Buying a home is a significant milestone in anyone’s life. Whether you’re purchasing your first house or investing in another property, securing a home loan is often necessary. One of the most critical factors that determine your eligibility for a home loan is your CIBIL score. But what exactly is a good CIBIL score for a housing loan, and how does it impact the home loan approval process? Including the minimum score required, how banks like SBI and PNB use this score, and steps to improve your CIBIL score.

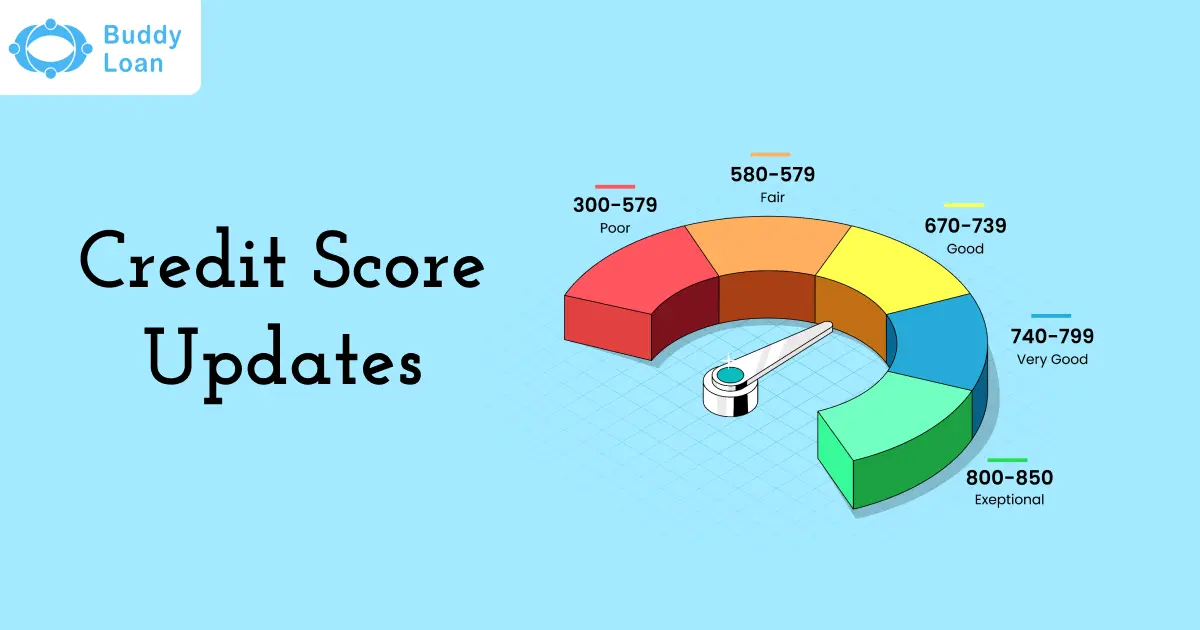

CIBIL Score Range

The CIBIL score is a three-digit number ranging from 300 to 900 that reflects your creditworthiness. The higher your score, the better your chances of getting a home loan approved with favourable terms.

Here’s a table of the CIBIL score range:

| CIBIL Score Range | Creditworthiness | Likelihood of Loan Approval |

| 750 – 900 | Excellent | Very High |

| 700 – 749 | Good | High |

| 650 – 699 | Fair | Moderate |

| 550 – 649 | Poor | Low |

| 300 – 549 | Very Poor | Very Low |

If your score is above 700, you are in a good position to secure a home loan. However, if your score is lower, it’s still possible to get a loan, but it may come with higher interest rates or additional scrutiny.

Score Needed For Home Loan

The minimum CIBIL score for a home loan varies depending on the bank and your financial profile. Here’s a general guideline:

1. Ideal CIBIL Score: A score of 750 or above is ideal for securing a home loan with favourable terms and lower interest rates.

2. Acceptable CIBIL Score: Many banks, including SBI (State Bank of India) and PNB (Punjab National Bank), may consider scores between 650 and 750 for home loans, though the terms might not be as favourable.

3. Low CIBIL Score (550-650): If your score is below 650, you might still get a home loan, but with higher interest rates or additional requirements like a guarantor or larger down payment.

4. Very Low CIBIL Score: A score below 550 makes it challenging to secure a home loan, but some lenders offer options like home loans without CIBIL checks or loans based on alternate credit evaluations.

Use Of CIBIL Score For Home Loans

Banks and financial institutions use your CIBIL score to assess your creditworthiness. Here’s how it plays a role in the home loan process:

1. Loan Eligibility:- Lenders check your CIBIL score to decide if you are eligible for a home loan. A higher score increases the likelihood of approval.

2. Interest Rates:- Borrowers with higher CIBIL scores often get lower home loan interest rates. For example, someone with a score of 800 might get a loan at 6.5% interest, while someone with a score of 650 might be offered 7.5% or higher.

3. Loan Amount:- A good CIBIL score can also influence the loan amount you qualify for. Lenders are more confident in approving higher amounts for applicants with strong credit histories.

4. Approval Speed:- Higher scores lead to faster loan processing and approval, as lenders perceive less risk.

Steps To Follow While Applying For A Loan

Applying for a home loan can be straightforward if you follow these steps:

1. Check Your CIBIL Score:- Before applying, check your CIBIL score for home loan free through authorized websites or CIBIL’s official site.

2. Gather Documents:- Prepare necessary documents like identity proof, address proof, income proof, bank statements, and property details.

3. Compare Lenders:- Research different lenders (SBI, PNB, private banks) to understand their interest rates, loan terms, and CIBIL score requirements.

4. Evaluate Your Eligibility:- Use online calculators to estimate your loan eligibility based on your income, CIBIL score, and existing debts.

5. Apply Online or Offline:- Submit your application through the bank’s website or by visiting a branch. For example, SBI home loan CIBIL checks can be initiated online for convenience.

Follow Up:

Track your application status and respond promptly to any queries from the bank.

Steps to Improve Your CIBIL Score

If your CIBIL score is low, here are some actionable tips to improve it:

1. Pay EMIs and Credit Card Bills on Time:- Consistent, timely payments can boost your score significantly.

2. Reduce Credit Utilization:- Try to use less than 30% of your available credit limit. High utilization can negatively impact your score.

3. Avoid Multiple Loan Applications:- Applying for multiple loans simultaneously can lower your score. Space out your credit applications.

4. Check for Errors in Your Credit Report:- Obtain your credit report and dispute any inaccuracies that may be affecting your score.

5. Clear Outstanding Debts:- Pay off any old or outstanding debts to improve your creditworthiness.

6. Diversify Your Credit Mix:- Having a mix of secured (home loan) and unsecured (credit card) credit helps build a robust credit profile.

Conclusion

Your CIBIL score plays a critical role in securing a home loan. A high score improves your chances of loan approval, lowers interest rates, and ensures a smooth borrowing experience. Whether you’re applying for an SBI home loan CIBIL score check or exploring options for a PNB home loan, maintaining a healthy CIBIL score is key. And if your score is low, remember that improving it is possible with consistent effort and smart financial planning.

By staying informed and taking proactive steps, you can make your dream of owning a home a reality.

Download Personal Loan App

Get a loan instantly! Best Personal Loan App for your needs!!

Looking for an instant loan? Buddy Loan helps you get an instant loan from the best-verified lenders. Download the Buddy Loan App from the Play Store or App Store and apply for a loan now!

Having any queries? Do reach us at info@buddyloan.com

Frequently Asked Questions

Q. What is a CIBIL score?

A. A CIBIL score is a three-digit number (300–900) that represents your creditworthiness based on your credit history.

Q. Why is the CIBIL score important for a home loan?

A. A good CIBIL score improves loan approval chances and ensures favourable interest rates for home loans.

Q. What is the minimum CIBIL score required for a home loan?

A. Most lenders prefer a CIBIL score of 750 or above for home loan approval.

Q. How can I check my CIBIL score?

A. You can check your CIBIL score online via the official CIBIL website or through financial platforms like Paisabazaar.

Q. How does my CIBIL score affect my home loan interest rate?

A. A higher CIBIL score qualifies you for lower interest rates, reducing your overall loan cost.

Q. What factors affect my CIBIL score?

A. Payment history, credit utilization, credit mix, length of credit history, and recent inquiries impact your score.

Q. How long does it take to improve a CIBIL score?

A. It may take 4–12 months to see significant improvements, depending on financial behaviour.

Q. What should I do if my CIBIL score is low?

A. Clear outstanding dues, avoid late payments, and maintain a low credit utilization ratio to rebuild your score.

Q. Can I get a home loan with no CIBIL score?

A. Yes, some lenders may offer loans based on income and employment details, but at higher interest rates.