers, lower interest rates, and a trustworthy financial reputation. Take charge of your credit health today, and let your CIBIL score work in your favour.

Download Personal Loan App

Get a loan instantly! Best Personal Loan App for your needs!!

Looking for an instant loan? Buddy Loan helps you get an instant loan from the best-verified lenders. Download the Buddy Loan App from the Play Store or App Store and apply for a loan now!

Having any queries? Do reach us at info@buddyloan.com

Frequently Asked Questions

Q. What is the full form of CIBIL?

A. The full form of CIBIL is Credit Information Bureau (India) Limited.

Q. Why is the CIBIL score important for loans?

A. A high CIBIL score increases your chances of loan approval and better interest rates as it indicates strong creditworthiness.

Q. How to check my CIBIL score for free?

A. You can check your CIBIL score for free once a year through the official CIBIL website or authorized partners.

Q. What is a good CIBIL score range?

A. A good CIBIL score ranges between 750 and 900.

Q. How can I improve my CIBIL score fast?

A. Timely payments, reducing credit utilization, and clearing outstanding debts can quickly boost your CIBIL score.

Q. Does late payment affect my CIBIL score?

A. Yes, late payments negatively impact your CIBIL score by lowering your creditworthiness.

Q. What factors determine my CIBIL score calculation?

A. Payment history, credit utilization, credit mix, and the number of inquiries are key factors in CIBIL score calculation.

Q. How often should I review my CIBIL report?

A. Review your CIBIL report every three months to monitor accuracy and detect errors early.

Q. What is the minimum CIBIL score for credit approval?

A. The minimum CIBIL score for credit approval varies, but a score of 750 or above is preferred by most lenders.

Q. How is CIBIL score different from a credit report?

A. The CIBIL score is a numeric summary of creditworthiness, while the credit report provides detailed credit history and accounts.